Kroger 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-66

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

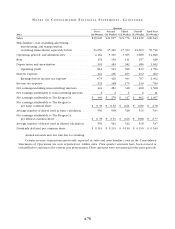

The Company uses the RP-2000 projected 2021 mortality table in calculating the pension obligation.

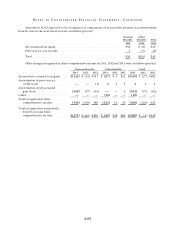

Pension Benefits

Qualified Plans Non-Qualified Plan Other Benefits

2013 2012 2011 2013 2012 2011 2013 2012 2011

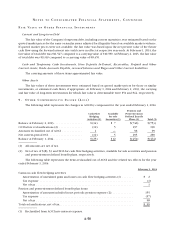

Components of net periodic benefit cost:

Service cost......................... $ 40 $ 44 $ 41 $ 3 $ 3 $ 3 $17 $16 $13

Interest cost ........................ 144 146 158 99 10 15 16 17

Expected return on plan assets.......... (224) (210) (207) —— — —— —

Amortization of:

Prior service cost (credit) ........... —— — —— 1 (4) (4) (5)

Actuarial (gain) loss ................ 93 88 57 99 7 —— (2)

Net periodic benefit cost ................. $ 53 $ 68 $ 49 $21 $21 $21 $28 $28 $23

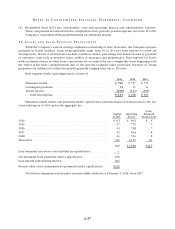

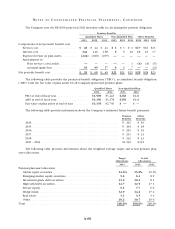

The following table provides the projected benefit obligation (“PBO”), accumulated benefit obligation

(“ABO”) and the fair value of plan assets for all Company-sponsored pension plans.

Qualified Plans Non-Qualified Plan

2013 2012 2013 2012

PBO at end of fiscal year .................... $3,509 $3,443 $263 $221

ABO at end of fiscal year .................... $3,360 $3,278 $256 $211

Fair value of plan assets at end of year ......... $3,135 $2,746 $ — $ —

The following table provides information about the Company’s estimated future benefit payments.

Pension

Benefits

Other

Benefits

2014 ....................................................... $ 201 $ 16

2015 ....................................................... $ 204 $ 18

2016 ....................................................... $ 203 $ 19

2017 ....................................................... $ 211 $ 21

2018 ....................................................... $ 221 $ 23

2019 – 2023 ................................................. $1,232 $135

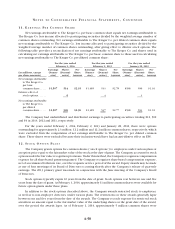

The following table provides information about the weighted average target and actual pension plan

asset allocations.

Target

allocations

Actual

Allocations

2013 2013 2012

Pension plan asset allocation

Global equity securities ..................................... 14.6% 15.0% 19.2%

Emerging market equity securities ............................. 5.6 6.2 8.9

Investment grade debt securities .............................. 11.6 10.4 8.1

High yield debt securities .................................... 12.7 12.5 17.3

Private equity ............................................. 9.1 7.7 6.0

Hedge funds .............................................. 32.9 34.2 27.2

Real estate ................................................ 3.3 3.3 3.3

Other.................................................... 10.2 10.7 10.0

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.0% 100.0% 100.0%