Kroger 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-71

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

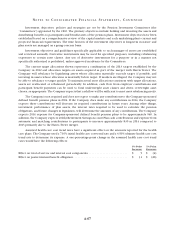

Under the terms of the MOU, the locals of the UFCW agreed to a future pension benefit formula through

2021. The Company was designated as the named fiduciary of the new consolidated pension plan with sole

investment authority over the assets. If investment results fail to meet expectations, the Company could be

responsible for the shortfall. The Company committed to contribute sufficient funds to cover the actuarial

cost of current accruals and to fund the pre-consolidation Unfunded Actuarial Accrued Liability (“UAAL”) that

existed as of December 31, 2011, in a series of installments on or before March 31, 2018. At January 1, 2012,

the UAAL was estimated to be $911 (pre-tax). In accordance with GAAP, the Company expensed $911 in 2011

related to the UAAL. The expense was based on a preliminary estimate of the contractual commitment. In

2012, the Company finalized the UAAL contractual commitment and recorded an adjustment that reduced

the 2011 estimated commitment by $53 (pre-tax). The final UAAL contractual commitment, at January 1,

2012, was $858 (pre-tax). In the fourth quarter of 2011, the Company contributed $650 to the consolidated

multi-employer pension plan of which $600 was allocated to the UAAL and $50 was allocated to service and

interest costs and expensed in 2011. In the fourth quarter of 2012, the Company contributed $258 to the

consolidated multi-employer pension plan to fully fund the Company’s UAAL contractual commitment. Future

contributions will be dependent, among other things, on the investment performance of assets in the plan.

The funding commitments under the MOU replace the prior commitments under the four existing funds to

pay an agreed upon amount per hour worked by eligible employees.

The Company recognizes expense in connection with its multi-employer pension plans as contributions

are funded, or in the case of the UFCW consolidated pension plan, when commitments are made. The Company

made contributions to these funds of $228 in 2013, $492 in 2012 and $946 in 2011. The cash contributions

for 2012 and 2011 include the Company’s $258 and $650 contributions described above, respectively, to the

UFCW consolidated pension plan in the fourth quarter of each year.

The risks of participating in multi-employer pension plans are different from the risks of participating in

single-employer pension plans in the following respects:

a. Assets contributed to the multi-employer plan by one employer may be used to provide benefits to

employees of other participating employers.

b. If a participating employer stops contributing to the plan, the unfunded obligations of the plan

allocable to such withdrawing employer may be borne by the remaining participating employers.

c. If the Company stops participating in some of its multi-employer pension plans, the Company may

be required to pay those plans an amount based on its allocable share of the underfunded status of

the plan, referred to as a withdrawal liability.

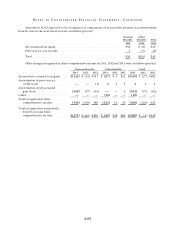

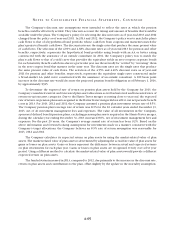

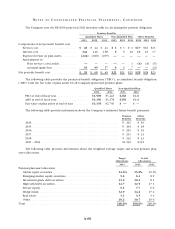

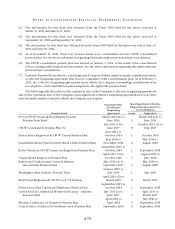

The Company’s participation in these plans is outlined in the following tables. The EIN / Pension Plan

Number column provides the Employer Identification Number (“EIN”) and the three-digit pension plan

number. The most recent Pension Protection Act Zone Status available in 2013 and 2012 is for the plan’s

year-end at December 31, 2012 and December 31, 2011, respectively. Among other factors, generally, plans in

the red zone are less than 65 percent funded, plans in the yellow zone are less than 80 percent funded and

plans in the green zone are at least 80 percent funded. The FIP/RP Status Pending / Implemented Column

indicates plans for which a funding improvement plan (“FIP”) or a rehabilitation plan (“RP”) is either pending

or has been implemented. Unless otherwise noted, the information for these tables was obtained from the

Forms 5500 filed for each plan’s year-end at December 31, 2012 and December 31, 2011. The multi-employer

contributions listed in the table below are the Company’s multi-employer contributions made in fiscal years

2013, 2012 and 2011.