Kraft 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

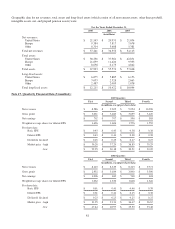

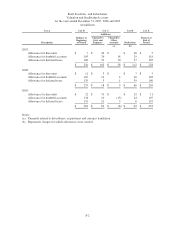

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum of the quarterly EPS

amounts may not equal the total for the year.

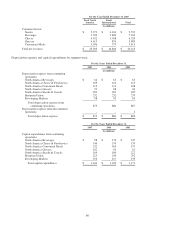

During 2007 and 2006, we recorded the following pre-tax charges or (gains) in earnings:

2007 Quarters

First Second Third Fourth

(in millions)

Asset impairment and exit costs $ 67 $ 107 $ 174 $ 104

(Gains) / losses on divestitures, net (12) (8) - 5

$ 55 $ 99 $ 174 $ 109

2006 Quarters

First Second Third Fourth

(in millions)

Asset impairment and exit costs $ 202 $ 226 $ 125 $ 449

(Gains) / losses on divestitures, net 3 8 3 (131)

Gain on redemption of United Biscuits

investment - - (251) -

$ 205 $ 234 $ (123) $ 318

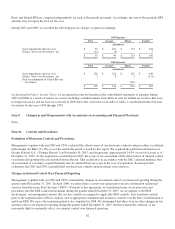

As discussed in Note 5, Income Taxes, we recognized income tax benefits in the consolidated statements of earnings during

2007 and 2006 as a result of various tax events, including a reimbursement from Altria in cash for federal tax reserves that were

no longer necessary and net state tax reversals in 2006 due to the conclusion of an audit of Altria’s consolidated federal income

tax returns for the years 1996 through 1999.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Management, together with our CEO and CFO, evaluated the effectiveness of our disclosure controls and procedures (as defined

in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. We acquired the global biscuit business of

Groupe Danone S.A. (“Danone Biscuit”) on November 30, 2007, and it represents approximately 14.0% of our total assets as of

December 31, 2007. As the acquisition occurred late in 2007, the scope of our assessment of the effectiveness of internal control

over financial reporting does not include Danone Biscuit. This exclusion is in accordance with the SEC’s general guidance that

an assessment of a recently acquired business may be omitted from our scope in the year of acquisition. Based upon that

evaluation, the CEO and CFO concluded that our disclosure controls and procedures were effective.

Changes in Internal Control Over Financial Reporting

Management, together with our CEO and CFO, evaluated the changes in our internal control over financial reporting during the

quarter ended December 31, 2007. In April 2006, we entered into a seven-year agreement to receive information technology

services from Electronic Data Systems (“EDS”). Pursuant to this agreement, we transitioned some of our processes and

procedures into the EDS control environment during the quarter ended December 31, 2007. As we migrate to the EDS

environment, our management ensures that our key controls are mapped to applicable EDS controls, tests transition controls

prior to the migration date of those controls, and as appropriate, maintains and evaluates controls over the flow of information to

and from EDS. We expect the transition period to be completed in 2008. We determined that there were no other changes in our

internal control over financial reporting during the quarter ended December 31, 2007, that have materially affected, or are

reasonably likely to materially affect, our internal control over financial reporting.

82