Kraft 2007 Annual Report Download - page 20

Download and view the complete annual report

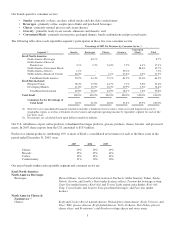

Please find page 20 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cheese: Kraft, Velveeta, and Eden process cheeses; Kraft and Philadelphia cream cheese; Kraft

natural cheese; and Cheez Whiz process cheese spread.

Grocery: Royal dry packaged desserts; Post ready-to-eat cereals; Kraft spoonable and pourable

salad dressings; Miracle Whip spoonable dressings;Jell-O dessert toppings; Kraft

peanut butter; and Vegemite yeast spread.

Convenient Meals: Kraft macaroni & cheese dinners.

(1) Note that foodservice products span all Kraft North America segments and sectors.

In February 2008, we announced the implementation of our new operating structure. Our new structure reflects our strategy to

Rewire the Organization for Growth. Within our new structure, business units now have full P&L accountability and are staffed

accordingly. This also ensures that we are putting our resources closer to where decisions are made that affect our consumers.

Our corporate and shared service functions are streamlining their organizations and focusing them on core activities that can

more efficiently support the goals of the business units. Our new operating structure will result in changes to the reportable

business segments within our North America commercial unit, beginning in the first quarter of 2008. These changes are:

• Cheese has been organized as a standalone operating segment in order to create a more self-contained and integrated

business unit in support of faster growth.

• We are also moving our macaroni & cheese category as well as other dinner products from our Convenient Meals

segment to our Grocery segment to take advantage of operating synergies.

• Canada and North America Foodservice will be structured as a standalone reportable segment. This change will allow

us to deliver on the unique requirements of the Canadian consumer and customer while maintaining strong North

American linkages to innovation, new product development and new capabilities to drive our business. Furthermore, it

will allow us to manage strategic customer decisions and continue to capture cross-border sales and marketing

synergies within our Foodservice operations.

As a result of implementing our new operating structure, we will report the results of operations under this new structure

beginning in the first quarter of 2008 and we will restate results from prior periods in a consistent manner.

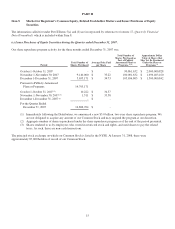

Significant Acquisitions and Divestitures

Danone Biscuit:

On November 30, 2007, we acquired the global biscuit business of Groupe Danone S.A. (“Danone Biscuit”) for €5.1 billion

(approximately $7.6 billion) in cash subject to purchase price adjustments. On October 12, 2007, we entered into a 364-day

bridge facility agreement, and at closing, we borrowed €5.1 billion under that facility in order to finance the acquisition. The

acquisition included 32 manufacturing facilities and approximately 14,000 employees. Danone Biscuit generated global

revenues of approximately $2.8 billion during 2007. Danone Biscuit will report results from operations on a one month lag; as

such, there was no impact on our operating results in 2007. On a proforma basis, Danone Biscuit’s net earnings for the year

ended December 31, 2007 would have been insignificant to Kraft.

Post Distribution:

On November 15, 2007, we announced a definitive agreement to merge our Post cereals business (“Post Business”) into Ralcorp

Holdings, Inc. (“Ralcorp”) after a tax-free distribution to our shareholders (the “Post Distribution”). We have signed an

agreement with Ralcorp to execute the Post Distribution by means of a “Reverse-Morris Trust” transaction. This transaction is

subject to customary closing conditions, including anti-trust approval, IRS tax-free ruling and Ralcorp shareholder approvals.

To date, the anti-trust approval has been obtained. We anticipate that this transaction will be completed in mid-2008.

The Post Business had net revenues of approximately $1.1 billion in 2007 and includes such cereals as Honey Bunches of Oats,

Pebbles,Shredded Wheat,Selects,Grape Nuts and Honeycomb. The brands in this transaction are distributed primarily in North

America. In addition to the Post brands, the transaction includes four manufacturing facilities and certain manufacturing

equipment. We anticipate that approximately 1,250 employees will join Ralcorp following the consummation of the transaction.

Our shareholders will receive at least 30.3 million shares of Ralcorp stock after the Post Distribution and the subsequent merger

of the Post Business with Ralcorp. Based on market conditions prior to closing, we will determine whether the shares will be

distributed in a spin-off or a split-off transaction. Either type of transaction is expected to be tax-free to our U.S. shareholders.

In a spin-off transaction, our shareholders would receive a pro rata number of Ralcorp shares. In a split-off transaction, our

shareholders would have the option to exchange their Kraft shares and receive Ralcorp shares at closing, resulting in a reduction

5