Kraft 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

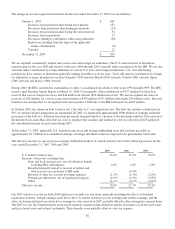

SFAS No. 158 also requires us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008. We

currently measure our non-U.S. pension plans (other than Canadian pension plans) at September 30 of each year. We expect to

adopt the measurement date provision of SFAS No. 158 and measure these plans as of our operating subsidiaries year-end close

date, beginning in 2008. We do not expect the adoption of this statement to have a material impact on our financial statements.

We sponsor noncontributory defined benefit pension plans covering most U.S. employees. As appropriate, we provide pension

coverage for employees of our non-U.S. subsidiaries through separate plans. Local statutory requirements govern many of these

plans. In addition, our U.S. and Canadian subsidiaries provide health care and other benefits to most retired employees. Local

government plans generally cover health care benefits for retirees outside the U.S. and Canada.

The plan assets and benefit obligations of our U.S. and Canadian pension plans are measured at December 31 of each year and

all other non-U.S. pension plans are currently measured at September 30 of each year. The benefit obligations of our

postretirement plans are measured at December 31 of each year.

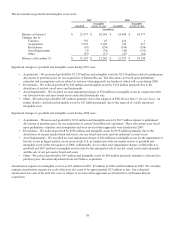

Pension Plans

Obligations and Funded Status:

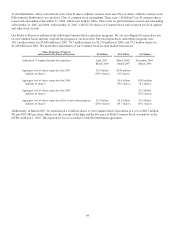

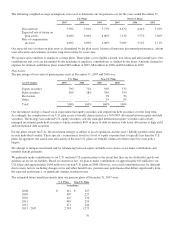

The projected benefit obligations, plan assets and funded status of our pension plans at December 31, 2007 and 2006 were:

U.S. Plans Non-U.S. Plans

2007 2006 2007 2006

(in millions)

Benefit obligation at January 1 $ 6,286 $ 6,305 $ 4,079 $ 3,762

Service cost 159 170 101 95

Interest cost 365 354 194 169

Benefits paid (585) (469) (219) (221)

Settlements 89 45 (3) (26)

Actuarial gains (376) (132) (323) (40)

Currency - - 423 256

Other 14 13 23 84

Benefit obligation at December 31 5,952 6,286 4,275 4,079

Fair value of plan assets at January 1 7,027 6,326 3,466 2,764

Actual return on plan assets 545 1,002 166 288

Contributions 19 143 269 457

Benefits paid (585) (469) (219) (221)

Currency - - 357 185

Actuarial gains / (losses) - 25 2 (7)

Fair value of plan assets at December 31 7,006 7,027 4,041 3,466

Net pension asset / (liability) recognized

at December 31 $ 1,054 $ 741 $ (234) $ (613)

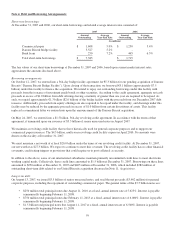

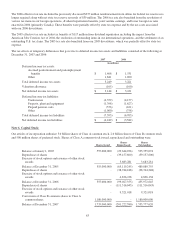

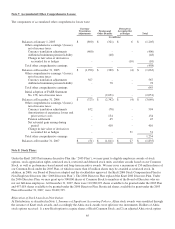

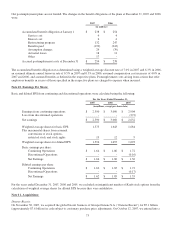

The combined U.S. and non-U.S. pension plans resulted in a net prepaid pension asset of $820 million at December 31, 2007

and $128 million at December 31, 2006. We recognized these amounts in our consolidated balance sheets at December 31, 2007

and 2006 as follows:

2007 2006

(in millions)

Prepaid pension assets $ 1,648 $ 1,168

Other accrued liabilities (18) (18)

Accrued pension costs (810) (1,022)

$ 820 $ 128

The accumulated benefit obligation, which represents benefits earned to date, was $5,349 million at December 31, 2007 and

$5,584 million at December 31, 2006 for the U.S. pension plans. The accumulated benefit obligation for the non-U.S. pension

plans was $3,979 million at December 31, 2007 and $3,784 million at December 31, 2006.

68