Kraft 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

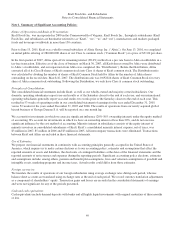

previously held, but with a proportionally reduced exercise price. For each employee stock option outstanding, the aggregate

intrinsic value immediately after the Distribution was not greater than the aggregate intrinsic value immediately prior to the

Distribution. Holders of Altria restricted stock or stock rights awarded before January 31, 2007, retained their existing awards

and received restricted stock or stock rights in Kraft Common Stock. Recipients of Altria restricted stock or stock rights

awarded on or after January 31, 2007, did not receive Kraft restricted stock or stock rights because Altria had announced the

Distribution at that time. We reimbursed Altria $179 million for net settlement of the employee stock awards as detailed below.

We determined the fair value of the stock options using the Black-Scholes option valuation model; and adjusted the fair value of

the restricted stock and stock rights by the value of projected forfeitures.

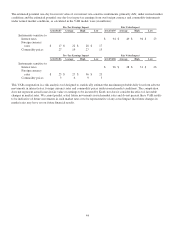

In April 2007, we paid the following to Altria (in millions):

Kraft stock options received by Altria employees $ 240

Altria stock options received by Kraft employees (440)

Kraft stock awards received by holders of Altria stock awards 33

Altria stock awards received by holders of Kraft stock awards (12)

Net payment to Altria $ (179)

Based upon the number of Altria stock awards outstanding at Distribution, we granted stock options for 24.2 million shares of

Common Stock at a weighted-average price of $15.75. The options expire between 2007 and 2012. In addition, we issued

3.0 million shares of restricted stock and stock rights. The market value per restricted share or right was $31.66 on the date of

grant. Restrictions on the majority of these restricted stock and stock rights lapse in either the first quarter of 2008 or 2009.

Our Board of Directors approved a stock option grant to our Chief Executive Officer on May 3, 2007, to recognize her election

as our Chairman. She received 300,000 stock options under the 2005 Performance Incentive Plan, which vest under varying

market and service conditions and expire ten years after the grant date.

In January 2007, we issued 5.2 million shares of restricted stock and stock rights to eligible U.S. and non-U.S. employees as

part of our annual incentive program. Restrictions on these shares and rights lapse in the first quarter of 2010. The market value

per restricted share or right was $34.655 on the date of grant. Additionally, we issued 1.0 million off-cycle shares of restricted

stock and stock rights during 2007. The weighted-average market value per restricted share or right was $34.085 on the date of

grant. The total number of restricted shares and rights issued in 2007 was 9.2 million, including those issued as a result of the

Distribution.

In 2006, we issued approximately 6.9 million shares of restricted stock and stock rights to eligible U.S. and non-U.S.

employees. Restrictions on most of these shares and rights lapse in the first quarter of 2009. The market value per restricted

share or right was $29.16 on the date of grant.

Effective January 1, 2006, we adopted the provisions of SFAS No. 123 (Revised 2004), Share-Based Payment, using the

modified prospective method, which requires measurement of compensation cost for all stock-based awards at fair value on date

of grant and recognition of compensation over the service periods for awards expected to vest. The fair value of restricted stock

and rights to receive shares of stock is determined based on the number of shares granted and the market value at date of grant.

The fair value of stock options is determined using a modified Black-Scholes methodology. The impact of adoption was not

material. At December 31, 2007, the number of shares to be issued upon exercise of outstanding stock options and vesting of

non-U.S. rights to receive equivalent shares was 37.5 million or 2.4% of total shares outstanding.

Dividends:

We paid dividends of $1,638 million in 2007 and $1,562 million in 2006. The 4.9% increase reflects a higher dividend rate in

2007, partially offset by a lower number of shares outstanding because of share repurchases. During the third quarter of 2007,

our Board of Directors approved an 8.0% increase in the current quarterly dividend rate to $0.27 per share on our Common

Stock. As a result, the present annualized dividend rate is $1.08 per common share. The declaration of dividends is subject to

the discretion of our Board of Directors and depends on various factors, including our net earnings, financial condition, cash

requirements, future prospects and other factors that our Board of Directors deems relevant to its analysis and decision-making.

42