Kraft 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

Item 1. Business.

General

Kraft was incorporated in 2000 in the Commonwealth of Virginia. We manufacture and market packaged foods and beverages

worldwide in more than 150 countries. We have nine brands with revenues exceeding $1 billion: Kraft cheeses, dinners and

dressings; Oscar Mayer meats; Philadelphia cream cheese; Maxwell House coffee; Nabisco cookies and crackers and its Oreo

brand; Jacobs coffees, Milka chocolates and LU biscuits. We have more than 50 additional brands with revenues of at least $100

million.

Prior to June 13, 2001, Kraft was a wholly-owned subsidiary of Altria Group, Inc. (“Altria”). On June 13, 2001, we completed

an initial public offering of 280,000,000 shares of our Common Stock at a price of $31.00 per share.

In the first quarter of 2007, Altria spun off its remaining interest (89.0%) in Kraft on a pro rata basis to Altria stockholders in a

tax-free transaction. Effective as of the close of business on March 30, 2007, all Kraft shares owned by Altria were distributed

to Altria’s stockholders, and our separation from Altria was completed (the “Distribution”). Before the Distribution, Altria

converted all of its Class B shares of Kraft common stock into Class A shares of Kraft common stock. The Distribution ratio

was calculated by dividing the number of shares of Kraft Common Stock held by Altria by the number of Altria shares

outstanding on the record date, March 16, 2007. The distribution ratio was 0.692024 shares of Kraft Common Stock for every

share of Altria common stock outstanding. Following the Distribution, we only have Class A common stock outstanding.

Because Kraft is a holding company, our principal source of funds is dividends from our subsidiaries. Our principal wholly-

owned subsidiaries currently are not limited by long-term debt or other agreements in their ability to pay cash dividends or make

other distributions with respect to their common stock.

Reportable Segments

We manufacture and market packaged food products, including snacks, beverages, cheese, convenient meals and various

packaged grocery products. We manage and report operating results through two commercial units, Kraft North America and

Kraft International. Kraft North America operates in the U.S. and Canada, and we manage Kraft North America’s operations by

product category. We manage Kraft International’s operations by geographic location. We have operations in more than 70

countries and sell our products in more than 150 countries.

Note 16 to our consolidated financial statements includes a breakout of net revenues and segment operating income by

reportable segment for each of the last three years. Management uses segment operating income to evaluate segment

performance and allocate resources. Segment operating income excludes unallocated general corporate expenses and

amortization of intangibles. Management believes it is appropriate to disclose this measure to help investors analyze segment

performance and trends.

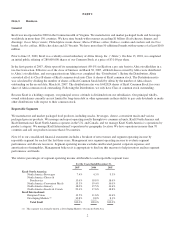

The relative percentages of segment operating income attributable to each reportable segment were:

For the Years Ended December 31,

2007 2006 2005

Kraft North America:

North America Beverages 7.4% 4.3% 9.3%

North America Cheese &

Foodservice 13.6% 18.8% 18.6%

North America Convenient Meals 15.3% 19.4% 16.0%

North America Grocery 18.0% 19.5% 14.6%

North America Snacks & Cereals 22.4% 17.6% 18.8%

Kraft International:

European Union 12.5% 11.6% 14.6%

Developing Markets (1) 10.8% 8.8% 8.1%

Total Kraft 100.0% 100.0% 100.0%

(1) This segment was formerly known as Developing Markets, Oceania & North Asia

2