Kraft 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

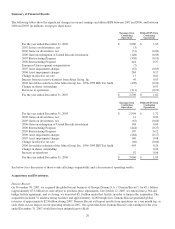

sugar confectionery business prior to the closing date as discontinued operations on the consolidated statements of earnings. We

recorded a loss on sale of discontinued operations of $272 million in 2005, related largely to taxes on the transaction.

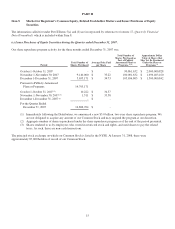

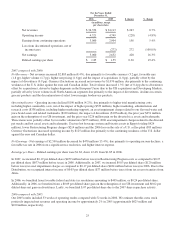

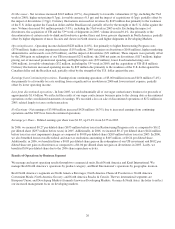

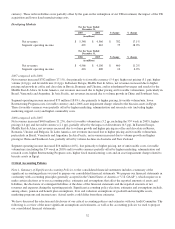

These (gains) / losses on divestitures were included in segment operating income as follows:

For the Years Ended

December 31,

2007 2006 2005

(in millions)

North America Beverages $ 5 $ 95 $ -

North America Cheese & Foodservice - 8 (1)

North America Convenient Meals - (226) -

North America Grocery - 1 2

North America Snacks & Cereals (12) 5 -

European Union - - (114)

Developing Markets (1) (8) - 5

Gains on divestitures, net $ (15) $ (117) $ (108)

(1) This segment was formerly known as Developing Markets, Oceania & North Asia

These gains and losses on divestitures do not reflect the related asset impairment charges discussed below.

The aggregate operating results of the acquisitions and divestitures discussed above, other than the UB acquisition, and the

divestiture of the sugar confectionery business, were not material to our financial statements in any of the periods presented.

Restructuring Program

In January 2004, we announced a three-year restructuring program (the “Restructuring Program”) and, in January 2006,

extended it through 2008. The objectives of this program are to leverage our global scale, realign and lower our cost structure,

and optimize capacity. As part of the Restructuring Program we anticipate:

• incurring approximately $2.8 billion in pre-tax charges reflecting asset disposals, severance and implementation costs;

• closing at least 35 facilities and eliminating approximately 13,500 positions;

• using cash to pay for approximately $1.7 billion of the $2.8 billion in charges; and

• cumulative, annualized savings reaching $1.2 billion by the end of 2009.

In February 2008, we announced the implementation of our new operating structure built on three core elements: accountable

business units; shared services that leverage the scale of our global portfolio; and a streamlined corporate staff. Within our new

structure, business units now have full P&L accountability and are staffed accordingly. This also ensures that we are putting our

resources closer to where decisions are made that affect our consumers. Our corporate and shared service functions are

streamlining their organizations and focusing them on core activities that can more efficiently support the goals of the business

units. The intent was to simplify, streamline and increase accountability, with the ultimate goal of generating reliable growth for

Kraft. As a result, we have eliminated approximately 700 positions as we streamline our headquarters functions.

We incurred charges under the Restructuring Program of $459 million in 2007, or $0.19 per diluted share; $673 million in 2006,

or $0.27 per diluted share; and $297 million in 2005, or $0.12 per diluted share. Since the inception of the Restructuring

Program, we have incurred $2.1 billion in charges, and paid cash for $1.1 billion. We announced the closure of three plants

during 2007; we have now announced the closure of 30 facilities since the program began in 2004. In connection with our

severance initiatives, we have eliminated approximately 11,000 positions as of December 31, 2007; at that time we had

announced the elimination of an additional 400 positions.

Under the Restructuring Program, we recorded asset impairment and exit costs of $332 million during 2007, $578 million

during 2006 and $210 million during 2005. We recorded implementation costs of $127 million in 2007, $95 million in 2006 and

$87 million in 2005. Implementation costs are directly attributable to exit costs; however they do not qualify for treatment under

Statement of Financial Accounting Standards (“SFAS”) No. 146, Accounting for Costs Associated with Exit or Disposal

Activities. These costs primarily include the discontinuance of certain product lines, incremental expenses related to the closure

of facilities and the Electronic Data Systems (“EDS”) transition discussed in Note 2 to the consolidated financial statements.

22