Kraft 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

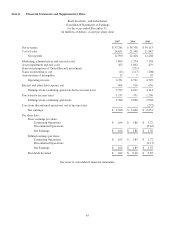

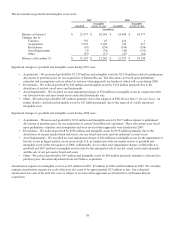

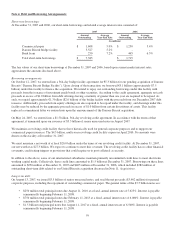

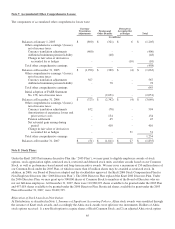

Restructuring liability activity for the years ended December 31, 2007 and 2006 was:

Severance

Asset

Write-downs Other Total

(in millions)

Liability balance, January 1, 2006 $ 114 $ - $ 1 $ 115

Charges 272 252 54 578

Cash (spent) / received (204) 16 (21) (209)

Charges against assets (25) (268) - (293)

Currency / other 8 - (2) 6

Liability balance, December 31, 2006 165 - 32 197

Charges 156 99 77 332

Cash (spent) / received (155) 6 (94) (243)

Charges against assets (25) (109) 1 (133)

Currency 13 4 - 17

Liability balance, December 31, 2007 $ 154 $ - $ 16 $ 170

Severance costs include the cost of benefits received by terminated employees. In connection with our severance initiatives, we

have eliminated approximately 11,000 positions as of December 31, 2007; at that time we had announced the elimination of an

additional 400 positions. Severance charges against assets primarily relate to incremental pension costs, which reduce prepaid

pension assets. Asset write-downs relate to the impairment of assets caused by plant closings and related activity. Cash received

on asset write-downs relates to proceeds received from the sale of assets that had previously been written-off under the

Restructuring Program. We incurred other costs related primarily to the renegotiation of supplier contract costs, workforce

reductions associated with the plant closings and the termination of leasing agreements.

Implementation Costs:

Implementation costs are directly attributable to exit costs; however they do not qualify for treatment under SFAS No. 146,

Accounting for Costs Associated with Exit or Disposal Activities. These costs primarily include the discontinuance of certain

product lines, incremental expenses related to the closure of facilities and the EDS transition discussed above. Management

believes the disclosure of implementation charges provides readers of our financial statements greater transparency to the total

costs of our Restructuring Program. Substantially all implementation costs incurred in 2007 will require cash payments.

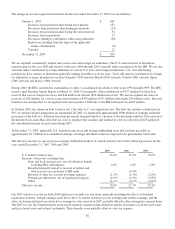

Implementation costs associated with the Restructuring Program were:

2007 2006 2005

(in millions)

Net Revenues $ - $ - $ 2 $2

Cost of sales 67 25 56

Marketing, administration and

research costs 60 70 29

Total implementation costs $ 127 $ 95 $ 87

Asset Impairment Charges

In 2007, we sold our flavored water and juice brand assets and related trademarks, including Veryfine and Fruit2O.In

recognition of the sale, we recorded a $120 million asset impairment charge for these assets. The charge included the write-off

of the associated goodwill of $3 million, intangible assets of $70 million and property, plant and equipment of $47 million, and

was recorded as asset impairment and exit costs on the consolidated statement of earnings.

During our 2006 annual review of goodwill and intangible assets we recorded a $24 million non-cash charge for impairment of

biscuits assets in Egypt and hot cereal assets in the U.S. Additionally, during 2006, we re-evaluated the business model for our

Tassimo hot beverage system, the revenues of which lagged our projections. This evaluation resulted in a $245 million non-cash

asset impairment charge related to lower utilization of existing manufacturing capacity. We recorded these charges as asset

impairment and exit costs on the consolidated statement of earnings.

We also incurred an asset impairment charge of $86 million during 2006 in recognition of our pet snacks brand and assets sale.

The charge included the write-off of a portion of the associated goodwill of $25 million, intangible assets of $55 million and

55