Kraft 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Discussion and Analysis

Growth Strategy

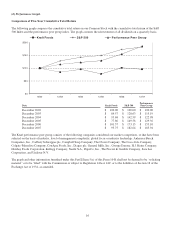

At the Consumer Analyst Group of New York (“CAGNY”) Conference in February 2008, we presented the progress we made

in 2007 on our long-term growth strategy and our plans for the second year of our three-year plan to return Kraft to reliable

growth. Our four growth strategies and 2007 developments are summarized below.

Rewire the organization for growth - We made significant changes to our incentive systems, senior management team and

organizational structure. Our annual bonuses and long-term incentive plans are now tied to measures that our people can control

and that will increase shareholder value such as operating income growth. We also complemented our veteran Kraft

management team by adding new talent. In February 2008, we announced the implementation of our new operating structure

built on three core elements: business units now have full P&L accountability and are staffed accordingly; shared services that

leverage the scale of our global portfolio; and a streamlined corporate staff.

Reframe our categories - We are utilizing the concept of the “Growth Diamond” to focus on four key consumer trends driving

category growth: Snacking; Quick Meals; Health and Wellness; and Premium.

We also reframed our portfolio through acquisitions and divestitures. In 2007, we divested our flavored water and juice brand

assets and related trademarks, including Veryfine and Fruit2O, and acquired the Danone Biscuit business. These changes will

result in increased revenues being derived from Kraft International. We also announced the planned merger of the Post Business

into Ralcorp, which we anticipate will be completed in mid-2008.

Exploit our sales capabilities - We are using our large scale as a competitive advantage as we better leverage our portfolio. Our

“Wall-to-Wall” initiative for Kraft North America combined the executional benefits of direct store delivery used in our Biscuit

business unit with the economics of our warehouse delivery to drive faster growth. Wall-to-Wall will increase the frequency of

our retail visits and build stronger, ongoing relationships with store management allowing us to: reduce out-of-stocks; get new

items to the shelves more quickly; and increase the number and quality of displays. We plan to complete the full rollout in North

America by mid-2008.

We plan to build profitable scale by expanding our distribution reach in countries with rapidly growing demand. The acquisition

of Danone Biscuit is part of our efforts to expand our reach in developing markets.

Drive down costs without compromising quality - We plan to contain administrative overhead costs while investing in quality,

R&D, marketing, sales and other capabilities that support growth. We are incrementally investing $100 million into quality

upgrades in 2008. Additionally, we anticipate completing our Restructuring Program in 2008 with total annualized savings

reaching $1.2 billion by the end of 2009.

19