Kraft 2007 Annual Report Download - page 38

Download and view the complete annual report

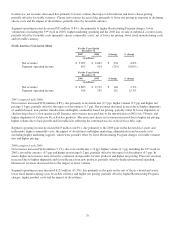

Please find page 38 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management believes the disclosure of implementation charges provides readers of our financial statements greater

transparency to the total costs of our Restructuring Program.

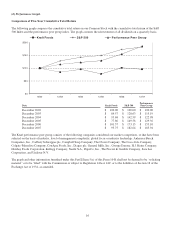

In addition, we expect to spend approximately $550 million in capital to implement the Restructuring Program. We have spent

$387 million in capital since the inception of the Restructuring Program, including $142 million spent in 2007. Cumulative

annualized cost savings resulting from the Restructuring Program were approximately $540 million through 2006. Incremental

cost savings totaled approximately $243 million in 2007, resulting in cumulative annualized savings under the Restructuring

Program of approximately $783 million to date. Refer to Note 2, Asset Impairment, Exit and Implementation Costs, for further

details of our Restructuring Program.

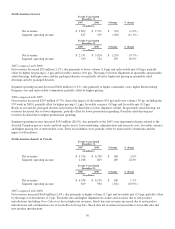

European Union Segment Reorganization

We are also in the process of reorganizing our European Union segment to function on a pan-European centralized category

management and value chain model. After the reorganization is complete, the European Principal Company (“EPC”) will

manage the European Union segment categories centrally and make decisions for all aspects of the value chain, except for sales

and distribution. The European subsidiaries will execute sales and distribution locally, and the local production companies will

act as toll manufacturers on behalf of the EPC. The EPC legal entity has already been incorporated as Kraft Foods Europe

GmbH in Zurich, Switzerland.

As part of this reorganization, we incurred $21 million of restructuring costs, $24 million of implementation costs and $10

million of other non-recurring costs during 2007, and incurred $7 million of restructuring costs during 2006. Restructuring and

implementation costs are recorded as part of our overall Restructuring Program. Other costs relating to our European Union

segment reorganization are recorded as marketing, administration and research costs. Management believes the disclosure of

implementation and other non-recurring charges provides readers of our financial statements greater transparency to the total

costs of our European Union segment reorganization.

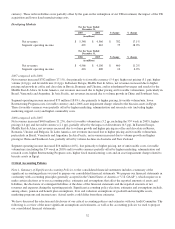

Asset Impairment Charges

During the first and fourth quarters of 2007, we completed our annual review of goodwill and intangible assets. No impairments

resulted from these reviews. Additionally, in 2007, we sold our flavored water and juice brand assets and related trademarks,

and incurred an asset impairment charge of $120 million, or $0.03 per diluted share, in recognition of the sale. The charge,

which included the write-off of the associated goodwill of $3 million, intangible assets of $70 million and property, plant and

equipment of $47 million, was recorded as asset impairment and exit costs on the consolidated statement of earnings.

We recorded aggregate asset impairment charges in 2006 amounting to $424 million, or $0.17 per diluted share. During our

2006 annual review of goodwill and intangible assets we recorded a $24 million non-cash charge for impairment of biscuits

assets in Egypt and hot cereal assets in the U.S. In addition, we incurred an asset impairment charge of $69 million in 2006 in

anticipation of the 2007 sale of our hot cereal assets and trademarks. The charge included the write-off of a portion of the

associated goodwill of $15 million, intangible assets of $52 million and property, plant and equipment of $2 million. No further

charges were incurred in 2007 related to this sale. Additionally, in 2006, we incurred an asset impairment charge of $86 million

in recognition of the pet snacks brand and assets sale. The charge included the write-off of a portion of the associated goodwill

of $25 million, intangible assets of $55 million and property, plant and equipment of $6 million. Also during 2006, we

re-evaluated the business model for our Tassimo hot beverage system due to lagging revenues. This evaluation resulted in a

$245 million non-cash asset impairment charge from lower utilization of existing manufacturing capacity. We recorded these

charges as asset impairment and exit costs on the consolidated statement of earnings.

We recorded aggregate asset impairment charges in 2005 amounting to $269 million, or $0.08 per diluted share. During the first

quarter of 2005, we completed our annual review of goodwill and intangible assets. No impairments resulted from this review.

In addition, we sold our fruit snacks assets during 2005 and incurred an asset impairment charge of $93 million in recognition of

the sale. We also incurred asset impairment charges of $176 million in 2005 in anticipation of the 2006 sales of certain assets in

Canada and a small biscuit brand in the U.S. These aggregate charges, which included the write-off of the associated goodwill

of $13 million, intangible assets of $118 million and asset write-downs of $138 million were recorded as asset impairment and

exit costs on the consolidated statement of earnings. Refer to Note 2, Asset Impairment, Exit and Implementation Costs, for

further asset impairment details.

23