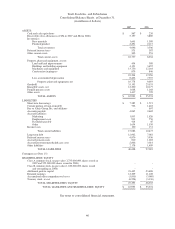

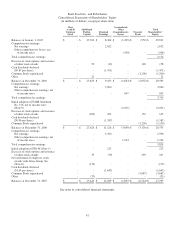

Kraft 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

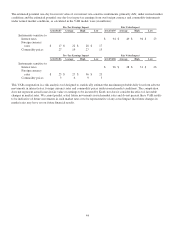

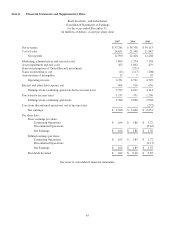

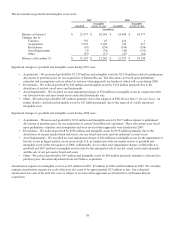

Note 2. Asset Impairment, Exit and Implementation Costs:

Restructuring Program

In January 2004, we announced a three-year restructuring program (the “Restructuring Program”) and, in January 2006,

extended it through 2008. The objectives of this program are to leverage our global scale, realign and lower our cost structure,

and optimize capacity. As part of the Restructuring Program we anticipate:

• incurring approximately $2.8 billion in pre-tax charges reflecting asset disposals, severance and implementation costs;

• closing up to 35 facilities and eliminating approximately 13,500 positions; and

• using cash to pay for approximately $1.7 billion of the $2.8 billion in charges.

We incurred charges under the Restructuring Program of $459 million in 2007, $673 million in 2006 and $297 million in 2005.

Since the inception of the Restructuring Program, we have incurred $2.1 billion in charges and paid cash for $1.1 billion.

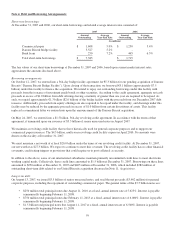

In February 2008, we announced the implementation of our new operating structure built on three core elements: accountable

business units; shared services that leverage the scale of our global portfolio; and a streamlined corporate staff. Within our new

structure, business units now have full P&L accountability and are staffed accordingly. This also ensures that we are putting our

resources closer to where decisions are made that affect our consumers. Our corporate and shared service functions are

streamlining their organizations and focusing them on core activities that can more efficiently support the goals of the business

units. The intent was to simplify, streamline and increase accountability, with the ultimate goal of generating reliable growth for

Kraft. As a result, we have eliminated approximately 700 positions as we streamline our headquarters functions.

We are also in the process of reorganizing our European Union segment to function on a pan-European centralized category

management and value chain model. After the reorganization is complete, the European Principal Company (“EPC”) will

manage the European Union segment categories centrally and make decisions for all aspects of the value chain, except for sales

and distribution. The European subsidiaries will execute sales and distribution locally, and the local production companies will

act as toll manufacturers on behalf of the EPC. The EPC legal entity has already been incorporated as Kraft Foods Europe

GmbH in Zurich, Switzerland. As part of this reorganization, we incurred $21 million of restructuring costs, $24 million of

implementation costs and $10 million of non-recurring costs during 2007, and incurred $7 million of restructuring costs during

2006. Implementation costs are included in the total Restructuring Program charges. Other costs relating to our European Union

segment reorganization are recorded as marketing, administration and research costs. Management believes the disclosure of

implementation and other non-recurring charges provides readers of our financial statements greater transparency to the total

costs of our European Union segment reorganization.

During the second quarter of 2006, we entered into a seven-year, $1.7 billion agreement to receive information technology

services from Electronic Data Systems (“EDS”). On June 1, 2006, we began using EDS’s data centers, and EDS started

providing us with web hosting, telecommunications and IT workplace services. In 2007, we reversed $6 million in restructuring

costs because our severance costs were lower than originally anticipated, and we incurred implementation costs of $47 million

related to the EDS transition. In 2006, we incurred restructuring costs of $51 million and implementation costs of $56 million.

These amounts are included in the total Restructuring Program charges.

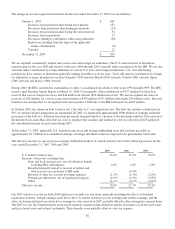

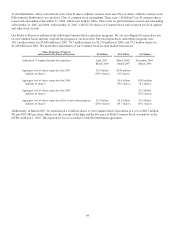

Restructuring Costs:

Under the Restructuring Program, we recorded asset impairment and exit costs of $332 million during 2007, $578 million

during 2006 and $210 million during 2005. We announced the closure of three plants during 2007; we have now announced the

closure of 30 facilities since the program began in 2004. We expect to pay cash for approximately $250 million of the charges

that we incurred during 2007.

54