Kraft 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

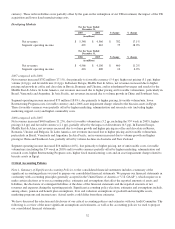

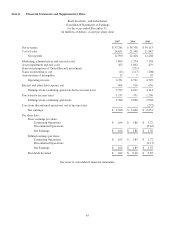

(3) Operating leases represent the minimum rental commitments under non-cancelable operating leases. We have no

significant capital lease obligations.

(4) Purchase obligations for inventory and production costs (such as raw materials, indirect materials and supplies,

packaging, co-manufacturing arrangements, storage and distribution) are commitments for projected needs to be

utilized in the normal course of business. Other purchase obligations include commitments for marketing,

advertising, capital expenditures, information technology and professional services. Arrangements are considered

purchase obligations if a contract specifies all significant terms, including fixed or minimum quantities to be

purchased, a pricing structure and approximate timing of the transaction. Most arrangements are cancelable

without a significant penalty, and with short notice (usually 30 days). Any amounts reflected on the consolidated

balance sheet as accounts payable and accrued liabilities are excluded from the table above.

(5) Other long-term liabilities primarily consist of postretirement health care costs of $2,280 million. The following

long-term liabilities included on the consolidated balance sheet are excluded from the table above: accrued

pension costs, income taxes, minority interest, insurance accruals and other accruals. We are unable to estimate

the timing of the payments (or contributions in the case of accrued pension costs) for these items. Currently, we

anticipate making U.S. pension contributions of approximately $15 million in 2008 and non-U.S. pension

contributions of approximately $160 million in 2008, based on current tax law. As of December 31, 2007, our

total liability for income taxes, including uncertain tax positions and associated accrued interest and penalties,

was $1,121 million. We expect to pay approximately $100 million in the next twelve months. While years 2000

through 2003 are currently under examination by the IRS, we are not able to reasonably estimate the timing of

future cash flows beyond 12 months due to uncertainties in the timing of this and other tax audit outcomes.

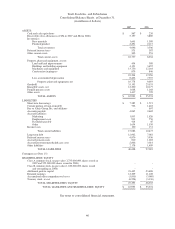

Equity and Dividends

Stock Repurchases:

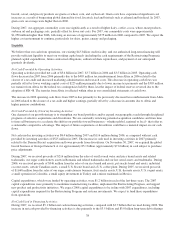

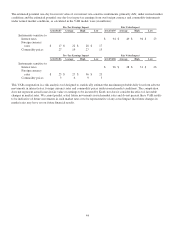

Our Board of Directors authorized the following Common Stock repurchase programs. We are not obligated to repurchase any

of our Common Stock and may suspend any program at our discretion. The total repurchases under these programs were

110.1 million shares for $3,640 million in 2007, 38.7 million shares for $1,250 million in 2006, and 39.2 million shares for

$1,200 million in 2005. We made these repurchases of our Common Stock in open market transactions.

Share Repurchase Program

authorized by the Board of Directors $5.0 billion $2.0 billion $1.5 billion

Authorized / Completed period for repurchase April 2007 -

March 2009

March 2006 -

March 2007

December 2004 -

March 2006

Aggregate cost of shares repurchased in 2007

(millions of shares)

$3.5 billion

(105.6 shares)

$140 million

(4.5 shares)

Aggregate cost of shares repurchased in 2006

(millions of shares)

$1.0 billion

(30.2 shares)

$250 million

(8.5 shares)

Aggregate cost of shares repurchased in 2005

(millions of shares)

$1.2 billion

(39.2 shares)

Aggregate cost of shares repurchased life-to-date under program

(millions of shares)

$3.5 billion

(105.6 shares)

$1.1 billion

(34.7 shares)

$1.5 billion

(49.1 shares)

Additionally, in March 2007, we repurchased 1.4 million shares of our Common Stock from Altria at a cost of $46.5 million.

We paid $32.085 per share, which was the average of the high and the low price of Kraft Common Stock as reported on the

NYSE on March 1, 2007. This repurchase was in accordance with the Distribution agreement.

As of December 31 2007, we had $1.5 billion left under our $5.0 billion share repurchase program and we expect to complete

the program before the authorization expires in March 2009.

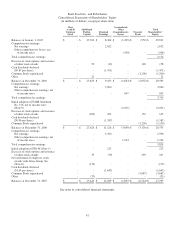

Stock Based Compensation:

At the Distribution, Altria stock awards were modified through the issuance of Kraft stock awards, and accordingly the Altria

stock awards were split into two instruments. Holders of Altria stock options received: 1) a new Kraft option to acquire shares

of Kraft Common Stock; and 2) an adjusted Altria stock option for the same number of shares of Altria common stock

41