Kraft 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc. and Subsidiaries

Notes to Consolidated Financial Statements

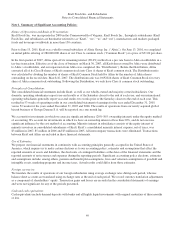

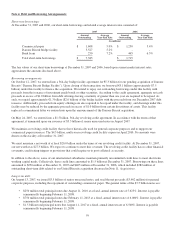

Note 1. Summary of Significant Accounting Policies:

Nature of Operations and Basis of Presentation:

Kraft Foods Inc. was incorporated in 2000 in the Commonwealth of Virginia. Kraft Foods Inc., through its subsidiaries (Kraft

Foods Inc. and subsidiaries are hereinafter referred to as “Kraft,” “we,” “us” and “our”), manufactures and markets packaged

foods and beverages worldwide in more than 150 countries.

Prior to June 13, 2001, Kraft was a wholly-owned subsidiary of Altria Group, Inc. (“Altria”). On June 13, 2001, we completed

an initial public offering of 280,000,000 shares of our Class A common stock (“Common Stock”) at a price of $31.00 per share.

In the first quarter of 2007, Altria spun off its remaining interest (89.0%) in Kraft on a pro rata basis to Altria stockholders in a

tax-free transaction. Effective as of the close of business on March 30, 2007, all Kraft shares owned by Altria were distributed

to Altria’s stockholders, and our separation from Altria was completed (the “Distribution”). Before the Distribution, Altria

converted all of its Class B shares of Kraft common stock into Class A shares of Kraft common stock. The Distribution ratio

was calculated by dividing the number of shares of Kraft Common Stock held by Altria by the number of Altria shares

outstanding on the record date, March 16, 2007. The distribution ratio was 0.692024 shares of Kraft Common Stock for every

share of Altria common stock outstanding. Following the Distribution, we only have Class A common stock outstanding.

Principles of Consolidation:

The consolidated financial statements include Kraft, as well as our wholly-owned and majority-owned subsidiaries. Our

domestic operating subsidiaries report year-end results as of the Saturday closest to the end of each year, and our international

operating subsidiaries generally report year-end results two weeks prior to the Saturday closest to the end of each year. This

resulted in 53 weeks of operating results in our consolidated statement of earnings for the year ended December 31, 2005,

versus 52 weeks for the years ended December 31, 2007 and 2006. The results of operations from our newly acquired global

biscuit business of Groupe Danone S.A. will be reported on a one month lag.

We account for investments in which we exercise significant influence (20%-50% ownership interest) under the equity method

of accounting. We account for investments in which we have an ownership interest of less than 20%, and do not exercise

significant influence by the cost method of accounting. Minority interest in subsidiaries consists of the equity interest of

minority investors in consolidated subsidiaries of Kraft. Kraft’s consolidated minority interest expense, net of taxes, was

$3 million in 2007, $5 million in 2006 and $3 million in 2005. All intercompany transactions were eliminated. Transactions

between Kraft and Altria are included in these financial statements.

Use of Estimates:

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of

America, which requires us to make certain elections as to our accounting policy, estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent liabilities at the dates of the financial statements and the

reported amounts of net revenues and expenses during the reporting periods. Significant accounting policy elections, estimates

and assumptions include, among others, pension and benefit plan assumptions, lives and valuation assumptions of goodwill and

intangible assets, marketing programs and income taxes. Actual results could differ from those estimates.

Foreign currencies:

We translate the results of operations of our foreign subsidiaries using average exchange rates during each period, whereas

balance sheet accounts are translated using exchange rates at the end of each period. We record currency translation adjustments

as a component of shareholders’ equity. Transaction gains and losses are recorded in the consolidated statements of earnings

and were not significant for any of the periods presented.

Cash and cash equivalents:

Cash equivalents include demand deposits with banks and all highly liquid investments with original maturities of three months

or less.

49