Kraft 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 4. Debt and Borrowing Arrangements:

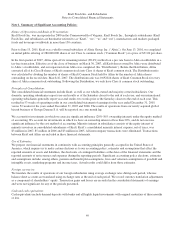

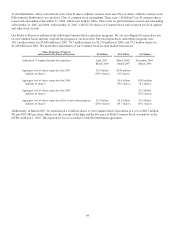

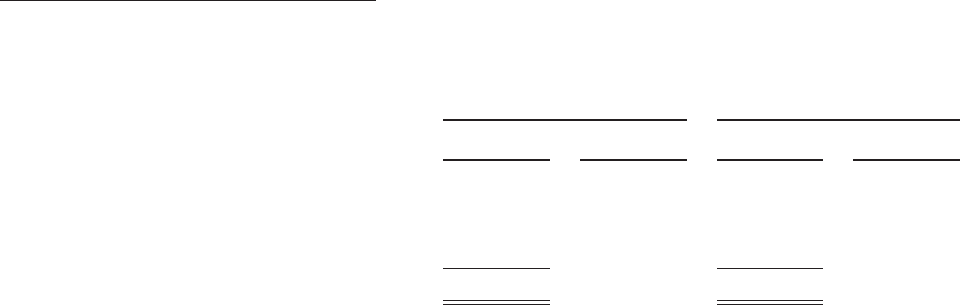

Short-term borrowings:

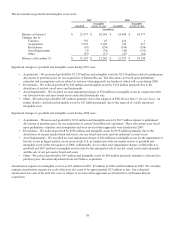

At December 31, 2007 and 2006, our short-term borrowings and related average interest rates consisted of:

2007 2006

Amount

Outstanding

Average

Year-End Rate

Amount

Outstanding

Average

Year-End Rate

(in millions)

Commercial paper $ 1,608 5.0% $ 1,250 5.4%

Danone Biscuit bridge facility 5,527 5.2% - -

Bank loans 250 7.2% 465 6.5%

Total short-term borrowings $ 7,385 $ 1,715

The fair values of our short-term borrowings at December 31, 2007 and 2006, based upon current market interest rates,

approximate the amounts disclosed above.

Borrowing arrangements:

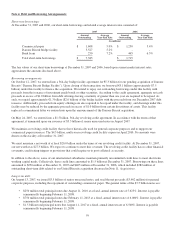

On October 12, 2007, we entered into a 364-day bridge facility agreement for €5.3 billion for our pending acquisition of Danone

Biscuit (“Danone Biscuit Bridge Facility”). Upon closing of the transaction, we borrowed €5.1 billion (approximately $7.5

billion) under this facility to finance the acquisition. We intend to repay our outstanding borrowings under this facility with

proceeds from the issuance of investment grade bonds or other securities. According to the credit agreement, aggregate net cash

proceeds in excess of $1.0 billion from debt offerings having a maturity of greater than one year are required to be repaid. As

such, we repaid approximately €1.3 billion ($2.0 billion) of the bridge facility with the proceeds from our December 2007 debt

issuance. Additionally, proceeds from equity offerings are also required to be repaid under the facility, and drawings under this

facility may be reduced by the aggregate proceeds in excess of $1.0 billion from certain divestitures of assets. This facility

replaced a commitment letter we entered into upon the announcement of the Danone Biscuit acquisition.

On May 24, 2007, we entered into a $1.5 billion, 364-day revolving credit agreement. In accordance with the terms of that

agreement, it terminated upon our issuance of $3.5 billion of senior unsecured notes in August 2007.

We maintain a revolving credit facility that we have historically used for general corporate purposes and to support our

commercial paper issuances. The $4.5 billion, multi-year revolving credit facility expires in April 2010. No amounts were

drawn on this facility at December 31, 2007.

We must maintain a net worth of at least $20.0 billion under the terms of our revolving credit facility. At December 31, 2007,

our net worth was $27.3 billion. We expect to continue to meet this covenant. The revolving credit facility has no other financial

covenants, credit rating triggers or provisions that could require us to post collateral as security.

In addition to the above, some of our international subsidiaries maintain primarily uncommitted credit lines to meet short-term

working capital needs. Collectively, these credit lines amounted to $1.5 billion at December 31, 2007. Borrowings on these lines

amounted to $250 million at December 31, 2007 and $465 million at December 31, 2006, which included $282 million of

outstanding short-term debt related to our United Biscuits acquisition discussed in Note 11, Acquisitions.

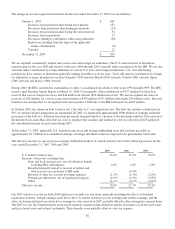

Long-term debt:

On August 13, 2007, we issued $3.5 billion of senior unsecured notes, and used the net proceeds ($3,462 million) for general

corporate purposes, including the repayment of outstanding commercial paper. The general terms of the $3.5 billion notes are:

• $250 million total principal notes due August 11, 2010 at a fixed, annual interest rate of 5.625%. Interest is payable

semiannually beginning February 11, 2008.

• $750 million total principal notes due February 11, 2013 at a fixed, annual interest rate of 6.000%. Interest is payable

semiannually beginning February 11, 2008.

• $1.5 billion total principal notes due August 11, 2017 at a fixed, annual interest rate of 6.500%. Interest is payable

semiannually beginning February 11, 2008.

59