Kraft 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

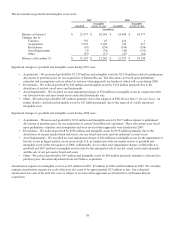

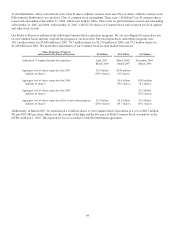

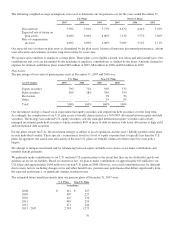

determined using a modified Black-Scholes methodology using the following weighted average assumptions for Altria common

stock.

Risk-Free

Interest Rate Expected Life

Expected

Volatility

Expected

Dividend Yield

Fair Value

at Grant Date

2006 Altria Group Inc. 5% 4 years 26.73% 4.43% $ 12.79

2005 Altria Group Inc. 4% 4 years 32.90% 4.43% $ 14.08

Restricted Stock Plans:

We may grant shares of restricted stock and rights to receive shares of stock to eligible employees, giving them in most

instances all of the rights of stockholders, except that they may not sell, assign, pledge or otherwise encumber the shares and

rights. Shares of restricted stock and rights are subject to forfeiture if certain employment conditions are not met. Restricted

stock generally vests on the third anniversary of the grant date.

The fair value of the restricted shares and rights at the date of grant is amortized ratably over the restriction period. We recorded

pre-tax compensation expense related to restricted stock and rights of $136 million in 2007, $139 million (including the pre-tax

cumulative effect gain of $9 million from the adoption of SFAS No. 123(R)) in 2006 and $148 million in 2005. The deferred tax

benefit recorded related to this compensation expense was $47 million for the year ended December 31, 2007, $51 million for

the year ended December 31, 2006 and $54 million for the year ended December 31, 2005. The unamortized compensation

expense related to our restricted stock and rights was $230 million at December 31, 2007 and is expected to be recognized over

a weighted average period of two years.

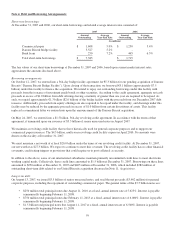

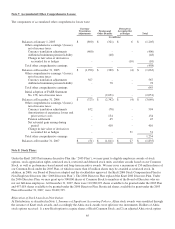

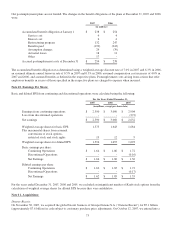

Our restricted stock and rights activity for the year ended December 31, 2007 was:

Number

of Shares

Weighted-Average

Grant Date Fair

Value Per Share

Balance at January 1, 2007 15,275,420 $ 31.31

Issued as part of Distribution 2,954,527 31.66

Granted 6,271,037 34.56

Vested (4,499,323) 32.19

Forfeited (1,340,751) 31.73

Balance at December 31, 2007 18,660,910 32.21

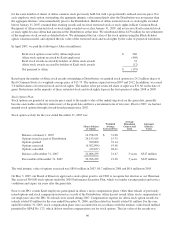

In January 2007, we issued 5.2 million shares of restricted stock and stock rights to eligible U.S. and non-U.S. employees as

part of our annual incentive program. Restrictions on these shares and rights lapse in the first quarter of 2010. The market value

per restricted share or right was $34.655 on the date of grant. Additionally, we issued 1.0 million off-cycle shares of restricted

stock and stock rights during 2007. The weighted-average market value per restricted share or right was $34.085 on the date of

grant. The total number of restricted shares and rights issued in 2007 was 9.2 million, including those issued as a result of the

Distribution.

The weighted-average grant date fair value of restricted stock and rights granted was $310 million, or $33.63 per restricted share

or right, in 2007, $200 million, or $29.16 per restricted share or right, in 2006 and $200 million, or $33.26 per restricted share or

right, in 2005. The vesting date fair value of restricted stock and rights was $153 million in 2007, $123 million in 2006 and

$2 million in 2005.

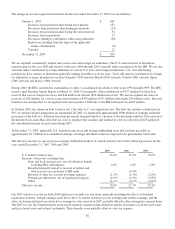

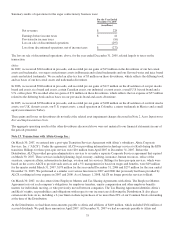

Note 9. Benefit Plans:

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans (“SFAS No. 158”). SFAS No. 158 requires us to recognize the funded status of our defined benefit

pension and other postretirement plans on the consolidated balance sheet. Subsequent changes in funded status that are not

recognized as a component of net periodic benefit cost are recorded as a component of other comprehensive income. We

prospectively adopted the recognition and related disclosure provisions of SFAS No. 158 on December 31, 2006. The adoption

resulted in a decrease to total assets of $2,286 million, a decrease to total liabilities of $235 million and a decrease to

shareholders’ equity of $2,051 million.

67