Kraft 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Progress in 2007

Over the past 12 months, we proved that we can grow our top line much faster. We grew

net revenue by 8.4%, delivering our best top-line performance since going public in 2001.

We invested an incremental $375 million in our business to improve product quality, drive

innovation and increase marketing support. And where we’ve invested, we’ve seen results.

We took several actions to strengthen our portfolio—acquiring Groupe Danone’s global

biscuit business, selling Veryfine and Fruit2O and announcing the merger of the Post cereal

business into Ralcorp.

We continue to make progress on the restructuring program that we began in 2004.

And we’ve returned value to you—increasing our dividend rate by 8% and buying back our

stock. In the first nine months following our spin-off from Altria, we repurchased 6.5% of

our outstanding shares—$3.5 billion of the $5 billion share repurchase plan authorized by

our board.

Addressing challenges

Our bottom-line results, however, were not where we wanted them to be. And so, as we

committed last year, our focus in 2008 is to build on our top-line momentum while getting

the bottom line growing again.

The biggest challenge we encountered last year was unprecedented high input costs—

which impacted everyone in the industry—and the fact that they remained at those levels

for an extended time. Because input costs, particularly dairy, stayed so high for so long, our

pricing actions did not keep pace with our cost increases. That hurt our gross margins, and

as a result, our profits.

We can and will be more aggressive with pricing in 2008. Our ability to charge higher prices

—and the willingness of consumers to pay them—depends on the strength of our brands

and the value they offer consumers. As a result of our investments, we believe we have

improved both. And so, we expect to see progressive improvement in our profit margins as

2008 unfolds.

Now I’d like to tell you about the progress we’ve made on our four growth strategies.

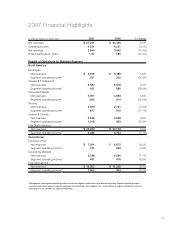

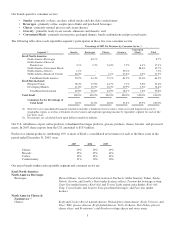

(in millions, except per share data) 2007 % Change

Net revenues $37,241 8.4%

Operating income 4,331 (4.2%)

Net earnings 2,590 (15.4%)

Diluted earnings per share 1.62 (12.4%)

Financial

Highlights

Consolidated

Results

8