Kraft 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

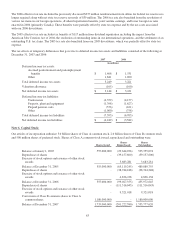

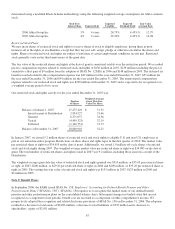

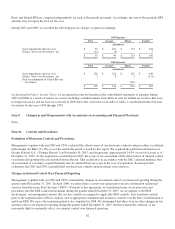

Our postemployment plans are not funded. The changes in the benefit obligations of the plans at December 31, 2007 and 2006

were:

2007 2006

(in millions)

Accumulated benefit obligation at January 1 $ 238 $ 254

Service cost 4 4

Interest cost 6 4

Restructuring program 132 247

Benefits paid (190) (243)

Assumption changes 29 (39)

Actuarial losses 18 11

Other 17 -

Accrued postemployment costs at December 31 $ 254 $ 238

The accumulated benefit obligation was determined using a weighted-average discount rate of 7.0% in 2007 and 6.3% in 2006,

an assumed ultimate annual turnover rate of 0.5% in 2007 and 0.3% in 2006, assumed compensation cost increases of 4.0% in

2007 and 2006, and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer

employees benefits in excess of those specified in the respective plans are charged to expense when incurred.

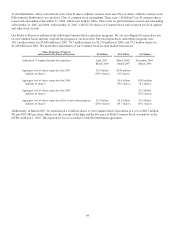

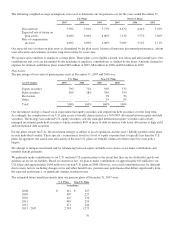

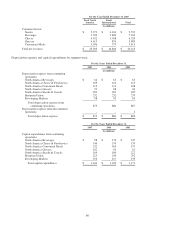

Note 10. Earnings Per Share:

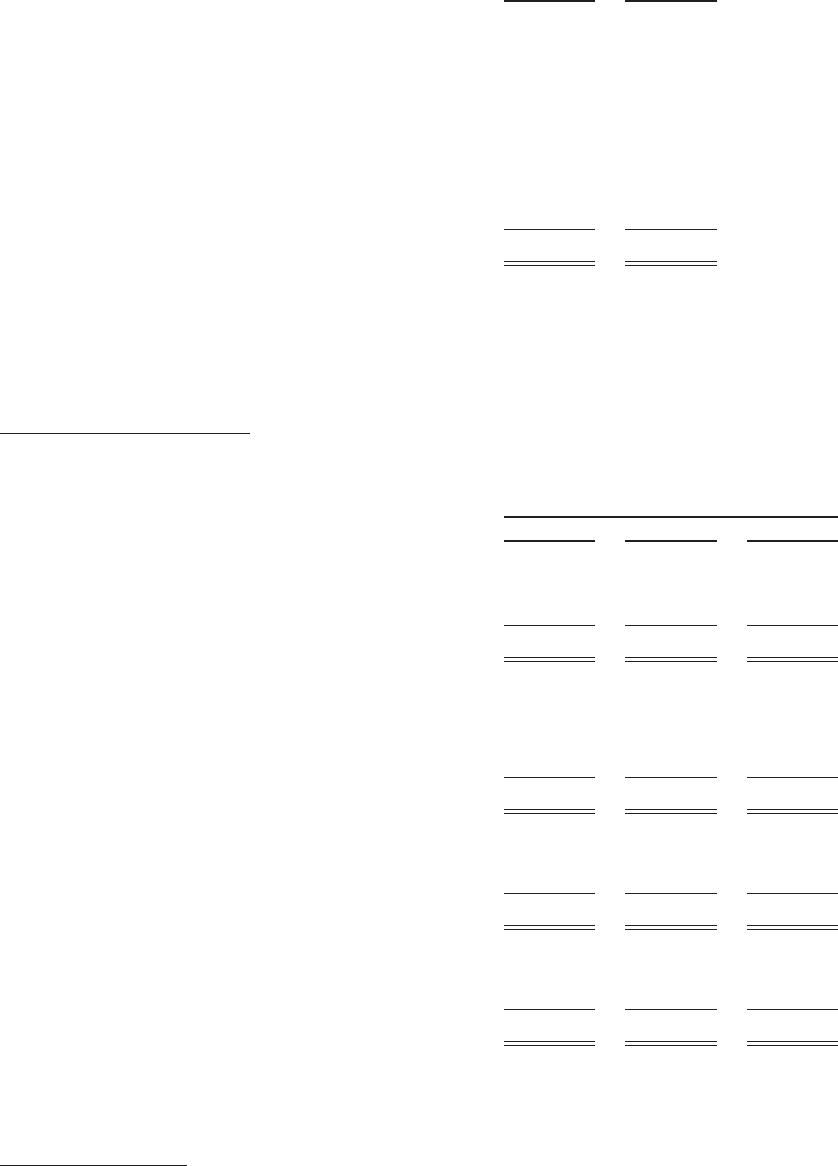

Basic and diluted EPS from continuing and discontinued operations were calculated using the following:

For the Years Ended December 31,

2007 2006 2005

(in millions, except per share data)

Earnings from continuing operations $ 2,590 $ 3,060 $ 2,904

Loss from discontinued operations - - (272)

Net earnings $ 2,590 $ 3,060 $ 2,632

Weighted average shares for basic EPS 1,575 1,643 1,684

Plus incremental shares from assumed

conversions of stock options,

restricted stock and stock rights 19 12 9

Weighted average shares for diluted EPS 1,594 1,655 1,693

Basic earnings per share:

Continuing Operations $ 1.64 $ 1.86 $ 1.72

Discontinued Operations - - (0.16)

Net Earnings $ 1.64 $ 1.86 $ 1.56

Diluted earnings per share:

Continuing Operations $ 1.62 $ 1.85 $ 1.72

Discontinued Operations - - (0.17)

Net Earnings $ 1.62 $ 1.85 $ 1.55

For the years ended December 31, 2007, 2006 and 2005, we excluded an insignificant number of Kraft stock options from the

calculation of weighted average shares for diluted EPS because they were antidilutive.

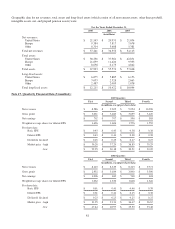

Note 11. Acquisitions:

Danone Biscuit:

On November 30, 2007, we acquired the global biscuit business of Groupe Danone S.A. (“Danone Biscuit”) for €5.1 billion

(approximately $7.6 billion) in cash subject to customary purchase price adjustments. On October 12, 2007, we entered into a

73