Kraft 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

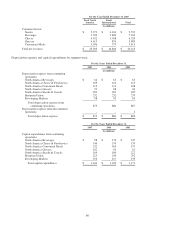

We incurred asset impairment, exit and implementation costs of $579 million in 2007, $1,097 million in 2006, and $566 million

in 2005. Refer to Note 2, Asset Impairment, Exit and Implementation Costs, for a breakout of charges by segment.

As described in Note 11. Acquisitions, in the third quarter of 2006, we acquired the Spanish and Portuguese operations of UB

and rights to all Nabisco trademarks in the European Union, Eastern Europe, the Middle East and Africa. The redemption of our

outstanding investment in UB resulted in a gain on closing of approximately $251 million. This gain is included in segment

operating income of the European Union segment.

As discussed in Note 12. Divestitures, during 2007, we sold our hot cereal assets and trademarks, our sugar confectionery assets

in Romania and related trademarks and our flavored water and juice brand assets and related trademarks for aggregate gains of

$15 million. During 2006, we sold our rice brand and assets, pet snacks brand and assets, industrial coconut assets, certain

Canadian assets, a small U.S. biscuit brand and a U.S. coffee plant for aggregate gains of $117 million. During 2005, we sold

our fruit snacks assets, U.K. desserts assets, U.S. yogurt assets, a small operation in Colombia, a minor trademark in Mexico and

a small equity investment in Turkey for aggregate gains of $108 million.

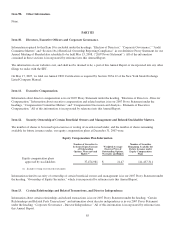

These (gains) / losses on divestitures were included in segment operating income as follows:

For the Years Ended December 31,

2007 2006 2005

(in millions)

North America Beverages $ 5 $ 95 $ -

North America Cheese & Foodservice - 8 (1)

North America Convenient Meals - (226) -

North America Grocery - 1 2

North America Snacks & Cereals (12) 5 -

European Union - - (114)

Developing Markets (8) - 5

Gains on divestitures, net $ (15) $ (117) $ (108)

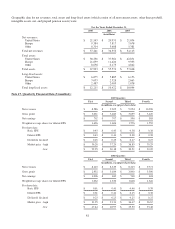

Net revenues by consumer sector, which includes the separation of Foodservice and Kraft International into sector components

and Cereals into the Grocery sector, were:

For the Year Ended December 31, 2007

Kraft North

America

Kraft

International Total

(in millions)

Consumer Sector:

Snacks $ 5,704 $ 5,657 $ 11,361

Beverages 3,499 4,562 8,061

Cheese 5,199 1,729 6,928

Grocery 4,198 926 5,124

Convenient Meals 5,339 428 5,767

Total net revenues $ 23,939 $ 13,302 $ 37,241

For the Year Ended December 31, 2006

Kraft North

America

Kraft

International Total

(in millions)

Consumer Sector:

Snacks $ 5,491 $ 4,537 $ 10,028

Beverages 3,352 3,973 7,325

Cheese 4,857 1,557 6,414

Grocery 4,282 799 5,081

Convenient Meals 5,136 372 5,508

Total net revenues $ 23,118 $ 11,238 $ 34,356

79