Kraft 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

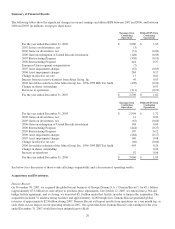

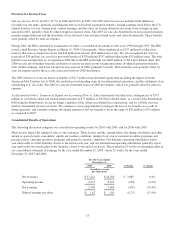

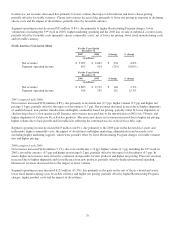

Summary of Financial Results

The following tables show the significant changes in our net earnings and diluted EPS between 2007 and 2006, and between

2006 and 2005 (in millions, except per share data):

Earnings from

Continuing

Operations

Diluted EPS from

Continuing

Operations

For the year ended December 31, 2006 $ 3,060 $ 1.85

2007 Losses on divestitures, net (3) -

2006 Gains on divestitures, net (31) (0.02)

2006 Gain on redemption of United Biscuits investment (148) (0.09)

2007 Restructuring Program (303) (0.19)

2006 Restructuring Program 444 0.27

European Union segment reorganization (7) -

2007 Asset impairment charges (52) (0.03)

2006 Asset impairment charges 284 0.17

Change in effective tax rate 13 0.01

Interest from tax reserve transfers from Altria Group, Inc. 49 0.03

2006 favorable resolution of the Altria Group, Inc. 1996-1999 IRS Tax Audit (405) (0.24)

Change in shares outstanding - 0.07

Decrease in operations (311) (0.21)

For the year ended December 31, 2007 $ 2,590 $ 1.62

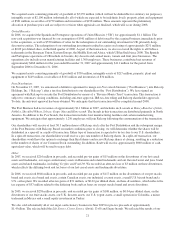

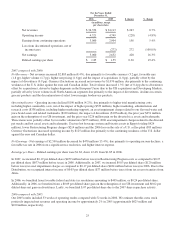

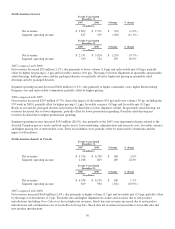

Earnings from

Continuing

Operations

Diluted EPS from

Continuing

Operations

For the year ended December 31, 2005 $ 2,904 $ 1.72

2006 Gains on divestitures, net 31 0.02

2005 Gains on divestitures, net (65) (0.04)

2006 Gain on redemption of United Biscuits investment 148 0.09

2006 Restructuring Program (444) (0.27)

2005 Restructuring Program 199 0.12

2006 Asset impairment charges (284) (0.17)

2005 Asset impairment charges 140 0.08

Change in effective tax rate (66) (0.04)

2006 favorable resolution of the Altria Group, Inc. 1996-1999 IRS Tax Audit 405 0.24

Change in shares outstanding - 0.04

Increase in operations 92 0.06

For the year ended December 31, 2006 $ 3,060 $ 1.85

See below for a discussion of those events affecting comparability and a discussion of operating results.

Acquisitions and Divestitures

Danone Biscuit:

On November 30, 2007, we acquired the global biscuit business of Groupe Danone S.A. (“Danone Biscuit”) for €5.1 billion

(approximately $7.6 billion) in cash subject to purchase price adjustments. On October 12, 2007, we entered into a 364-day

bridge facility agreement, and at closing, we borrowed €5.1 billion under that facility in order to finance the acquisition. The

acquisition included 32 manufacturing facilities and approximately 14,000 employees. Danone Biscuit generated global

revenues of approximately $2.8 billion during 2007. Danone Biscuit will report results from operations on a one month lag; as

such, there was no impact on our operating results in 2007. On a proforma basis, Danone Biscuit’s net earnings for the year

ended December 31, 2007 would have been insignificant to Kraft.

20