Kraft 2007 Annual Report Download - page 68

Download and view the complete annual report

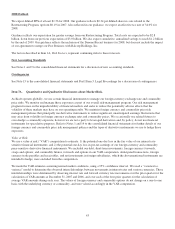

Please find page 68 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.By using derivatives to hedge exposures to changes in exchange rates and commodity prices, Kraft has exposure on these

derivatives to credit and market risk. We are exposed to credit risk that the counterparty might fail to fulfill its performance

obligations under the terms of the derivative contract. We minimize our credit risk by entering into transactions with high-

quality counterparties with investment grade credit ratings, limiting the amount of exposure we have with each counterparty and

monitoring the financial condition of our counterparties. We also maintain a policy of requiring that all significant,

non-exchange traded derivative contracts be governed by an International Swaps and Derivatives Association master agreement.

Market risk is the risk that the value of the financial instrument might be adversely affected by a change in foreign currency

exchange rates, commodity prices, or interest rates. We manage market risk by incorporating monitoring parameters within our

risk management strategy that limits the types of derivative instruments and derivative strategies, and the degree of market risk

that may be undertaken by the use of derivative instruments.

We record derivative financial instruments at fair value in our consolidated balance sheets as either current assets or current

liabilities. Changes in the fair value of derivatives are recorded each period either in accumulated other comprehensive earnings

/ (losses) or in earnings, depending on whether a derivative is designated and effective as part of a hedge transaction and, if it is,

the type of hedge transaction. Gains and losses on derivative instruments reported in accumulated other comprehensive earnings

/ (losses) are reclassified to the consolidated statement of earnings in the periods in which operating results are affected by the

hedged item. Cash flows from hedging instruments are classified in the same manner as the affected hedged item in the

consolidated statements of cash flows.

Guarantees:

We account for guarantees in accordance with FASB Interpretation No. 45, Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others, (“FIN 45”). FIN 45 requires us to

disclose certain guarantees and to recognize a liability for the fair value of the obligation of qualifying guarantee activities. See

Note 15, Commitments and Contingencies for a further discussion of guarantees.

Reclassification:

We reclassified minority interest in earnings in the prior year statement of earnings from a separate line item into general

corporate expenses within marketing, administration and research costs to conform with the current year’s presentation.

Additionally, we reclassified dividends payable in the prior year balance sheet from other accrued liabilities to a separate line

item to conform with the current year’s presentation.

New Accounting Pronouncements:

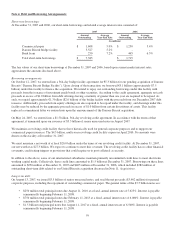

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value

Measurements, as amended in February 2008 by FSP FAS 157-2, Effective Date of FASB Statement No. 157. The provisions of

SFAS No. 157 are effective for Kraft as of January 1, 2008. However, FSP FAS 157-2 defers the effective date for all

nonfinancial assets and liabilities, except those items recognized or disclosed at fair value on an annual or more frequently

recurring basis, until January 1, 2009. SFAS No. 157 defines fair value, establishes a framework for measuring fair value and

expands disclosures about fair value measurements. We do not expect the adoption of this statement to have a material impact

on our financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities -

Including an amendment of FASB Statement No. 115. The provisions are effective for Kraft as of January 1, 2008. This

statement permits entities to choose to measure many financial instruments and certain other items at fair value and report

unrealized gains and losses on these instruments in earnings. We do not expect the adoption of this statement to have a material

impact on our financial statements.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations. The provisions, which change the way

companies account for business combinations, are effective for Kraft as of January 1, 2009. This statement requires the

acquiring entity in a business combination to recognize assets acquired and liabilities assumed in the transaction; establishes the

acquisition-date fair value as the measurement objective for all assets acquired and liabilities assumed; and requires the acquirer

to disclose all information needed by investors to understand the nature and financial effect of the business combination. We do

not expect the adoption of this statement to have a material impact on our financial statements.

In December 2007, the FASB also issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements - an

amendment of Accounting Research Bulletin No. 51, the provisions of which are effective for Kraft as of January 1, 2009. This

statement requires an entity to classify noncontrolling interests in subsidiaries as a separate component of equity. Additionally,

transactions between an entity and noncontrolling interests are required to be treated as equity transactions. We are currently

evaluating the impact of this statement on our financial statements.

53