Kraft 2007 Annual Report Download - page 22

Download and view the complete annual report

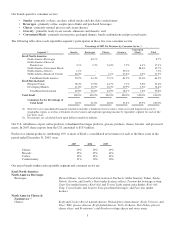

Please find page 22 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.biscuit, cereal, and grocery products are grains or wheat, corn, and soybean oil. Grain costs have experienced significant cost

increases as a result of burgeoning global demand for food, livestock feed and biofuels such as ethanol and biodiesel. In 2007,

grain costs on average were higher than in 2006.

During 2007, our aggregate commodity costs rose significantly as a result of higher dairy, coffee, cocoa, wheat, meat products,

soybean oil and packaging costs, partially offset by lower nut costs. For 2007, our commodity costs were approximately

$1,250 million higher than 2006, following an increase of approximately $275 million for 2006 compared with 2005. We expect

the higher cost environment to continue, particularly for dairy, grains, energy and packaging.

The prices paid for raw materials and agricultural materials used in our products generally reflect external factors such as

weather conditions, commodity market fluctuations, currency fluctuations and the effects of governmental agricultural

programs. Although the prices of the principal raw materials can be expected to fluctuate as a result of these factors, we believe

there will be an adequate supply of the raw materials we use and that they are generally available from numerous sources. We

use hedging techniques to limit the impact of price fluctuations in our principal raw materials. However, we do not fully hedge

against changes in commodity prices and these strategies may not protect us from increases in specific raw material costs.

Intellectual Property

We consider our trademarks, in the aggregate, to be material to our business. We protect our trademarks by registration or

otherwise in the U.S. and in other markets where we sell our products. Trademark protection continues in some countries for as

long as the mark is used and, in other countries, for as long as it is registered. Registrations generally are for fixed, but

renewable, terms. From time to time, we grant third parties licenses to use one or more of our trademarks in particular

locations. Similarly, we sell some of our products under brands we license and those licenses are generally renewable at our

discretion. These licensed brands include, among others:

•Starbucks bagged coffee, Seattle’s Best coffee, and Torrefazione Italia coffee for sale in U.S. grocery stores and other

distribution channels;

•Starbucks and Seattle’s Best coffee T-Discs and Tazo teas T-Discs for use in our Tassimo hot beverage system;

•Tazo teas for sale in grocery stores in the U.S.;

•Capri Sun aseptic juice drinks for sale in the U.S., Canada and within our Developing Markets segment;

•Taco Bell Home Originals Mexican style food products for sale in U.S. grocery stores;

•California Pizza Kitchen frozen pizzas for sale in grocery stores in the U.S. and Canada;

•Pebbles ready-to-eat cereals for sale in the U.S. and Canada; and

•South Beach Living pizzas, meals, breakfast wraps, lunch wrap kits, crackers, cookies, snack bars, cereals and

dressings for sale in grocery stores in the U.S.

Additionally, we own numerous patents worldwide. While our patent portfolio is material to our business, the loss of one patent

or a group of related patents would not have a material adverse effect on our business. We have either been issued patents or

have patent applications pending that relate to a number of current and potential products, including products licensed to others.

Patents, issued or applied for, cover inventions ranging from basic packaging techniques to processes relating to specific

products and to the products themselves. Our issued patents extend for varying periods according to the date of patent

application filing or grant and the legal term of patents in the various countries where patent protection is obtained. The actual

protection afforded by a patent, which can vary from country to country, depends upon the type of patent, the scope of its

coverage as determined by the patent office or courts in the country, and the availability of legal remedies in the country. We

consider that in the aggregate our patent applications, patents and licenses under patents owned by third parties are of material

importance to our operations. We are currently involved in a number of legal proceedings relating to the scope of protection and

validity of our patents and those of others. These proceedings may result in a significant commitment of our resources in the

future and, depending on their outcome, may adversely affect the validity and scope of certain of our patent or other proprietary

rights.

We also have proprietary trade secrets, technology, know-how processes and related intellectual property rights that are not

registered.

Research and Development

We pursue four objectives in research and development: product safety and quality; growth through new products; superior

consumer satisfaction; and reduced costs. We have more than 2,100 food scientists, chemists and engineers working primarily in

7