Kraft 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

exchange options with aggregate notional amounts of $4.0 billion at December 31, 2007, and $2.6 billion at December 31, 2006.

As of December 31, 2007, we had hedged forecasted foreign currency transactions for periods not exceeding the next 48

months. During the first quarter of 2007, we hedged currency exposure related to new, longer term intercompany loans with

foreign subsidiaries. Excluding these intercompany loans, we had hedged forecasted foreign currency transactions for periods

not exceeding the next twelve months.

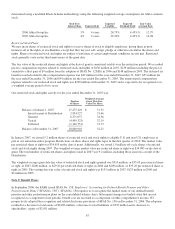

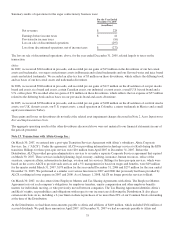

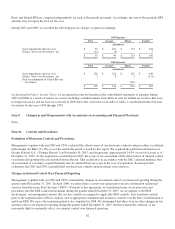

Hedging activity affected accumulated other comprehensive losses, net of income taxes, during the years ended December 31,

2007, 2006 and 2005 as follows:

2007 2006 2005

(in millions)

Accumulated gain / (loss) at beginning

of period $ (4) $ (4) $ 6

Transfer of realized (gains) / losses in

fair value to earnings (10) 32 (42)

Unrealized gain / (loss) in fair value 41 (32) 32

Accumulated gain / (loss) at December 31 $ 27 $ (4) $ (4)

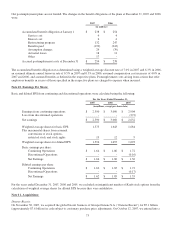

Hedges of net investments in foreign operations:

We have numerous investments in foreign subsidiaries. The net assets of these subsidiaries are exposed to volatility in foreign

currency exchange rates. Upon the acquisition of Danone Biscuit, we designated the euro denominated borrowings used to

finance the transaction as a net investment hedge of a portion of our overall European operations. The gains and losses in our

net investment in these designated European operations are economically offset by losses and gains in our euro denominated

borrowings. For the year ended December 31, 2007, $28 million of gains related to the euro denominated borrowings were

included in our cumulative translation adjustment.

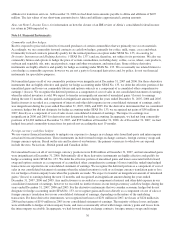

Note 15. Commitments and Contingencies:

Legal Proceedings:

We are defendants in a variety of legal proceedings. Plaintiffs in a few of those cases seek substantial damages. We cannot

predict with certainty the results of these proceedings. However, we believe that the final outcome of these proceedings will not

materially affect our financial results.

Third-Party Guarantees:

We have third-party guarantees because of our acquisition, divestiture and construction activities. As part of those transactions,

we guarantee that third parties will make contractual payments or achieve performance measures. At December 31, 2007, the

maximum potential payments under our third-party guarantees were approximately $32 million, of which approximately

$8 million have no specified expiration dates. Substantially all of the remainder expire at various times through 2016. The

carrying amounts of these guarantees were $25 million on our consolidated balance sheet at December 31, 2007.

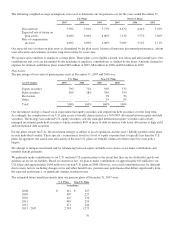

Leases:

Rental expenses were $456 million in 2007, $441 million in 2006 and $436 million in 2005. Minimum rental commitments

under non-cancelable operating leases in effect at December 31, 2007 were (in millions):

2008 $ 256

2009 189

2010 140

2011 109

2012 84

Thereafter 82

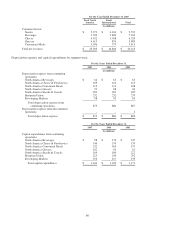

Note 16. Segment Reporting:

Kraft manufactures and markets packaged food products, including snacks, beverages, cheese, convenient meals and various

packaged grocery products. We manage and report operating results through two commercial units, Kraft North America and

Kraft International. We manage Kraft North America’s operations by product category, and its reportable segments are North

America Beverages; North America Cheese & Foodservice; North America Convenient Meals; North America Grocery; and

77