Kraft 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

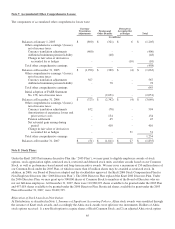

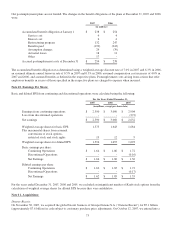

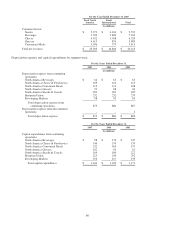

Summary results of operations for the sugar confectionery business were:

For the Year Ended

December 31, 2005

(in millions)

Net revenues $ 228

Earnings before income taxes $ 41

Provision for income taxes (16)

Loss on sale of discontinued operations (297)

Loss from discontinued operations, net of income taxes $ (272)

The loss on sale of discontinued operations, above, for the year ended December 31, 2005, related largely to taxes on the

transaction.

Other:

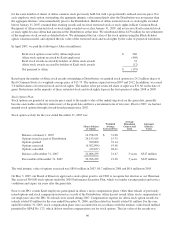

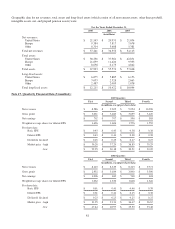

In 2007, we received $216 million in proceeds, and recorded pre-tax gains of $15 million on the divestitures of our hot cereal

assets and trademarks, our sugar confectionery assets in Romania and related trademarks and our flavored water and juice brand

assets and related trademarks. We recorded an after-tax loss of $3 million on these divestitures, which reflects the differing book

and tax bases of our hot cereal assets and trademarks divestiture.

In 2006, we received $946 million in proceeds, and recorded pre-tax gains of $117 million on the divestitures of our pet snacks

brand and assets, rice brand and assets, certain Canadian assets, our industrial coconut assets, a small U.S. biscuit brand and a

U.S. coffee plant. We recorded after-tax gains of $31 million on these divestitures, which reflects the tax expense of $57 million

related to the differing book and tax bases on our pet snacks brand and assets divestiture.

In 2005, we received $238 million in proceeds, and recorded pre-tax gains of $108 million on the divestitures of our fruit snacks

assets, our U.K. desserts assets, our U.S. yogurt assets, a small operation in Colombia, a minor trademark in Mexico and a small

equity investment in Turkey.

These gains and losses on divestitures do not reflect the related asset impairment charges discussed in Note 2, Asset Impairment,

Exit and Implementation Costs.

The aggregate operating results of the other divestitures discussed above were not material to our financial statements in any of

the periods presented.

Note 13. Transactions with Altria Group, Inc.:

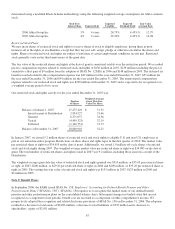

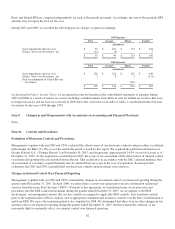

On March 30, 2007, we entered into a post-spin Transition Services Agreement with Altria’s subsidiary, Altria Corporate

Services, Inc. (“ALCS”). Under the agreement, ALCS was providing information technology services to Kraft during the EDS

transition. Billings for these post-spin services were $10 million from April 2007 to December 31, 2007. Before the

Distribution, ALCS provided pre-spin administrative services to us under a separate Corporate Services agreement that expired

on March 30, 2007. These services included planning, legal, treasury, auditing, insurance, human resources, office of the

secretary, corporate affairs, information technology, aviation and tax services. Billings for these pre-spin services, which were

based on the cost to ALCS to provide such services and a 5% management fee based on wages and benefits, were $19 million

for the quarter ended March 31, 2007, $178 million for the year ended December 31, 2006 and $237 million for the year ended

December 31, 2005. We performed at a similar cost various functions in 2007 and 2006 that previously had been provided by

ALCS, resulting in lower expense in 2007 and 2006. As of January 1, 2008, ALCS no longer provides services to Kraft.

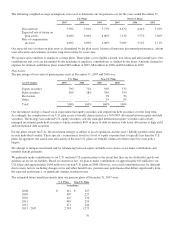

On March 30, 2007, we also entered into Employee Matters and Tax Sharing Agreements with Altria. The Employee Matters

Agreement sets out each company’s obligations for employee transfers, equity compensation and other employee benefits

matters for individuals moving, or who previously moved between companies. The Tax Sharing Agreement identifies Altria’s

and Kraft’s rights, responsibilities and obligations with respect to our income taxes following the Distribution. It also places

certain restrictions on us, including a 2-year limit on share repurchases of no more than 20% of our Common Stock outstanding

at the time of the Distribution.

At the Distribution, we had short-term amounts payable to Altria and affiliates of $449 million, which included $364 million of

accrued dividends. We paid these amounts in April 2007. At December 31, 2007 we had no amounts payable to Altria and

75