Kraft 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

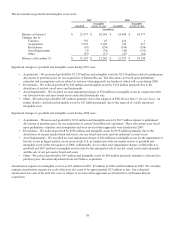

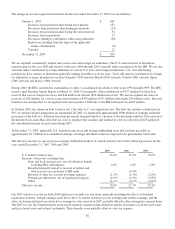

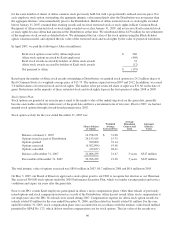

Interest and other debt expense:

Interest and other debt (income) / expense for the last three years were:

For the Years Ended December 31,

2007 2006 2005

(in millions)

Interest and other debt expense, net:

Interest income, Altria Group, Inc.

and affiliates $ (74) $ (47) $ (6)

Interest expense, external debt 698 579 657

Interest income (20) (22) (15)

Total interest and other debt expense, net $ 604 $ 510 $ 636

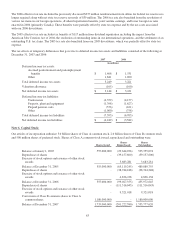

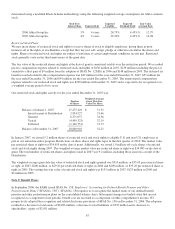

Note 5. Income Taxes:

Earnings from continuing operations before income taxes and provision for income taxes consisted of the following for the

years ended December 31, 2007, 2006 and 2005:

2007 2006 2005

(in millions)

Earnings from continuing operations

before income taxes:

United States $ 2,454 $ 2,754 $ 2,774

Outside United States 1,273 1,257 1,339

Total $ 3,727 $ 4,011 $ 4,113

Provision for income taxes:

United States federal:

Current $ 722 $ 613 $ 876

Deferred (306) (150) (210)

416 463 666

State and local 116 95 115

Total United States 532 558 781

Outside United States:

Current 660 411 466

Deferred (55) (18) (38)

Total outside United States 605 393 428

Total provision for income taxes $ 1,137 $ 951 $ 1,209

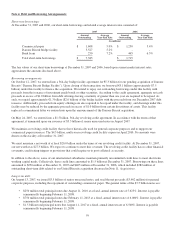

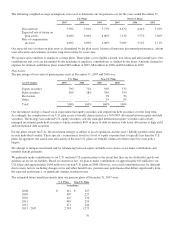

The loss from discontinued operations for the year ended December 31, 2005, includes additional tax expense of $280 million

from the sale of the sugar confectionery business.

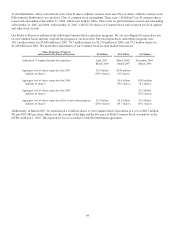

After the implementation of FIN 48 on January 1, 2007, our unrecognized tax benefits were $667 million. If we had recognized

all of these benefits, the net impact on our income tax provision would have been $530 million. Our unrecognized tax benefits

were $850 million at December 31, 2007, and if we had recognized all of these benefits, the net impact on our income tax

provision would have been $666 million. We expect that our unrecognized tax benefits will decrease by an insignificant amount

during the next twelve months. Furthermore, we recorded $72 million of unrecognized tax benefits and $30 million of accrued

interest and penalties as part of our preliminary purchase price allocation of Danone Biscuit, which is subject to revision when

the purchase price allocations are finalized during 2008. We include accrued interest and penalties related to uncertain tax

positions in our tax provision. We had accrued interest and penalties of $125 million as of January 1, 2007 and $232 million as

of December 31, 2007. Our 2007 provision for income taxes includes $90 million for interest and penalties, and we paid $13

million during 2007.

61