Kraft 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

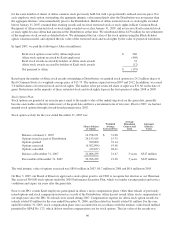

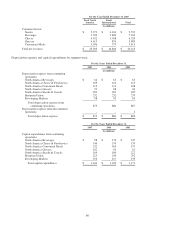

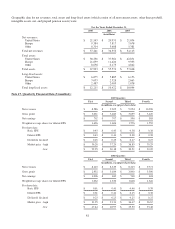

Postretirement Benefit Plans

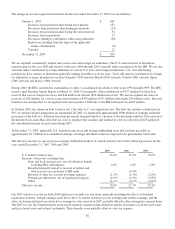

Net postretirement health care costs consisted of the following for the years ended December 31, 2007, 2006 and 2005:

2007 2006 2005

(in millions)

Service cost $ 46 $ 50 $ 48

Interest cost 177 174 170

Amortization:

Net loss from experience

differences 58 78 61

Prior service cost (26) (28) (26)

Other expense 5 (3) -

Net postretirement health care costs $ 260 $ 271 $ 253

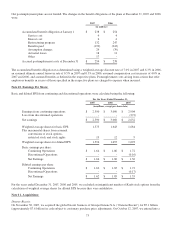

The estimated net loss for the postretirement benefit plans that is expected to be amortized from accumulated other

comprehensive losses into net postretirement health care costs during 2008 is $48 million. The estimated prior service cost for

the postretirement benefit plans that is expected to be amortized from accumulated other comprehensive losses into net

postretirement health care costs during 2008 is a net credit of $23 million.

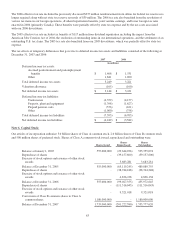

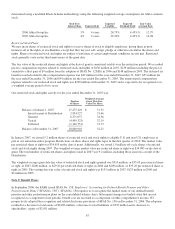

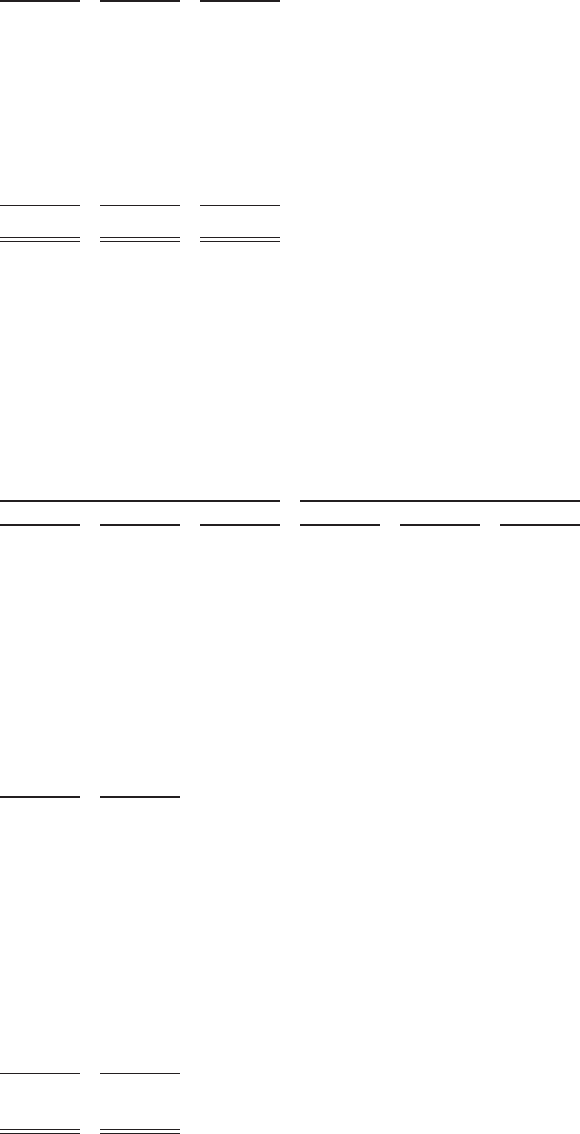

The following weighted-average assumptions were used to determine our net postretirement cost for the years ended

December 31:

U.S. Plans Canadian Plans

2007 2006 2005 2007 2006 2005

Discount rate 5.90% 5.60% 5.75% 5.00% 5.00% 5.75%

Health care cost trend rate 8.00% 8.00% 8.00% 8.50% 9.00% 9.50%

In 2008, the discount rate used to determine our net postretirement cost will be 6.10% for our U.S. plans and 5.80% for our

Canadian plans, and the health care cost trend rate will be 7.50% for our U.S. plans and 9.00% for our Canadian plans.

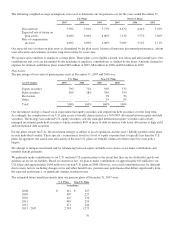

Our postretirement health care plans are not funded. The changes in the accumulated benefit obligation and net amount accrued

at December 31, 2007 and 2006 were:

2007 2006

(in millions)

Accumulated postretirement benefit

obligation at January 1 $ 3,230 $ 3,263

Service cost 46 50

Interest cost 177 174

Benefits paid (203) (203)

Plan amendments (45) (16)

Currency 21 3

Assumption changes 14 13

Actuarial gains (179) (50)

Curtailments / other 2 (4)

Accrued postretirement health care costs

at December 31 $ 3,063 $ 3,230

The current portion of our accrued postretirement health care costs of $217 million at December 31, 2007 and $216 million at

December 31, 2006, is included in other accrued liabilities on the consolidated balance sheets.

71