Kraft 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to higher postemployment benefit plan costs related to the Restructuring Program, as well as higher amortization of the net loss

from experience differences in our U.S. and non-U.S. pension plan costs and postretirement health care costs.

At December 31, 2007, our health care cost trend rate assumption decreased from 8.00% to 7.50% for our U.S. postretirement

plans and increased from 8.50% to 9.00% for our Canadian postretirement plans. We updated these rates based upon our

expectation for health care trend rates going forward. We anticipate that our health care cost trend rate assumption will be

5.00% for U.S. plans and 6.00% for Canadian plans by 2013. Assumed health care cost trend rates have a significant effect on

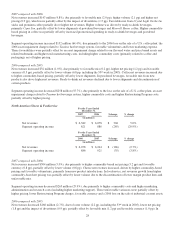

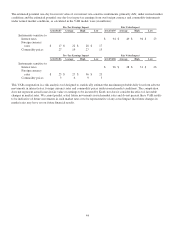

the amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would

have the following effects as of December 31, 2007:

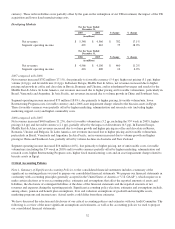

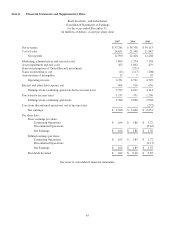

One-Percentage-Point

Increase Decrease

Effect on total of service and interest cost 13.3% (10.9%)

Effect on postretirement benefit obligation 10.8% (9.1%)

At December 31, 2007, our discount rate assumption increased from 5.90% to 6.10% for our U.S. postretirement plans, and

increased from 5.90% to 6.30% for our U.S. pension plans. We model our discount rates using a portfolio of high quality,

fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Changes in

our discount rates are primarily the result of changes in bond yields year-over-year. Our expected rate of return on plan assets

remained unchanged at 8.0%. We presently anticipate that assumption changes, coupled with the amortization of deferred gains

and losses will result in a decrease in 2008 pre-tax U.S. and non-U.S. pension and postretirement expense. While we do not

presently anticipate further changes in our 2008 assumptions, as a sensitivity measure, a fifty-basis point decline in our discount

rate would increase our U.S. pension and postretirement expense by approximately $80 million, and a fifty-basis point increase

in our discount rate would decrease our U.S. pension and postretirement expense by approximately $75 million. Similarly, a

fifty-basis point decrease / (increase) in the expected rate of return on plan assets would increase / (decrease) our U.S. pension

expense by approximately $33 million.

Transactions with Altria Group, Inc.:

On March 30, 2007, we entered into a post-spin Transition Services Agreement with Altria’s subsidiary, Altria Corporate

Services, Inc. (“ALCS”). Under the agreement, ALCS was providing information technology services to Kraft during the EDS

transition. Billings for these post-spin services were $10 million from April 2007 to December 31, 2007. Before the

Distribution, ALCS provided pre-spin administrative services to us under a separate Corporate Services agreement that expired

on March 30, 2007. These services included planning, legal, treasury, auditing, insurance, human resources, office of the

secretary, corporate affairs, information technology, aviation and tax services. Billings for these pre-spin services, which were

based on the cost to ALCS to provide such services and a 5% management fee based on wages and benefits, were $19 million

for the quarter ended March 31, 2007, $178 million for the year ended December 31, 2006 and $237 million for the year ended

December 31, 2005. We performed at a similar cost various functions in 2007 and 2006 that previously had been provided by

ALCS, resulting in lower expense in 2007 and 2006. As of January 1, 2008, ALCS no longer provides services to Kraft.

On March 30, 2007, we also entered into Employee Matters and Tax Sharing Agreements with Altria. The Employee Matters

Agreement sets out each company’s obligations for employee transfers, equity compensation and other employee benefits

matters for individuals moving, or who previously moved between companies. The Tax Sharing Agreement identifies Altria’s

and Kraft’s rights, responsibilities and obligations with respect to our income taxes following the Distribution. It also places

certain restrictions on us, including a 2-year limit on share repurchases of no more than 20% of our Common Stock outstanding

at the time of the Distribution.

At the Distribution, we had short-term amounts payable to Altria and affiliates of $449 million, which included $364 million of

accrued dividends. We paid these amounts in April 2007. At December 31, 2007 we had no short-term amounts payable to

Altria and affiliates for transition services. At December 31, 2006 we had short-term amounts payable to Altria and affiliates of

$607 million. The fair values of our short-term amounts due to Altria and affiliates approximated carrying amounts.

In the first quarter 2007, we repurchased 1.4 million shares of our Common Stock from Altria at a cost of $46.5 million. We

paid $32.085 per share, which was the average of the high and the low price of Kraft Common Stock as reported on the NYSE

on March 1, 2007. This repurchase was in accordance with the Distribution agreement.

36