Kraft 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

affiliates for transition services. At December 31, 2006 we had short-term amounts payable to Altria and affiliates of $607

million. The fair values of our short-term amounts due to Altria and affiliates approximated carrying amounts.

Also, see Note 5, Income Taxes, for information on how the closure of an IRS review of Altria’s consolidated federal income

tax return in 2006 impacted us.

Note 14. Financial Instruments:

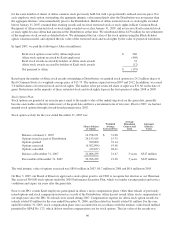

Commodity cash flow hedges:

Kraft is exposed to price risk related to forecasted purchases of certain commodities that we primarily use as raw materials.

Accordingly, we use commodity forward contracts as cash flow hedges, primarily for coffee, milk, sugar, cocoa and wheat.

Commodity forward contracts generally qualify for the normal purchase exception under SFAS No. 133, Accounting for

Derivative Instruments and Hedging Activities, (“SFAS No. 133”) and are, therefore, not subject to its provisions. We also use

commodity futures and options to hedge the price of certain commodities, including dairy, coffee, cocoa, wheat, corn products,

soybean and vegetable oils, nuts, meat products, sugar and other sweeteners, and natural gas. Some of these derivative

instruments are highly effective and qualify for hedge accounting under SFAS No. 133. We occasionally use related futures to

cross-hedge a commodity exposure; however we are not a party to leveraged derivatives and, by policy, do not use financial

instruments for speculative purposes.

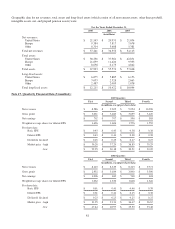

Net unrealized gains on all of our commodity positions were insignificant at December 31, 2007 and 2006. For those derivative

instruments that are highly effective and qualify for hedge accounting under SFAS No. 133, we defer the effective portion of the

unrealized gains and losses on commodity futures and option contracts as a component of accumulated other comprehensive

earnings / (losses). We recognize the deferred portion as a component of cost of sales in our consolidated statement of earnings

when the related inventory is sold. We expect to transfer an insignificant amount of unrealized gains / (losses) to earnings

during the next 12 months, and recognized an insignificant amount during the years ended December 31, 2007, 2006 and 2005.

Ineffectiveness is recorded as a component of interest and other debt expense in our consolidated statement of earnings, and it

was insignificant during the years ended December 31, 2007, 2006, and 2005. For the derivative instruments that we considered

economic hedges but did not designate for hedge accounting under SFAS No. 133, we recognized net gains of $56 million in

2007, directly as a component of cost of sales in our consolidated statement of earnings. The impact to earnings was

insignificant in 2006 and 2005 for derivatives not designated for hedge accounting. In aggregate, we had net long commodity

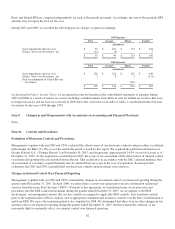

positions of $1,069 million at December 31, 2007, and $533 million at December 31, 2006. As of December 31, 2007, we had

hedged forecasted commodity transactions for periods not exceeding the next 19 months.

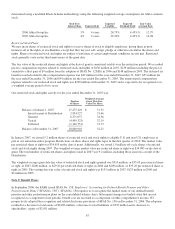

Foreign currency cash flow hedges:

We use various financial instruments to mitigate our exposure to changes in exchange rates from third-party and intercompany

actual and forecasted transactions. These instruments include forward foreign exchange contracts, foreign currency swaps and

foreign currency options. Based on the size and location of our business, the primary currencies to which we are exposed

include the euro, Swiss franc, British pound and Canadian dollar.

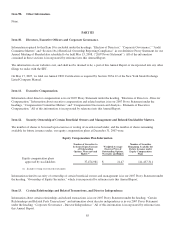

Net unrealized losses on all of our foreign currency positions were $166 million at December 31, 2007, and net unrealized gains

were insignificant at December 31, 2006. Substantially all of these derivative instruments are highly effective and qualify for

hedge accounting under SFAS No. 133. We defer the effective portion of unrealized gains and losses associated with forward,

swap and option contracts as a component of accumulated other comprehensive earnings / (losses) until the underlying hedged

transactions are reported in our consolidated statement of earnings. We recognize the deferred portion as a component of cost of

sales in our consolidated statement of earnings when the related inventory is sold or as foreign currency translation gain or loss

for our hedges of intercompany loans when the payments are made. We expect to transfer an insignificant amount of unrealized

gains / (losses) to earnings during the next 12 months, and recognized an insignificant amount during the years ended

December 31, 2007, 2006 and 2005. Any ineffectiveness is recorded as a component of interest and other debt expense in our

consolidated statement of earnings, however we recorded no ineffectiveness in our foreign currency cash flow hedges during the

years ended December 31, 2007, 2006 and 2005. For the derivative instruments that we consider economic hedges but do not

designate for hedge accounting under SFAS No. 133, we recognize gains and losses directly as a component of cost of sales or

foreign currency translation loss in our consolidated statement of earnings, depending on the nature of the underlying

transaction. For these derivative instruments, we recognized net losses of $231 million in 2007, net losses of $124 million in

2006 and net gains of $199 million in 2005 in our consolidated statement of earnings. The majority of these losses and gains

were attributable to hedges of intercompany loans, and were economically offset with foreign currency gains and losses from

the intercompany receivable. In aggregate, we had forward foreign exchange contracts, foreign currency swaps and foreign

76