Kraft 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

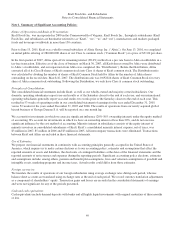

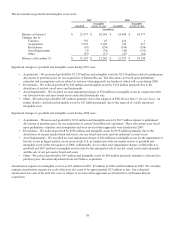

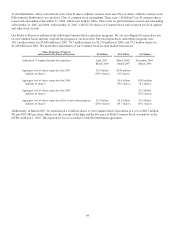

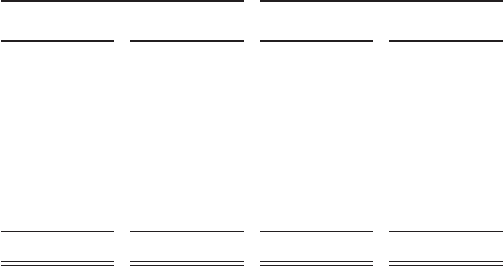

The movements in goodwill and intangible assets were:

2007 2006

Goodwill

Intangible

Assets, at cost Goodwill

Intangible

Assets, at cost

(in millions)

Balance at January 1 $ 25,553 $ 10,244 $ 24,648 $ 10,577

Changes due to:

Currency 536 43 454 1

Acquisitions 5,239 2,196 734 217

Divestitures (45) (134) (196) (356)

Asset Impairments (3) (70) (40) (131)

Other (87) (17) (47) (64)

Balance at December 31 $ 31,193 $ 12,262 $ 25,553 $ 10,244

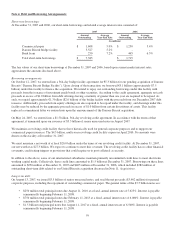

Significant changes to goodwill and intangible assets during 2007 were:

• Acquisitions - We increased goodwill by $5,239 million and intangible assets by $2,196 million related to preliminary

allocations of purchase price for our acquisition of Danone Biscuit. The allocations are based upon preliminary

estimates and assumptions and are subject to revision when appraisals are finalized, which will occur during 2008.

• Divestitures - We reduced goodwill by $45 million and intangible assets by $134 million primarily due to the

divestiture of our hot cereal assets and trademarks.

• Asset Impairments - We recorded an asset impairment charge of $70 million to intangible assets in conjunction with

our flavored water and juice brand assets and related trademarks sale.

• Other - We reduced goodwill by $87 million primarily due to the adoption of FIN 48 (see Note 5, Income Taxes, for

further details), and reduced intangible assets by $17 million primarily due to the removal of a fully amortized

intangible asset.

Significant changes to goodwill and intangible assets during 2006 were:

• Acquisitions - We increased goodwill by $734 million and intangible assets by $217 million related to preliminary

allocations of purchase price for our acquisition of certain United Biscuits operations. These allocations were based

upon preliminary estimates and assumptions and were revised when appraisals were finalized in 2007.

• Divestitures - We reduced goodwill by $196 million and intangible assets by $356 million primarily due to the

divestitures of our pet snacks brand and assets, our rice brand and assets and our industrial coconut assets.

• Asset Impairments - We recorded an asset impairment charge of $24 million to intangible assets for the impairment of

biscuits assets in Egypt and hot cereal assets in the U.S. in conjunction with our annual review of goodwill and

intangible assets in the first quarter of 2006. Additionally, we recorded asset impairment charges of $40 million to

goodwill and $107 million to intangible assets related to the anticipated sale of our hot cereal assets and trademarks

and the sale of our pet snacks brand and assets.

• Other - We reduced goodwill by $47 million and intangible assets by $64 million primarily relating to a deferred tax

purchase price allocation adjustment from our Nabisco acquisition.

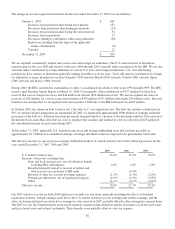

Amortization expense for intangible assets was $13 million in 2007, $7 million in 2006 and $10 million in 2005. We currently

estimate amortization expense for each of the next five years to be approximately $13 million or less. Our estimated

amortization for each of the next five years is subject to revision when appraisals are finalized for our Danone Biscuit

acquisition.

58