Honeywell 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

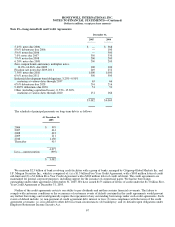

Additionally, each of the banks has the right to terminate its commitment to lend additional funds or issue additional letters of credit

under the credit agreements if any person or group acquires beneficial ownership of 30 percent or more of our voting stock, or, during

any 12-month period, individuals who were directors of Honeywell at the beginning of the period cease to constitute a majority of the

Board of Directors (the Board).

Loans under the $1.3 billion Five-Year Credit Agreement are required to be repaid no later than November 26, 2008. Loans under

the $1 billion Five-Year Credit Agreement are required to be repaid no later than October 22, 2009. We have agreed to pay a facility

fee of 0.08 percent per annum on the aggregate commitment for both Five-Year Credit Agreements.

Interest on borrowings under both Five-Year Credit Agreements would be determined, at Honeywell's option, by (a) an auction

bidding procedure; (b) the highest of the floating base rate publicly announced by Citibank, N.A., 0.5 percent above the average CD

rate, or 0.5 percent above the Federal funds rate; or (c) the Eurocurrency rate plus 0.22 percent (applicable margin).

The facility fee, the applicable margin over the Eurocurrency rate on both Five-Year Credit Agreements and the letter of credit

issuance fee in both Five-Year Credit Agreements, are subject to change, based upon a grid determined by our long-term debt ratings.

Neither credit agreement is subject to termination based upon a decrease in our debt ratings or a material adverse change.

A new 364-Day 240 million Canadian dollar credit facility was established on September 9, 2005, arranged by Citibank, N.A.,

Canadian Branch. The facility was established for general corporate purposes, including support for the issuance of commercial paper

in Canada. There are no borrowings outstanding under this credit facility at December 31, 2005. We have agreed to pay a facility fee

of 0.06 percent per annum on the commitment amount. Interest on borrowings under this facility would be determined, at Honeywell's

option, by (a) the highest of the floating base rate publicly announced by Citibank, N.A., 0.5 percent above the average CD rate, or 0.5

percent above the Federal funds rate; (b) the highest of the Canadian dollar prime rate publicly announced by Citibank, N.A. or 0.5

percent above the Canadian dollar bankers' acceptance; or (c) the Eurocurrency rate or bankers' acceptance plus 0.24 percent

(applicable margin).

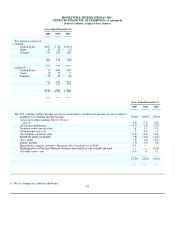

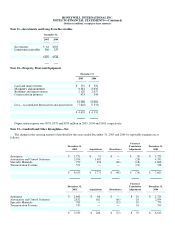

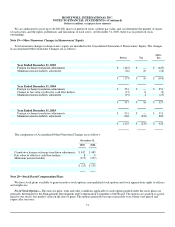

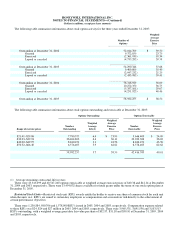

Note 16—Lease Commitments

Future minimum lease payments under operating leases having initial or remaining noncancellable lease terms in excess of one

year are as follows:

At December 31,

2005

2006 $ 285

2007 206

2008 146

2009 94

2010 69

Thereafter 201

$ 1,001

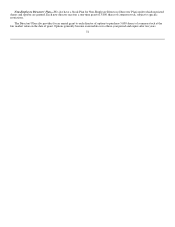

We have entered into agreements to lease land, equipment and buildings. Principally all our operating leases have initial terms of

up to 25 years, and some contain renewal options subject to customary conditions. At any time during the terms of some of our leases,

we may at our option purchase the leased assets for amounts that approximate fair value. We do not expect that any of our

commitments under the lease agreements will have a material adverse effect on our consolidated results of operations, financial

position or liquidity.

68