Honeywell 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

voluntary contributions of approximately $45 million to our U.S. pension plans in 2006. We also expect to make

contributions to our non-U.S. plans of approximately $150 million in 2006. See Note 22 of Notes to Financial Statements in

“Item 8. Financial Statements and Supplementary Data” for further discussion of pension contributions.

• Repositioning actions—we expect that cash spending for severance and other exit costs necessary to execute the remaining

repositioning actions will approximate $125 million in 2006.

• Environmental remediation costs—we expect to spend approximately $250 million in 2006 for remedial response and

voluntary clean-up costs. See Environmental Matters section of this MD&A for further discussion.

We have made an all-cash Offer for the entire issued ordinary share capital of First Technology plc, a provider of gas sensing and

detection products and services headquartered in the UK. The aggregate value of the Offer is approximately $718 million, fully diluted

for the exercise of all outstanding options and including the assumption of approximately $199 million of outstanding debt. We expect

to complete the transaction in the first half of 2006, subject to regulatory approval.

We continuously assess the relative strength of each business in our portfolio as to strategic fit, market position, profit and cash

flow contribution in order to upgrade our combined portfolio and identify business units that will most benefit from increased

investment. We identify acquisition candidates that will further our strategic plan and strengthen our existing core businesses. We also

identify businesses that do not fit into our long-term strategic plan based on their market position, relative profitability or growth

potential. These businesses are considered for potential divestiture, restructuring or other repositioning actions subject to regulatory

constraints. In 2005, we realized $997 million in cash proceeds from sales of non-strategic businesses.

Based on past performance and current expectations, we believe that our operating cash flows will be sufficient to meet our future

cash needs. Our available cash, committed credit lines, access to the public debt and equity markets as well as our ability to sell trade

accounts receivables, provide additional sources of short-term and long-term liquidity to fund current operations, debt maturities, and

future investment opportunities. Based on our current financial position and expected economic performance, we do not believe that

our liquidity will be adversely impacted by an inability to access our sources of financing.

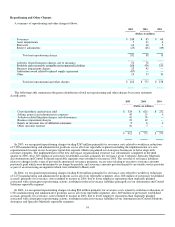

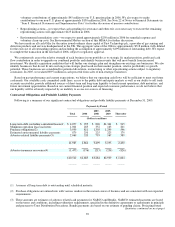

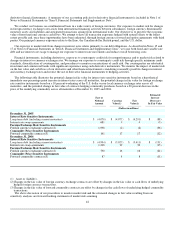

Contractual Obligations and Probable Liability Payments

Following is a summary of our significant contractual obligations and probable liability payments at December 31, 2005:

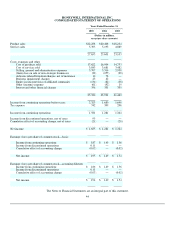

Payments by Period

Total 2006 2007-

2008 2009-

2010 Thereafter

(Dollars in millions)

Long-term debt, including capitalized leases(1) $ 4,077 $ 995 $ 826 $1,341 $ 915

Minimum operating lease payments 1,001 285 352 163 201

Purchase obligations(2) 3,959 811 1,303 1,299 546

Estimated environmental liability payments 879 250 225 225 179

Asbestos related liability payments(3) 2,069 520 793 167 589

11,985 2,861 3,499 3,195 2,430

Asbestos insurance recoveries(4) (1,473) (176) (215) (256) (826)

$10,512 $2,685 $3,284 $2,939 $ 1,604

(1) Assumes all long-term debt is outstanding until scheduled maturity.

(2) Purchase obligations are entered into with various vendors in the normal course of business and are consistent with our expected

requirements.

(3)

These amounts are estimates of asbestos related cash payments for NARCO and Bendix. NARCO estimated payments are based

on the terms and conditions, including evidentiary requirements, specified in the definitive agreements or agreements in principle

and pursuant to Trust Distribution Procedures. Bendix payments are based on our estimate of pending claims. Projecting future

(footnotes continued on next page)

39