Honeywell 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

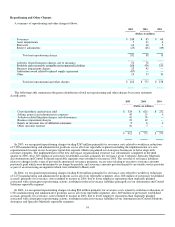

independent debt-rating agencies. In 2004, Standard and Poor's and Fitch's Rating Services affirmed their corporate ratings on our

long-term debt, A and A+, respectively, and short-term debt A1 and F1, respectively, and maintained Honeywell's ratings outlook as

“stable”. In 2005, Moody's Investors Service affirmed its corporate rating on our long-term and short-term debt of A2 and P-1,

respectively, and revised Honeywell's ratings outlook to “stable” from “negative”.

Revolving Credit Facilities of $2.3 billion are maintained with a group of banks, arranged by Citigroup Global Markets Inc. and

J.P. Morgan Securities Inc., which is comprised of: (a) a $1 billion Five-Year Credit Agreement and (b) a $1.3 billion Five-Year

Credit Agreement. The credit agreements are maintained for general corporate purposes, including support for the issuance of

commercial paper. The $1 billion Five-Year Credit Agreement includes a $200 million sub-limit for the potential issuance of letters of

credit. The $1.3 billion Five-Year Credit Agreement includes a $300 million sub-limit for the potential issuance of letters of credit. A

new 364-Day 240 million Canadian dollar facility ($206 million in U.S. dollars) was established in 2005. The new facility was

arranged by Citibank, N.A., Canadian Branch for general corporate purposes, including support for the issuance of commercial paper

in Canada. See Note 15 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data.”

We also have a shelf registration statement filed with the Securities and Exchange Commission which allows us to issue up to $3

billion in debt securities, common stock and preferred stock that may be offered in one or more offerings on terms to be determined at

the time of the offering. Net proceeds of any offering would be used for general corporate purposes, including repayment of existing

indebtedness, capital expenditures and acquisitions.

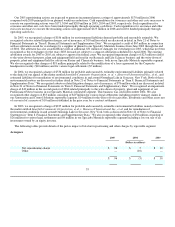

We also sell interests in designated pools of trade accounts receivables to third parties. The sold receivables were over-

collateralized by $178 million at December 31, 2005 and we retain a subordinated interest in the pool of receivables representing that

over-collateralization as well as an undivided interest in the balance of the receivables pools. New receivables are sold under the

agreement as previously sold receivables are collected. The retained interests in the receivables are reflected at the amounts expected

to be collected by us, and such carrying value approximates the fair value of our retained interests. The sold receivables were $500

million at both December 31, 2005 and 2004.

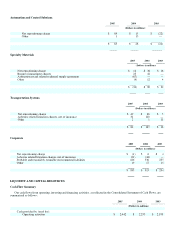

In addition to our normal operating cash requirements, our principal future cash requirements will be to fund capital expenditures,

debt repayments, dividends, employee benefit obligations, environmental remediation costs, asbestos claims, severance and exit costs

related to repositioning actions, share repurchases and any strategic acquisitions.

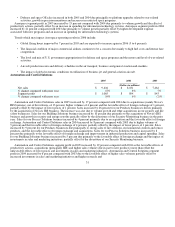

Specifically, we expect our primary cash requirements in 2006 to be as follows:

• Capital expenditures—we expect to spend approximately $800 million for capital expenditures in 2006 primarily for growth,

replacement, production capacity expansion, cost reduction and maintenance.

• Debt repayments—there are $995 million of scheduled long-term debt maturities in 2006. We expect to refinance

substantially all of these maturities in the debt capital markets during 2006.

• Share repurchases—in November 2005, Honeywell's Board of Directors authorized the Company to repurchase up to $3

billion of its common stock. We intend to repurchase outstanding shares from time to time in the open market using cash

generated from operations.

• Dividends—we expect to pay approximately $750 million in dividends on our common stock in 2006 reflecting the 10

percent increase in the dividend rate announced by Honeywell's Board of Directors in December 2005.

• Asbestos claims—we expect our cash spending for asbestos claims and our cash receipts for related insurance recoveries to

be approximately $520 and $176 million, respectively, in 2006. See Asbestos Matters in Note 21 of Notes to Financial

Statements in “Item 8. Financial Statements and Supplementary Data” for further discussion.

• Pension contributions—assuming that actual pension plan returns are consistent with our expected rate of return of 9 percent

in 2006 and beyond and that interest rates remain constant, we would not be required to make any contributions to our U.S.

pension plans to satisfy minimum statutory funding requirements for the foreseeable future. However, we expect to make

38