Honeywell 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

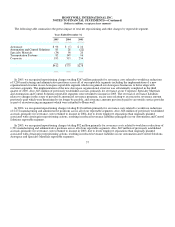

improve decision-making and controls for sales incentives. As a result of this change, Honeywell will apply this new accounting

policy retrospectively to the Company's previously issued financial statements as if it had been applicable during those historical

periods. When adopted in the first quarter of 2006, the new accounting policy will reduce previously reported net income in 2005,

2004 and 2003 by approximately $20, $35 and $35 million, respectively, or $0.02 per share in 2005, $0.04 per share in 2004 and $0.04

per share in 2003. Additionally, application of the new accounting policy would have reduced shareowners' equity as of the beginning

of 2003 by approximately $400 million. There is no impact on previously reported cash flows. See Note 13 for additional details.

Environmental Expenditures—Environmental expenditures that relate to current operations are expensed or capitalized as

appropriate. Expenditures that relate to an existing condition caused by past operations, and that do not provide future benefits, are

expensed as incurred. Liabilities are recorded when environmental remedial efforts or damage claim payments are probable and the

costs can be reasonably estimated. Such liabilities are based on our best estimate of the undiscounted future costs required to complete

the remedial work. The recorded liabilities are adjusted periodically as remediation efforts progress or as additional technical or legal

information becomes available. Given the uncertainties regarding the status of laws, regulations, enforcement policies, the impact of

other potentially responsible parties, technology and information related to individual sites, we do not believe it is possible to develop

an estimate of the range of reasonably possible environmental loss in excess of our accruals.

Asbestos Related Contingencies and Insurance Recoveries—Honeywell is a defendant in personal injury actions related to

asbestos containing products (refractory products and friction products). We recognize a liability for any asbestos related contingency

that is probable of occurrence and reasonably estimable. Regarding North American Refractories Company (NARCO) asbestos related

claims, we accrue for pending claims based on terms and conditions, including evidentiary requirements, in definitive agreements or

agreements in principle with current claimants. We also accrued for the probable value of future asbestos related claims through 2018

based on the disease criteria and payment values contained in the NARCO trust as described in Note 21. In light of the inherent

uncertainties in making long term projections regarding claims filing rates and disease manifestation, we do not believe that we have a

reasonable basis for estimating NARCO asbestos claims beyond 2018 under Statement of Financial Accounting Standards No. 5,

“Accounting for Contingencies” (SFAS No. 5). Regarding Bendix asbestos related claims, we accrue for the estimated value of

pending claims based on expected claim resolution values and dismissal rates. We have not accrued for future Bendix asbestos related

claims as we cannot reasonably predict how many additional claims may be brought against us, the allegations in such claims or their

probable outcomes and resulting settlement values in the tort system. We continually assess the likelihood of any adverse judgments

or outcomes to our contingencies, as well as potential ranges of probable losses and recognize a liability, if any, for these

contingencies based on an analysis of each individual issue with the assistance of outside legal counsel and, if applicable, other

experts.

In connection with the recognition of liabilities for asbestos related matters, we record asbestos related insurance recoveries that

are deemed probable. In assessing the probability of insurance recovery, we make judgments concerning insurance coverage that we

believe are reasonable and consistent with our historical dealings with our insurers, our knowledge of any pertinent solvency issues

surrounding insurers and various judicial determinations relevant to our insurance programs.

Research and Development—Research and development costs for company-sponsored research and development projects are

expensed as incurred. Such costs are principally included in Cost of Products Sold and were $1,072, $917 and $751 million in 2005,

2004 and 2003, respectively.

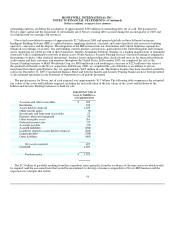

Stock-Based Compensation Plans—We account for our fixed stock option plans under Accounting Principles Board Opinion No.

25, “Accounting for Stock Issued to Employees” (APB No. 25). Under APB No. 25, there is no compensation cost recognized for our

fixed stock option plans,

50