Honeywell 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

minimal or no impairment. The approximately 77,000 pending claims also include claims filed in jurisdictions such as Texas, Virginia

and Mississippi that historically allowed for consolidated filings. In these jurisdictions, plaintiffs were permitted to file complaints

against a pre-determined master list of defendants, regardless of whether they have claims against each individual defendant. Many of

these plaintiffs may not actually have claims against Honeywell. Based on state rules and prior experience in these jurisdictions, we

anticipate that many of these claims will ultimately be dismissed.

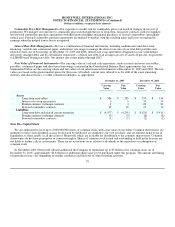

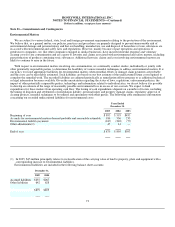

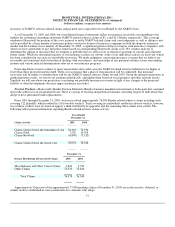

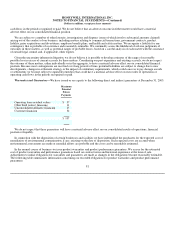

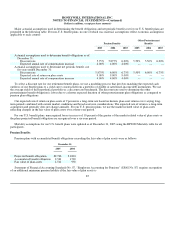

Honeywell has experienced average resolution values per claim excluding legal costs as follows:

Years Ended December 31,

2005 2004 2003

(in whole dollars)

Malignant claims $58,000 $90,000 $95,000

Nonmalignant claims $ 600 $ 1,600 $ 3,500

It is not possible to predict whether resolution values for Bendix related asbestos claims will increase, decrease or stabilize in the

future.

We have accrued for the estimated cost of pending Bendix related asbestos claims. The estimate is based on the number of pending

claims at December 31, 2005, disease classifications, expected settlement values and historic dismissal rates. Honeywell retained the

expert services of HR&A (see discussion of HR&A under Refractory products above) to assist in developing the estimated expected

settlement values and historic dismissal rates. HR&A updates expected settlement values for pending claims during the second quarter

each year. We cannot reasonably estimate losses which could arise from future Bendix related asbestos claims because we cannot

predict how many additional claims may be brought against us, the allegations in such claims or their probable outcomes and resulting

settlement values in the tort system.

Honeywell currently has approximately $1.9 billion of insurance coverage remaining with respect to pending and potential future

Bendix related asbestos claims of which $377 and $336 million are reflected as receivables in our consolidated balance sheet at

December 31, 2005 and 2004, respectively. This coverage is provided by a large number of insurance policies written by dozens of

insurance companies in both the domestic insurance market and the London excess market. Insurance receivables are recorded in the

financial statements simultaneous with the recording of the liability for the estimated value of the underlying asbestos claims. The

amount of the insurance receivable recorded is based on our ongoing analysis of the insurance that we estimate is probable of

recovery. This determination is based on our analysis of the underlying insurance policies, our historical experience with our insurers,

our ongoing review of the solvency of our insurers, our interpretation of judicial determinations relevant to our insurance programs,

and our consideration of the impacts of any settlements reached with our insurers. Insurance receivables are also recorded when

structured insurance settlements provide for future fixed payment streams that are not contingent upon future claims or other events.

Such amounts are recorded at the net present value of the fixed payment stream.

On a cumulative historical basis, Honeywell has recorded insurance receivables equal to approximately 50 percent of the value of

the underlying asbestos claims recorded. However, because there are gaps in our coverage due to insurance company insolvencies,

certain uninsured periods, and insurance settlements, this rate is expected to decline for any future Bendix related asbestos liabilities

that may be recorded. Future recoverability rates may also be impacted by numerous other factors, such as future insurance

settlements, insolvencies and judicial determinations relevant to our coverage program, which are difficult to predict. Assuming

continued defense and indemnity spending at current levels, we estimate that the cumulative recoverability rate could decline over the

next five years to approximately 40 percent.

Honeywell believes it has sufficient insurance coverage and reserves to cover all pending Bendix related asbestos claims.

Although it is impossible to predict the outcome of pending claims or to

78