Honeywell 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

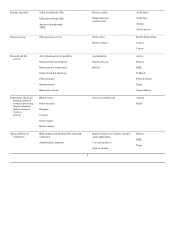

Approximately 2 percent of total 2005 net sales of Automation and Control Solutions products were exports of U.S. manufactured

products. Foreign manufactured products and performance of services accounted for 53 percent of total 2005 net sales of Automation

and Control Solutions. The principal manufacturing facilities outside the U.S. are in Europe and Mexico, with less significant

operations in Asia and Canada.

Approximately 13 percent of total 2005 net sales of Specialty Materials products were exports of U.S. manufactured products.

Exports were principally made to Asia, Europe, Latin America and Canada. Foreign manufactured products comprised 18 percent of

total 2005 net sales of Specialty Materials. The principal manufacturing facilities outside the U.S. are in Europe, with less significant

operations in Asia and Canada.

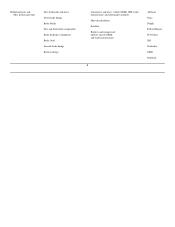

Exports of U.S. manufactured products comprised 1 percent of total 2005 net sales of Transportation Systems products. Foreign

manufactured products accounted for 60 percent of total 2005 net sales of Transportation Systems. The principal manufacturing

facilities outside the U.S. are in Europe, with less significant operations in Asia, Latin America and Canada.

Financial information related to geographic areas is included in Note 24 of Notes to Financial Statements in “Item 8. Financial

Statements and Supplementary Data”. Information regarding the economic, political, regulatory and other risks associated with

international operations is included in “Item 1A. Risk Factors.”

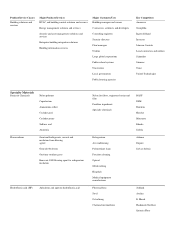

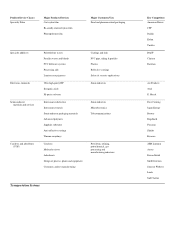

Raw Materials

The principal raw materials used in our operations are generally readily available. We experienced no significant or unusual

problems in the purchase of key raw materials and commodities in 2005. Except related to phenol, a raw material used in our Specialty

Materials segment, we are not dependent on any one supplier for a material amount of our raw materials. We purchase phenol under a

supply agreement with one supplier. We have no reason to believe there is any material risk to this supply.

We are highly dependent on our suppliers and subcontractors in order to meet commitments to our customers. In addition, many

major components and product equipment items are procured or subcontracted on a sole-source basis with a number of domestic and

foreign companies. We maintain a qualification and performance surveillance process to control risk associated with such reliance on

third parties. While we believe that sources of supply for raw materials and components are generally adequate, it is difficult to predict

what effects shortages or price increases may have in the future.

The costs of certain key raw materials, including natural gas and benzene, in our Specialty Materials' business were at historically

high levels in 2005 and are expected to remain at those levels in 2006. We will continue to attempt to offset raw material cost

increases with formula price agreements and price increases where feasible. At present, we have no reason to believe a shortage of raw

materials will cause any material adverse impact during 2006. See “Item 1A. Risk Factors” for further discussion.

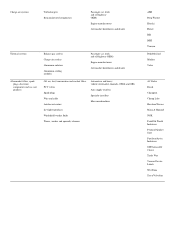

Patents, Trademarks, Licenses and Distribution Rights

Our businesses are not dependent upon any single patent or related group of patents, or any licenses or distribution rights. We own,

or are licensed under, a large number of patents, patent applications and trademarks acquired over a period of many years, which relate

to many of our products or improvements to those products and which are of importance to our business. From time to time, new

patents and trademarks are obtained, and patent and trademark licenses and rights are acquired from others. We also have distribution

rights of varying terms for a number of products and services produced by other companies. In our judgment, those rights are adequate

for the conduct of our business. We believe that, in the aggregate, the rights under our patents, trademarks and licenses are generally

important to our operations, but we do not consider any patent, trademark or related group of patents, or any licensing or distribution

rights related to a specific process or product, to be of material importance in relation to our total business. See “Item 1A. Risk

Factors” for further discussion.

We have registered trademarks for a number of our products, including such consumer brands as Honeywell, Prestone, FRAM,

Autolite, Bendix, Jurid, Holts and Garrett.

8