Honeywell 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

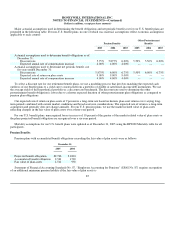

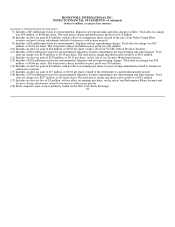

less than the accumulated benefit obligation at the end of the plan year. In 2005, we recorded a non-cash adjustment to equity through

accumulated other nonowner changes of $16 million ($26 million on a pretax basis) which increased the minimum pension liability. In

2004, we recorded a non-cash adjustment to equity through accumulated other nonowner changes of $15 million ($19 million on a

pretax basis) which increased the additional minimum pension liability. In 2003, we recorded a non-cash adjustment to equity through

accumulated other nonowner changes of $369 million ($604 million on a pretax basis) to reduce the additional minimum pension

liability by $304 million and reinstate a portion of the pension assets ($300 million) written off in the prior year's minimum pension

liability adjustment. This 2003 adjustment resulted from an increase in our pension assets in 2003 due to the improvement in equity

markets and our contribution of $670 million to our U.S. plans.

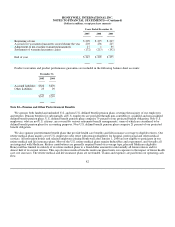

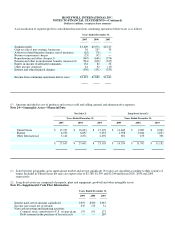

Our U.S. pension plans assets were $12.0 and $11.5 billion and our non-U.S. pension plans assets were $2.6 and $1.6 billion at

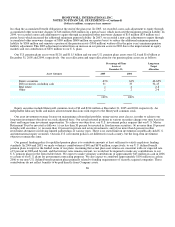

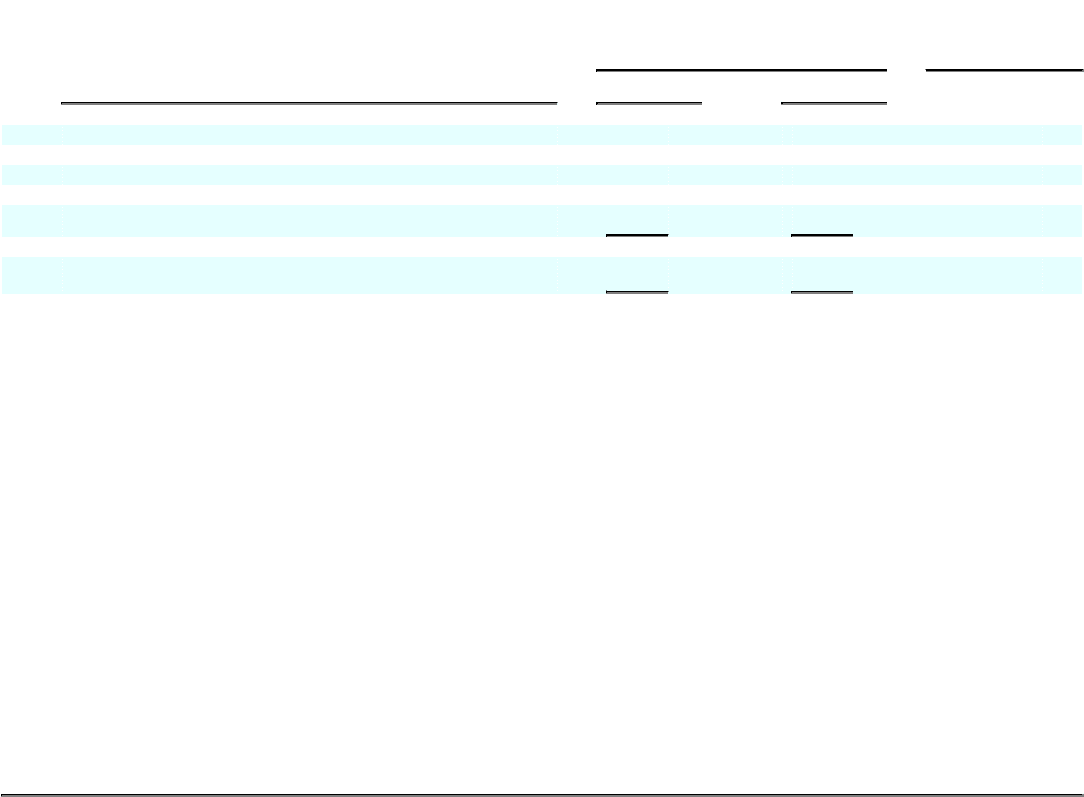

December 31, 2005 and 2004, respectively. Our asset allocation and target allocation for our pension plans assets are as follows:

Percentage of Plans

Assets at

December 31,

Long-term

Target

Allocation

Asset Category 2005 2004

Equity securities 63% 61% 40-65%

Debt securities, including cash 31 33 30-45

Real estate 4 4 2-8

Other 2 2 2-6

100% 100%

Equity securities include Honeywell common stock of $2 and $214 million at December 31, 2005 and 2004, respectively. An

independent fiduciary holds and makes all investment decisions with respect to the Honeywell common stock.

Our asset investment strategy focuses on maintaining a diversified portfolio, using various asset classes, in order to achieve our

long-term investment objectives on a risk adjusted basis. Our actual invested positions in various securities change over time based on

short and longer-term investment opportunities. To achieve our objectives, our U.S. investment policy requires that our U.S. Master

Retirement Trust be invested as follows: (a) no less than 30 percent be invested in fixed income securities; (b) no more than 10 percent

in high-yield securities; (c) no more than 10 percent in private real estate investments; and (d) no more than 6 percent in other

investment alternatives involving limited partnerships of various types. There is no stated limit on investments in publically-held U.S.

and international equity securities. Our non-U.S. investment policies are different for each country, but the long-term investment

objectives remain the same.

Our general funding policy for qualified pension plans is to contribute amounts at least sufficient to satisfy regulatory funding

standards. In 2004 and 2003, we made voluntary contributions of $40 and $670 million, respectively, to our U.S. defined benefit

pension plans to improve the funded status of our plans. Assuming that actual plan asset returns are consistent with our expected rate

of 9 percent in 2006 and beyond, and that interest rates remain constant, we would not be required to make any contributions to our

U.S. pension plans for the foreseeable future. We expect to make voluntary contributions of approximately $45 million in cash in 2006

to certain of our U.S. plans for government contracting purposes. We also expect to contribute approximately $150 million in cash in

2006 to our non-U.S. defined benefit pension plans primarily related to funding requirements of recently acquired companies. These

contributions do not reflect benefits to be paid directly from Company assets.

86