Honeywell 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

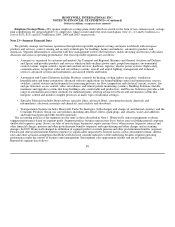

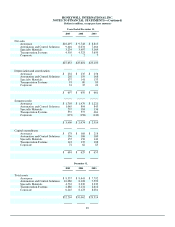

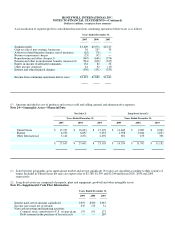

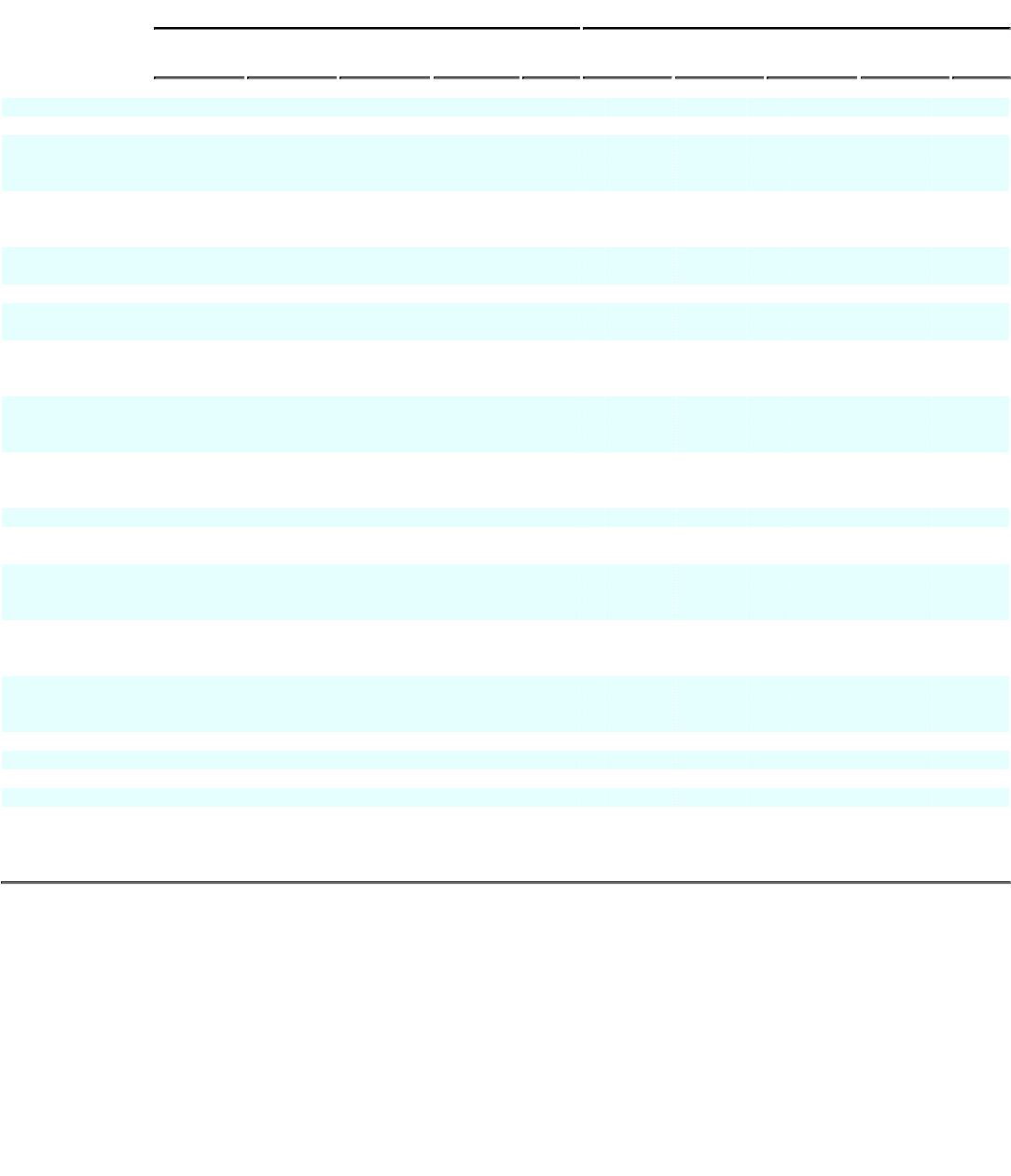

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

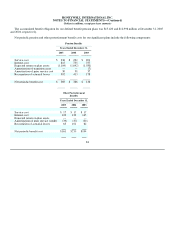

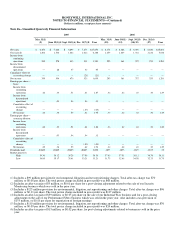

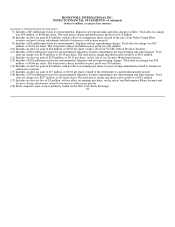

Note 26—Unaudited Quarterly Financial Information

2005 2004

Mar. 31(1)

(2) June 30(3)(4) Sept. 30(5)(6) Dec. 31(7)(8) Year Mar. 31(9)

(10) June 30(11)

(12) Sept. 30(13)

(14)(15) Dec. 31(16)

(17) Year

Net sales $ 6,453 $ 7,026 $ 6,899 $ 7,275 $27,653 $ 6,178 $ 6,388 $ 6,395 $ 6,640 $25,601

Gross profit 1,402 1,530 1,644 1,612 6,188 1,259 1,209 1,332 1,216 5,016

Income from

continuing

operations

359

278

433

511

1,581

295

361

372

253

1,281

Income from

discontinued

operations

—

28

37

30

95

—

—

—

—

—

Cumulative effect of

accounting change — — — (21) (21) — — — — —

Net income 359 306 470 520 1,655 295 361 372 253 1,281

Earnings per share—

basic:

Income from

continuing

operations

.42

.33

.51

.61

1.87

.34

.42

.43

.30

1.49

Income from

discontinued

operations

—

.03

.04

.04

.11

—

—

—

—

—

Cumulative effect of

accounting

change

—

—

—

(.03)

(.03)

—

—

—

—

—

Net income .42 .36 .55 .62 1.95 .34 .42 .43 .30 1.49

Earnings per share—

assuming dilution:

Income from

continuing

operations

.42

.33

.51

.61

1.86

.34

.42

.43

.30

1.49

Income from

discontinued

operations

—

.03

.04

.04

.11

—

—

—

—

—

Cumulative effect of

accounting

change

—

—

—

(.03)

(.03)

—

—

—

—

—

Net income .42 .36 .55 .62 1.94 .34 .42 .43 .30 1.49

Dividends paid .20625 .20625 .20625 .20625 .8250 .1875 .1875 .1875 .1875 .75

Market price(18)

High 39.30 38.12 39.29 37.96 39.30 37.43 37.51 38.11 36.76 38.11

Low 34.00 35.17 35.41 33.21 33.21 31.75 32.60 34.58 32.23 31.75

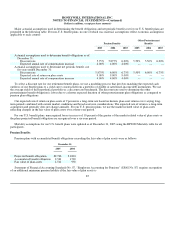

(1) Includes a $99 million provision for environmental, litigation and net repositioning charges. Total after-tax charge was $70

million, or $0.08 per share. The total pretax charge included in gross profit was $68 million.

(2) Includes an after-tax gain of $5 million, or $0.01 per share for a post-closing adjustment related to the sale of our Security

Monitoring business which was sold in the prior year.

(3) Includes a $123 million provision for environmental, litigation, net repositioning and other charges. Total after-tax charge was $96

million, or $0.11 per share. The total pretax charge included in gross profit was $117 million.

(4) Includes an after-tax gain of $39 million, or $0.05 per share on the sale of our Industrial Wax business and for a post-closing

adjustment on the sale of our Performance Fibers business which was sold in the prior year. Also includes a tax provision of

$155 million, or $0.18 per share for repatriation of foreign earnings.

(5) Includes a $110 million provision for environmental, litigation, net repositioning and other charges. Total after-tax charge was $76

million, or $0.09 per share. The total pretax charge included in gross profit was $24 million.

(6) Includes an after-tax gain of $13 million, or $0.02 per share, for post-closing adjustments related to businesses sold in the prior

year.