Honeywell 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that any losses related to our retained interests at risk will have a material adverse effect on our consolidated results of operations,

financial position or liquidity.

Environmental Matters

We are subject to various federal, state, local and foreign government requirements relating to the protection of the environment.

We believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of

environmental damage and personal injury and that our handling, manufacture, use and disposal of hazardous or toxic substances are

in accord with environmental and safety laws and regulations. However, mainly because of past operations and operations of

predecessor companies, we, like other companies engaged in similar businesses, have incurred remedial response and voluntary

cleanup costs for site contamination and are a party to lawsuits and claims associated with environmental and safety matters, including

past production of products containing toxic substances. Additional lawsuits, claims and costs involving environmental matters are

likely to continue to arise in the future.

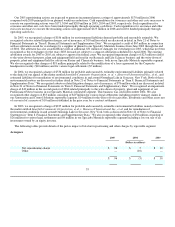

With respect to environmental matters involving site contamination, we continually conduct studies, individually or jointly with

other responsible parties, to determine the feasibility of various remedial techniques to address environmental matters. It is our policy

(see Note 1 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data”) to record appropriate

liabilities for environmental matters when remedial efforts or damage claim payments are probable and the costs can be reasonably

estimated. Such liabilities are based on our best estimate of the undiscounted future costs required to complete the remedial work. The

recorded liabilities are adjusted periodically as remediation efforts progress or as additional technical or legal information becomes

available. Given the uncertainties regarding the status of laws, regulations, enforcement policies, the impact of other potentially

responsible parties, technology and information related to individual sites, we do not believe it is possible to develop an estimate of

the range of reasonable possible environmental loss in excess of our accrual. We expect to fund expenditures for these matters from

operating cash flow. The timing of cash expenditures depends on a number of factors, including the timing of litigation and

settlements of remediation liability, personal injury and property damage claims, regulatory approval of cleanup projects, remedial

techniques to be utilized and agreements with other parties.

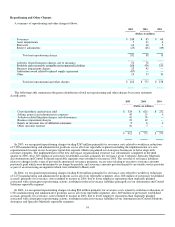

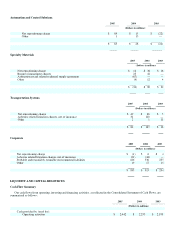

Remedial response and voluntary cleanup payments were $247, $248 and $77 million in 2005, 2004, and 2003, respectively, and

are currently estimated to be approximately $250 million in 2006. We expect to fund such expenditures from operating cash flow.

Remedial response and voluntary cleanup costs charged against pretax earnings were $186, $536 and $235 million in 2005, 2004

and 2003, respectively. At December 31, 2005 and 2004, the recorded liability for environmental matters was $879 and $895 million,

respectively. In addition, in 2005 and 2004 we incurred operating costs for ongoing businesses of approximately $87 and $75 million,

respectively, relating to compliance with environmental regulations.

Although we do not currently possess sufficient information to reasonably estimate the amounts of liabilities to be recorded upon

future completion of studies, litigation or settlements, and neither the timing nor the amount of the ultimate costs associated with

environmental matters can be determined, they could be material to our consolidated results of operations or operating cash flows in

the periods recognized or paid. However, considering our past experience and existing reserves, we do not expect that environmental

matters will have a material adverse effect on our consolidated financial position.

See Note 21 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data” for a discussion of our

commitments and contingencies, including those related to environmental matters and toxic tort litigation.

Financial Instruments

As a result of our global operating and financing activities, we are exposed to market risks from changes in interest and foreign

currency exchange rates and commodity prices, which may adversely affect our operating results and financial position. We minimize

our risks from interest and foreign currency exchange rate and commodity price fluctuations through our normal operating and

financing activities and, when deemed appropriate, through the use of derivative financial instruments. We do not use derivative

financial instruments for trading or other speculative purposes and do not use leveraged

41