Honeywell 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

outstanding options), including the assumption of approximately $569 million of outstanding debt, net of cash. The payment for

Novar's share capital and the repayment of substantially all of Novar's existing debt occurred during the second quarter of 2005 and

was funded with our existing cash resources.

Novar had consolidated revenues of approximately $2.7 billion in 2004 and operated globally in three different businesses.

Intelligent Building Systems (IBS) is a global business supplying electrical, electronic and control products and services to building

operators, contractors and developers. The integration of the IBS business into our Automation and Control Solutions segment has

enhanced our offerings of security, fire and building controls products and services, particularly in the United Kingdom and Germany,

and is supporting our global growth of these businesses. Indalex Aluminum Solutions (Indalex) is a leading manufacturer of aluminum

extrusions with a comprehensive network of plants across North America. Security Printing Services (Security Printing) is engaged in

the printing of checks, other financial instruments, business forms and providing other check-related services for financial institutions,

credit unions and their customers and members throughout the United States. In December 2005, we completed the sale of the

Security Printing business to M&F Worldwide Corp. for $800 million in cash resulting in a decrease of $225 million to the value of

the goodwill attributable to the Novar acquisition. In February 2006, we completed the sale of Indalex to an affiliate of private

investment firm Sun Capital Partners, Inc. for approximately $425 million in cash. The Indalex business has been classified as held for

sale in our December 31, 2005 Consolidated Balance Sheet and both the Indalex and Security Printing businesses have been presented

as discontinued operations in our Statement of Operations for all periods presented.

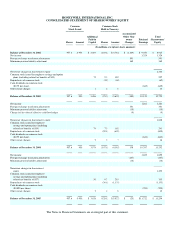

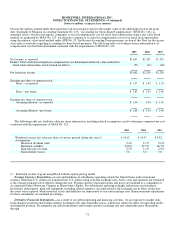

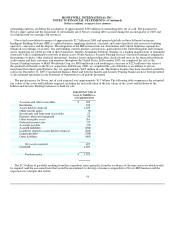

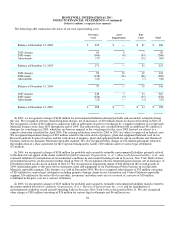

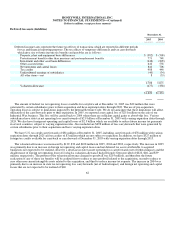

The purchase price for Novar, net of cash acquired, was approximately $1.7 billion. The following table summarizes the estimated

fair values of the assets and liabilities acquired, including the reclassification of the fair values of the assets and liabilities of the

Indalex and Security Printing businesses to held for sale.

Adjusted Fair Value of

Assets & Liabilities as

of Acquisition Date

Accounts and other receivables $ 304

Inventories 124

Assets held for disposal 1,429

Other current assets (9)

Investments and long-term receivables 21

Property, plant and equipment 99

Other intangible assets 261

Deferred income taxes 97

Accounts payable (79)

Accrued liabilities (256)

Liabilities related to assets held for disposal (204)

Long-term debt (700)

Other liabilities (680)

Net assets acquired 407

Goodwill 1,295

Purchase price $ 1,702

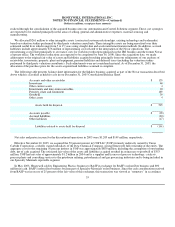

The $1.3 billion of goodwill resulting from this acquisition arises primarily from the avoidance of the time and costs which would

be required (and the associated risks that would be encountered) to develop a business comparable to Novar's IBS business and the

expected cost synergies that will be

54