Honeywell 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

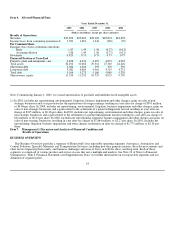

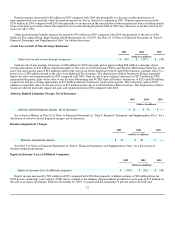

Pension expense decreased by $8 million in 2005 compared with 2004 due principally to a decrease in the amortization of

unrecognized net losses partially offset by pension expense for Novar, which was acquired in 2005. Pension expense increased by

$276 million in 2004 compared with 2003 due primarily to an increase in the amortization of unrecognized net losses resulting mainly

from actual plan asset returns below the expected rate of return during the period 2000 to 2002 and a decrease in the discount rate for

each year since 2001.

Other postretirement benefits expense decreased by $59 million in 2005 compared with 2004 due primarily to the effect of the

Medicare Prescription Drug, Improvement and Modernization Act of 2003. See Note 22 of Notes to Financial Statements in “Item 8.

Financial Statements and Supplementary Data” for further discussion.

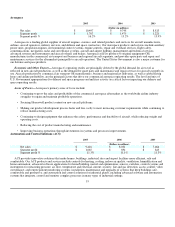

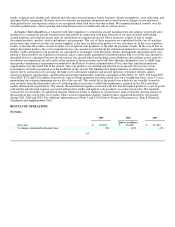

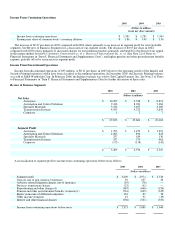

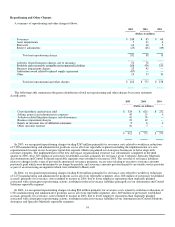

(Gain) Loss on Sale of Non-Strategic Businesses

2005 2004 2003

(Dollars in millions)

(Gain) loss on sale of non-strategic businesses $ (36) $ (255) $ (38)

Gain on sale of non-strategic businesses of $36 million in 2005 represents pretax gains totaling $66 million consisting of post-

closing adjustments of $43 million related principally to the sales of our Performance Fibers and Security Monitoring businesses in the

prior year and a pretax gain of $23 million related to the sale of our North American Nylon Carpet Fiber business, partially offset by a

pretax loss of $30 million related to the sale of our Industrial Wax business. The dispositions of these businesses did not materially

impact net sales and segment profit in 2005 compared with 2004. Gain on sale of non-strategic businesses of $255 million in 2004

represented the pretax gains on the sales of our Security Monitoring and VCSEL Optical Products businesses of $215 and $36 million,

respectively and post-closing adjustments of $19 million related to businesses sold in prior periods. The total pretax gain of $270

million was partially offset by the pretax loss of $15 million on the sale of our Performance Fibers business. The dispositions of these

businesses did not materially impact net sales and segment profit in 2004 compared with 2003.

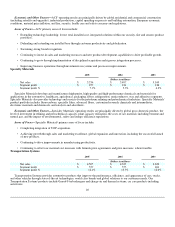

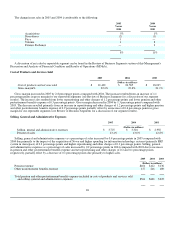

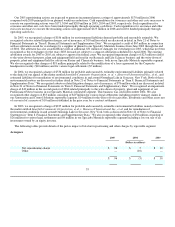

Asbestos Related Litigation Charges, Net of Insurance

2005 2004 2003

(Dollars in millions)

Asbestos related litigation charges, net of insurance $ 10 $ 76 $ —

See Asbestos Matters in Note 21 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data” for a

discussion of asbestos related litigation charges, net of insurance.

Business Impairment Charges

2005 2004 2003

(Dollars in millions)

Business impairment charges $ 23 $ 42 $ —

See Note 3 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data” for a discussion of

business impairment charges.

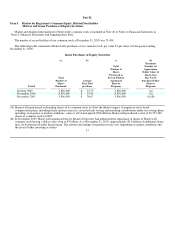

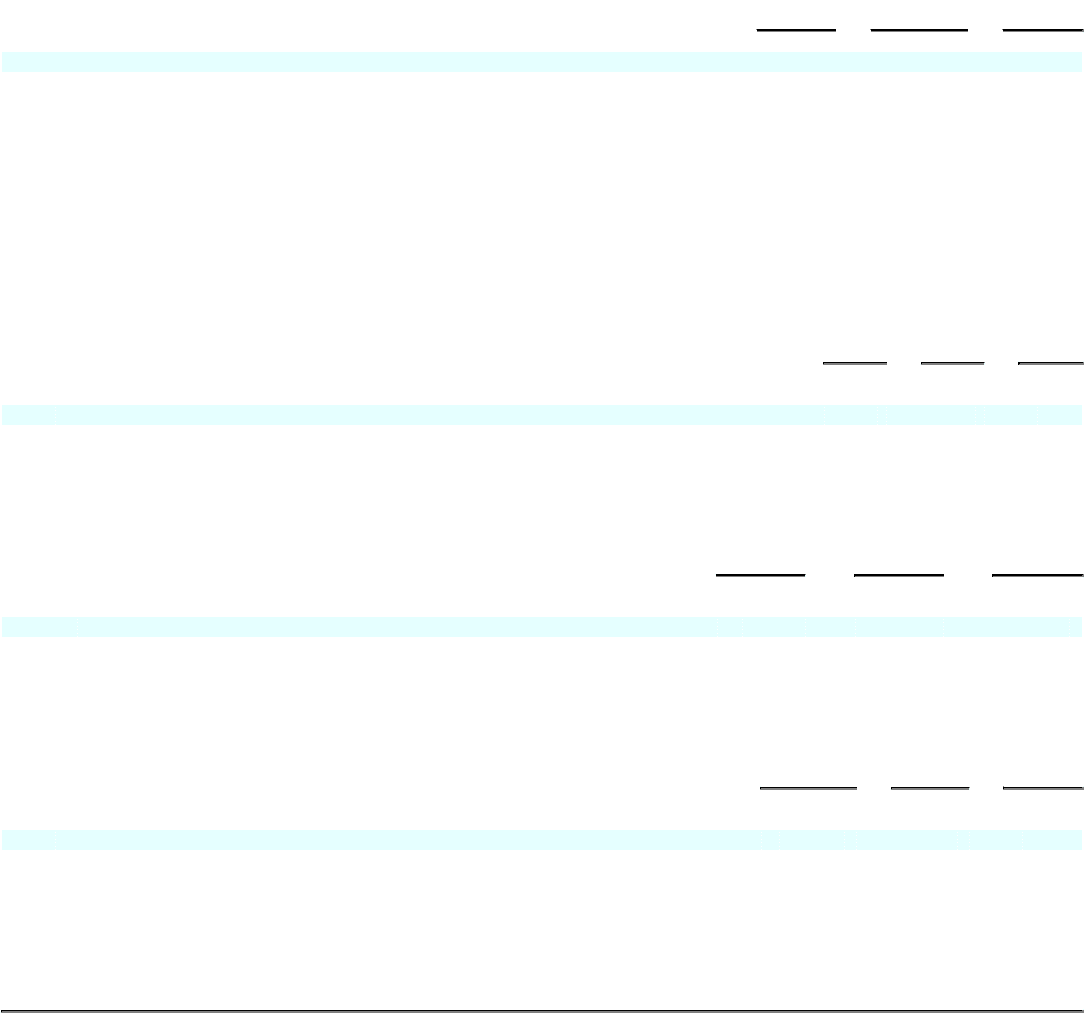

Equity in (Income) Loss of Affiliated Companies

2005 2004 2003

(Dollars in millions)

Equity in (income) loss of affiliated companies $ (134) $ (82) $ (38)

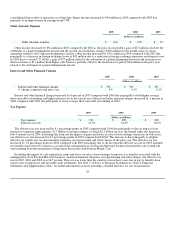

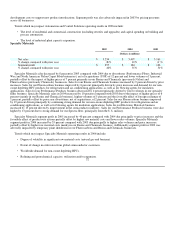

Equity income increased by $52 million in 2005 compared with 2004 due primarily to higher earnings of $36 million from our

UOP process technology joint venture (UOP) due to strength in the refining and petrochemical industries and a gain of $15 million on

the sale of an equity investment. Effective November 30, 2005, we purchased the remaining 50 percent interest in UOP and

27