Honeywell 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

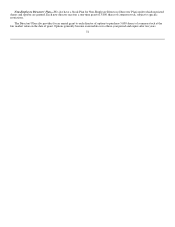

(footnotes continued from previous page)

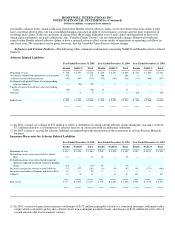

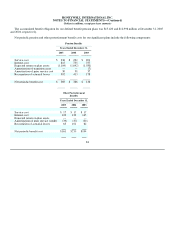

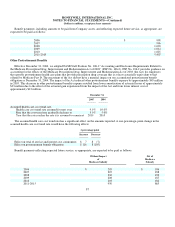

(2) In 2004, $47 million related to additional probable insurance recoveries identified in the second quarter of 2004 based on our

ongoing evaluation of the enforceability of our rights under the various insurance policies. In 2003, $155 million related to

additional probable insurance recoveries recognized in connection with the accrual for asbestos liabilities recorded upon the

termination of the transaction to sell our Friction Materials business.

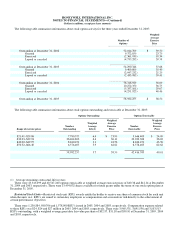

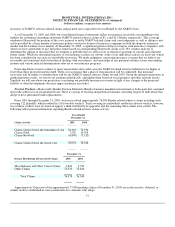

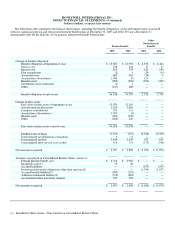

NARCO and Bendix asbestos related balances are included in the following balance sheet accounts:

December 31,

2005 2004

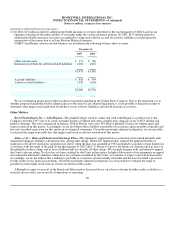

Other current assets $ 171 $ 150

Insurance recoveries for asbestos related liabilities 1,302 1,412

$1,473 $1,562

Accrued liabilities $ 520 $ 744

Asbestos related liabilities 1,549 2,006

$2,069 $2,750

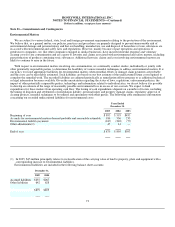

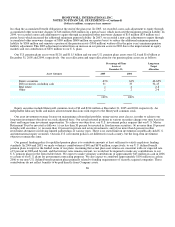

We are monitoring proposals for federal asbestos legislation pending in the United States Congress. Due to the uncertainty as to

whether proposed legislation will be adopted and as to the terms of any adopted legislation, it is not possible at this point in time to

determine what impact such legislation would have on our asbestos liabilities and related insurance recoveries.

Other Matters

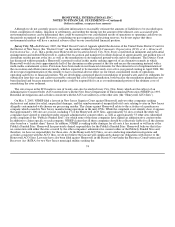

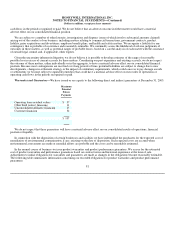

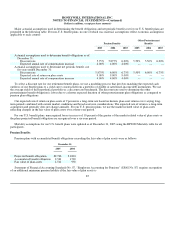

Breed Technologies Inc. v. AlliedSignal—The plaintiff alleges fraud in connection with AlliedSignal's (a predecessor to the

Company) October 1997 sale of its safety restraints business to Breed and seeks compensatory damages of up to $375 million and

punitive damages. The trial commenced in January 2006 in Florida state court. We believe plaintiff's claims are without merit and

expect to prevail in this matter. Accordingly, we do not believe that a liability is probable of occurrence and reasonably estimable and

have not recorded a provision for this matter in our financial statements. Given the uncertainty inherent in litigation, it is not possible

to estimate the range of possible loss that might result from an adverse resolution of this matter.

Allen, et. al. v. Honeywell Retirement Earnings Plan—This represents a purported class action lawsuit in which plaintiffs seek

unspecified damages relating to allegations that, among other things, Honeywell impermissibly reduced the pension benefits of

employees of Garrett Corporation (a predecessor entity) when the plan was amended in 1983 and failed to calculate certain benefits in

accordance with the terms of the plan. In the third quarter of 2005, the U.S. District Court for the District of Arizona ruled in favor of

the plaintiffs on these claims and in favor of Honeywell on virtually all other claims. We strongly disagree with, and intend to appeal,

the Court's adverse ruling. No class has yet been certified by the Court in this matter. In light of the merits of our arguments on appeal

and substantial affirmative defenses which have not yet been considered by the Court, we continue to expect to prevail in this matter.

Accordingly, we do not believe that a liability is probable of occurrence and reasonably estimable and have not recorded a provision

for this matter in our financial statements. Given the uncertainty inherent in litigation, it is not possible to estimate the range of

possible loss that might result from an adverse resolution of this matter.

Although we expect to prevail in the Breed and Allen matters discussed above, an adverse outcome in either matter could have a

material adverse effect on our results of operations or operating

80