Honeywell 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

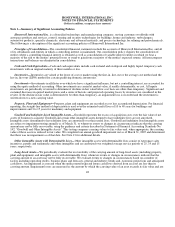

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

retirement of facilities in our Automation and Control Solutions and Specialty Materials reportable segments. Upon adoption on

December 31, 2005, we recorded an increase in property, plant and equipment, net of $14 million and recognized an asset retirement

obligation of $46 million. This resulted in the recognition of a non-cash charge of $32 million ($21 million after tax, or $0.03 per

share) that was reported as a cumulative effect of an accounting change.

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based

Payment” (SFAS No. 123R) requiring that the compensation cost relating to share-based payment transactions be recognized in the

financial statements. The cost is to be measured based on the fair value of the equity or liability instruments issued. SFAS No. 123R is

effective for fiscal years that begin after June 15, 2005. We will adopt SFAS No. 123R effective January 1, 2006 and currently expect

to use the modified prospective method of adoption and therefore will not restate our prior-period results. Under the modified

prospective method, awards that are granted, modified, or settled after the date of adoption should be measured and accounted for in

accordance with SFAS No. 123R. Unvested equity-classified awards that were granted prior to the effective date of SFAS No. 123R

should continue to be accounted for in accordance with SFAS No. 123, except that amounts must be recognized in the financial

statements. We currently estimate that the adoption of SFAS No. 123R will reduce 2006 diluted earnings per share by $0.08 to $0.10.

Future compensation cost will be impacted by various factors, including the number of awards granted and their related fair value at

the date of grant.

In November 2004, the FASB issued Statement of Financial Accounting Standards No. 151, “Inventory Costs, an amendment of

ARB No. 43, Chapter 4” (SFAS No. 151) which clarifies that abnormal amounts of idle facility expense, freight, handling costs and

wasted materials (spoilage) should be recognized as current-period charges. In addition, SFAS No. 151 requires that allocation of

fixed production overhead to inventory be based on the normal capacity of the production facilities. SFAS No. 151 is effective for

inventory costs incurred during fiscal years beginning after June 15, 2005. We do not expect that the adoption of SFAS No. 151 will

have a material effect on our consolidated financial statements.

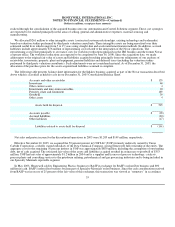

Statement of Financial Accounting Standards No. 143, “Accounting for Asset Retirement Obligations” (SFAS No. 143) requires

recognition of the fair value of obligations associated with the retirement of tangible long-lived assets when there is a legal obligation

to incur such costs. Upon initial recognition of a liability the cost is capitalized as part of the related long-lived asset and depreciated

over the corresponding asset's useful life. SFAS No. 143 primarily impacted our accounting for costs associated with the future

retirement of nuclear fuel conversion facilities in our Specialty Materials reportable segment. Upon adoption on January 1, 2003, we

recorded an increase in property, plant and equipment, net of $16 million and recognized an asset retirement obligation of $47 million.

This resulted in the recognition of a non-cash charge of $31 million ($20 million after-tax, or $0.02 per share) that was reported as a

cumulative effect of an accounting change. This accounting change did not have a material impact on results of operations for 2005,

2004 and 2003.

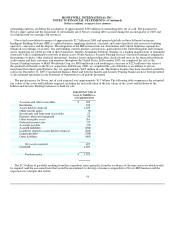

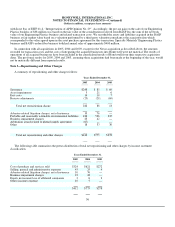

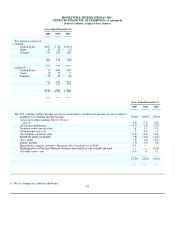

Note 2—Acquisitions

We acquired businesses for an aggregate cost of $3,500, $396 and $199 million in 2005, 2004 and 2003, respectively. All of our

acquisitions were accounted for under the purchase method of accounting, and accordingly, the assets and liabilities of the acquired

businesses were recorded at their estimated fair values at the dates of acquisition. Significant acquisitions made in these years are

discussed below.

On March 31, 2005, Honeywell declared its Offers for the entire issued and ordinary preference share capital of Novar plc (Novar)

wholly unconditional and assumed control of Novar as of that date. The aggregate value of the Offers was approximately $2.4 billion

(fully diluted for the exercise of all

53