Honeywell 2005 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New York State court or federal court of the United States of America sitting in New York City, and any appellate court from any thereof, in any action or

proceeding arising out of or relating to this Agreement or the Notes, or for recognition or enforcement of any judgment, and each of the parties hereto hereby

irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding may be heard and determined in any such New York State

court or, to the extent permitted by law, in such federal court. Each Borrower hereby agrees that service of process in any such action or proceeding brought in

the any such New York State court or in such federal court may be made upon Corporation Service Company, 2711 Centerville Road Suite 400, Wilmington,

Delaware 19808 (the "Process Agent") and each Borrower hereby irrevocably appoints the Process Agent its authorized agent to accept such service of

process, and agrees that the failure of the Process Agent to give any notice of any such service shall not impair or affect the validity of such service or of any

judgment rendered in any action or proceeding based thereon. Each Borrower hereby further irrevocably consents to the service of process in any action or

proceeding in such courts by the mailing thereof by any parties hereto by registered or certified mail, postage prepaid, to such Borrower at its address

specified pursuant to Section 9.02. Each of the parties hereto agrees that a final judgment in any such action or proceeding shall be conclusive and may be

enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Agreement shall affect any right that any party

may otherwise have to serve legal process in any other manner permitted by law or to bring any action or proceeding relating to this Agreement or the Notes

in the courts of any jurisdiction. To the extent that each Borrower has or hereafter may acquire any immunity from jurisdiction of any court or from any legal

process (whether through service or notice, attachment prior to judgment, attachment in aid of execution, execution or otherwise) with respect to itself or its

property, each Borrower hereby irrevocably waives such immunity in respect of its obligations under this Agreement.

(b) Each of the parties hereto irrevocably and unconditionally waives, to the fullest extent it may legally and effectively do so, any objection that

it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Agreement or the Notes in any New York

State or federal court. Each of the parties hereto hereby irrevocably waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the

maintenance of such action or proceeding in any such court.

SECTION 9.12. Final Agreement. This written agreement represents the full and final agreement between the parties with respect to the matters

addressed herein and supercedes all prior communications, written or oral, with respect thereto. There are no unwritten agreements between the parties.

SECTION 9.13. Judgment. (a) If for the purposes of obtaining judgment in any court it is necessary to convert a sum due hereunder or under the

Notes in any currency (the "Original Currency") into another currency (the "Other Currency"), the parties hereto agree, to the fullest extent that they may

effectively do so, that the rate of exchange used shall be that at which in accordance with normal banking procedures the Agent could purchase the Original

Currency with the Other Currency at 9:00 A.M. (New York City time) on the first Business Day preceding that on which final judgment is given.

(b) The obligation of each Borrower in respect of any sum due in the Original Currency from it to any Lender or the Agent hereunder or under

any Note held by such Lender

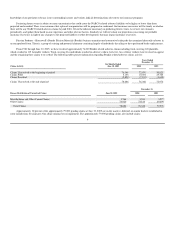

60