Honeywell 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

realized through the consolidation of the acquired business into our Automation and Control Solutions segment. These cost synergies

are expected to be realized principally in the areas of selling, general and administrative expenses, material sourcing and

manufacturing.

We allocated $261 million to other intangible assets (contractual customer relationships, existing technology and trademarks)

based on valuation studies performed by third party valuation consultants. These intangible assets are being amortized over their

estimated useful lives which range from 5 to 15 years using straight-line and accelerated amortization methods. In addition, accrued

liabilities include approximately $76 million of repositioning costs related to the integration of the Novar operations. The

repositioning costs relate principally to severance costs for workforce reductions primarily in the IBS business and the former Novar

corporate office. The workforce reductions are expected to be completed by June 30, 2006. Since the acquisition date, we made

adjustments to the original fair value of assets and liabilities acquired resulting principally from our refinements of our analyses of

receivables, inventories, property, plant and equipment, pension liabilities and deferred taxes (including the valuation studies

performed by third party valuation consultants). Such adjustments were not considered material. As of December 31, 2005, the

allocation of the purchase price for the assets acquired and liabilities assumed is complete.

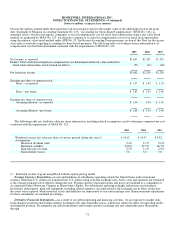

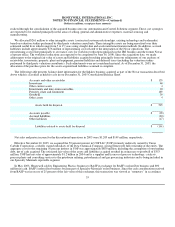

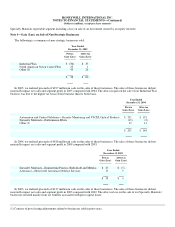

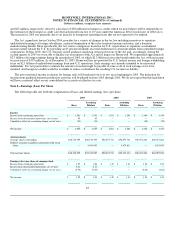

The following table presents balance sheet information for the Indalex business acquired as part of the Novar transaction described

above which is classified as held for sale in our December 31, 2005 Consolidated Balance Sheet.

Accounts and other receivables $ 135

Inventories 60

Other current assets 4

Investments and long-term receivables 94

Property, plant and equipment 189

Goodwill 39

Other assets 4

Assets held for disposal $ 525

Accounts payable $ (90)

Accrued liabilities (24)

Other liabilities (47)

Liabilities related to assets held for disposal $ (161)

Net sales and pretax income for the discontinued operations in 2005 were $1,209 and $149 million, respectively.

Effective November 30, 2005, we acquired the 50 percent interest in UOP LLC (UOP) formerly indirectly owned by Union

Carbide Corporation, a wholly owned subsidiary of the Dow Chemical Company, giving Honeywell full ownership of the entity. The

aggregate cost for the remaining 50 percent interest in UOP was approximately $800 million, including the assumption of outstanding

debt, net of cash acquired. The estimated fair value of the assets and liabilities acquired resulted in an increase to goodwill of $353

million. UOP had net sales of approximately $1.2 billion in 2004 and is a supplier and licensor of process technology, catalysts,

process plants and consulting services to the petroleum refining, petrochemical and gas processing industries and is being included in

our Specialty Materials reportable segment.

In May 2003, Honeywell sold its Engineering Plastics business to BASF in exchange for BASF's nylon fiber business and $90

million in cash. BASF's nylon fiber business became part of Specialty Materials' nylon business. Since the cash consideration received

from BASF was in excess of 25 percent of the fair value of this exchange, this transaction was viewed as “monetary” in accordance

55