Honeywell 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286

|

|

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

with Issue 8(a) of EITF 01-2, “Interpretations of APB Opinion No. 29”. Accordingly, the pre-tax gain on the sale of our Engineering

Plastics business of $38 million was based on the fair value of the consideration received from BASF less the sum of the net book

value of our Engineering Plastics business and related transaction costs. We recorded the assets and liabilities acquired in the BASF

business at fair market value based on a valuation performed by a third party valuation consultant at the acquistion date which

corresponded to the value agreed upon in the asset purchase agreement for this transaction. Specialty Materials' Engineering Plastics

business and BASF's nylon fiber business both had annual sales of approximately $400 million.

In connection with all acquisitions in 2005, 2004 and 2003, except for the Novar acquisition as described above, the amounts

recorded for transaction costs and the costs of integrating the acquired businesses into Honeywell were not material. The results of

operations of all acquired businesses have been included in the consolidated results of Honeywell from their respective acquisition

dates. The pro forma results for 2005, 2004 and 2003, assuming these acquisitions had been made at the beginning of the year, would

not be materially different from reported results.

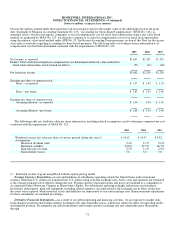

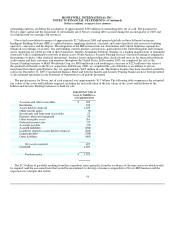

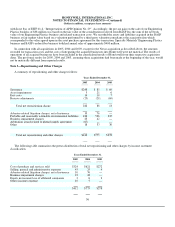

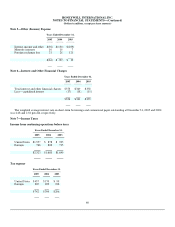

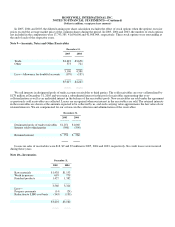

Note 3—Repositioning and Other Charges

A summary of repositioning and other charges follows:

Years Ended December 31,

2005 2004 2003

Severance $248 $ 85 $ 69

Asset impairments 5 21 6

Exit costs 14 10 7

Reserve adjustments (25) (28) (69)

Total net repositioning charge 242 88 13

Asbestos related litigation charges, net of insurance 10 76 —

Probable and reasonably estimable environmental liabilities 186 536 235

Business impairment charges 23 42 —

Arbitration award related to phenol supply agreement (67) — —

Other 18 33 30

Total net repositioning and other charges $412 $775 $278

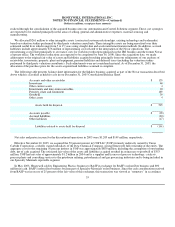

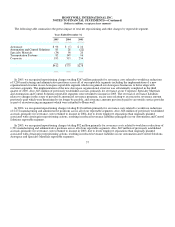

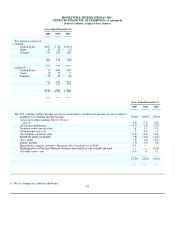

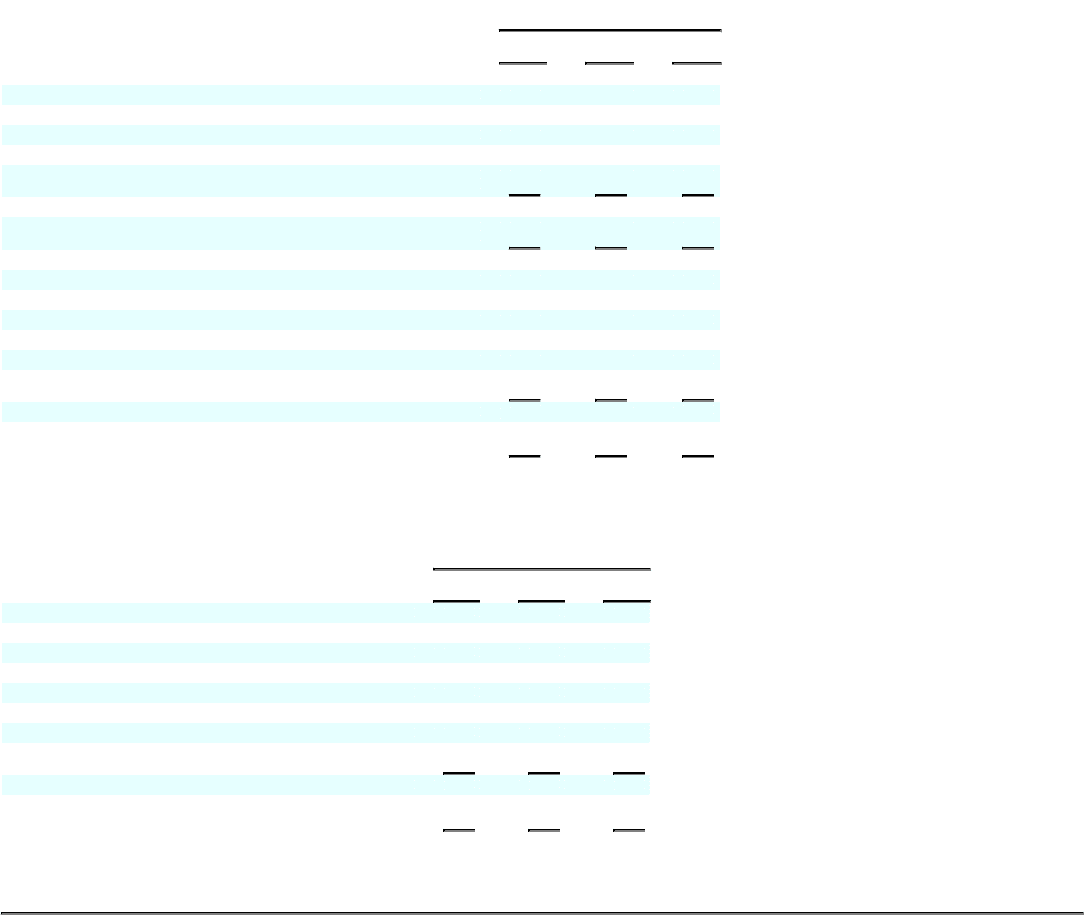

The following table summarizes the pretax distribution of total net repositioning and other charges by income statement

classification.

Years Ended December 31,

2005 2004 2003

Cost of products and services sold $324 $621 $272

Selling, general and administrative expenses 43 25 4

Asbestos related litigation charges, net of insurance 10 76 —

Business impairment charges 23 42 —

Equity in (income) loss of affiliated companies 2 6 2

Other (income) expense 10 5 —

$412 $775 $278

56