Honeywell 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

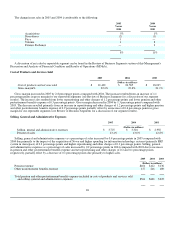

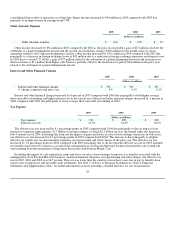

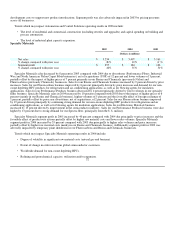

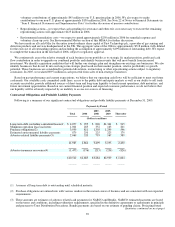

Transportation Systems

2005 2004 2003

(Dollars in millions)

Net sales $ 4,505 $ 4,323 $ 3,650

% change compared with prior year 4% 18% 15%

Segment profit $ 557 $ 575 $ 461

% change compared with prior year (3)% 25% 17%

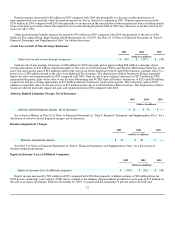

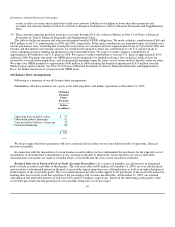

Transportation Systems sales in 2005 increased by 4 percent compared with 2004 due primarily to favorable sales mix of 2

percent, the favorable effect of foreign exchange of 1 percent and the impact of higher prices of 1 percent (principally ethylene glycol

in our Consumer Products business). Sales for our Turbo Technologies business increased by 5 percent due to a favorable sales mix

and the favorable effect of foreign exchange partially offset by lower volumes in Europe. The favorable sales mix was driven by

continued strength in the North American truck segment. The lower volumes in Europe principally resulted from a shift in consumer

demand among automotive platforms and slightly lower light vehicle production partially offset by a slight increase in diesel

penetration. Sales for our Consumer Products Group business increased by 8 percent largely due to higher prices (primarily ethylene

glycol). Sales for our Friction Materials business decreased by 3 percent primarily due to our exit in 2005 from the North American

OE business. Transportation Systems sales in 2004 increased by 18 percent compared with 2003 due primarily to a favorable sales

mix and higher volumes of 12 percent and the favorable effect of foreign exchange of 6 percent. The increase in sales for the segment

resulted principally from a 29 percent increase in sales for our Honeywell Turbo Technologies business due to a favorable sales mix

and volume growth driven by increasing diesel penetration in Europe and strength in the North American truck segment, and the

favorable effect of foreign exchange. Sales for our Consumer Products Group business increased by 7 percent driven by strong retail

demand for our high-end products and recent introductions of new Autolite, FRAM and Prestone products and the favorable effect of

foreign exchange and higher prices (offsetting incremental ethylene glycol raw material costs). Sales for our Friction Materials

business increased by 7 percent largely due to the favorable effect of foreign exchange.

Transportation Systems segment profit in 2005 decreased by 3 percent compared with 2004 due primarily to the impact of higher

raw material costs (mainly steel and other metals in each of the segment's businesses) and operating costs associated with the exit from

Friction Materials North American OE business, partially offset by the effects of higher prices and productivity actions.

Transportation Systems segment profit in 2004 increased by 25 percent compared with 2003 due primarily to the effect of favorable

sales mix and volume growth in our Honeywell Turbo Technologies business partially offset by higher raw material costs (mostly

steel and other metals in each of the segment's businesses).

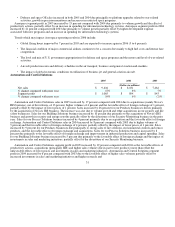

Trends which may impact Transportation Systems operating results in 2006 include:

• Turbocharger demand for diesel passenger cars in the European OEM market.

• Shift in European consumer preferences to diesel passenger cars with lower displacement engines.

• Demand for North American truck production in conjunction with the 2007 emissions change.

• Change in consumer spending for automotive aftermarket and car care products.

33