Honeywell 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

our normal operating and financing activities and, when deemed appropriate through the use of derivative financial instruments.

Derivative financial instruments are used to manage risk and are not used for trading or other speculative purposes and we do not use

leveraged derivative financial instruments. Derivative financial instruments used for hedging purposes must be designated and

effective as a hedge of the identified risk exposure at the inception of the contract. Accordingly, changes in fair value of the derivative

contract must be highly correlated with changes in fair value of the underlying hedged item at inception of the hedge and over the life

of the hedge contract.

All derivatives are recorded on the balance sheet as assets or liabilities and measured at fair value. For derivatives designated as

hedges of the fair value of assets or liabilities, the changes in fair values of both the derivatives and the hedged items are recorded in

current earnings. For derivatives designated as cash flow hedges, the effective portion of the changes in fair value of the derivatives

are recorded in Accumulated Other Nonowner Changes in Shareowners' Equity and subsequently recognized in earnings when the

hedged items impact earnings. Changes in the fair value of derivatives not designated as hedges and the ineffective portion of cash

flow hedges are recorded in current earnings.

Transfers of Financial Instruments—Sales, transfers and securitization of financial instruments are accounted for under

Statement of Financial Accounting Standards No. 140, “Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities”. We sell interests in designated pools of trade accounts receivables to third parties. The receivables are

removed from the Consolidated Balance Sheet at the time they are sold. The value assigned to our subordinated interests and

undivided interests retained in trade receivables sold is based on the relative fair values of the interests retained and sold. The carrying

value of the retained interests approximates fair value due to the short-term nature of the collection period for the receivables.

Income Taxes—Deferred tax liabilities or assets reflect temporary differences between amounts of assets and liabilities for

financial and tax reporting. Such amounts are adjusted, as appropriate, to reflect changes in tax rates expected to be in effect when the

temporary differences reverse. A valuation allowance is established to offset any deferred tax assets if, based upon the available

evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

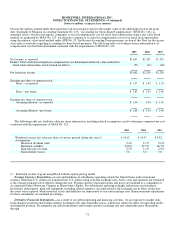

Earnings Per Share—Basic earnings per share is based on the weighted average number of common shares outstanding. Diluted

earnings per share is based on the weighted average number of common shares outstanding and all dilutive potential common shares

outstanding.

Use of Estimates—The preparation of consolidated financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts in the financial statements and

related disclosures in the accompanying notes. Actual results could differ from those estimates. Estimates and assumptions are

periodically reviewed and the effects of revisions are reflected in the consolidated financial statements in the period they are

determined to be necessary.

Reclassifications—Certain prior year amounts have been reclassified to conform with the current year presentation.

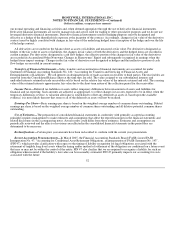

Recent Accounting Pronouncements—In March 2005, the Financial Accounting Standards Board (FASB) issued FASB

Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations, an interpretation of FASB Statement No. 143”,

(FIN 47), which provides clarification with respect to the timing of liability recognition for legal obligations associated with the

retirement of tangible long-lived assets when the timing and/or method of settlement of the obligation are conditional on a future event

that may or may not be within the control of the entity. FIN 47 also clarifies that we are required to recognize a liability for such an

obligation when incurred if the liability's fair value can be reasonably estimated. FIN 47 primarily impacts our accounting for costs

associated with the future

52