Honda 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

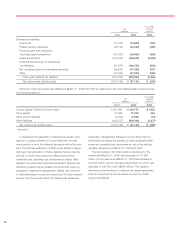

At March 31, 2007, certain of the Company’s subsidiaries have operating loss carryforwards for income tax purposes of

¥128,162 million ($1,086 million), which are available to offset future taxable income, if any. Periods available to offset future

taxable income vary in each tax jurisdiction and range from one year to an indefinite period as follows:

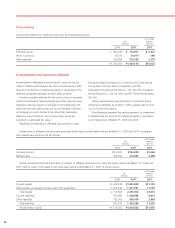

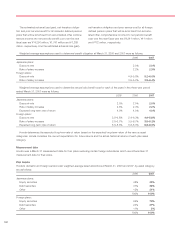

U.S. dollars

Yen (millions)

(millions) (note 2)

Within 1 year ¥000,528 $0,005

1 to 5 years 10,599 90

5 to 15 years 11,947 101

Indefinite periods 105,088 890

¥128,162 $1,086

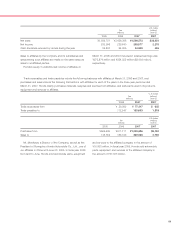

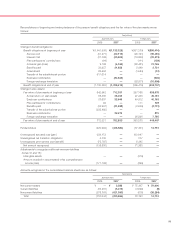

At March 31, 2006 and 2007, Honda did not recognize

deferred tax liabilities of ¥60,703 million and ¥78,252 million

($663million), respectively, for certain portions of the undis-

tributed earnings of the Company’s foreign subsidiaries

because such portions were considered permanently rein-

vested. At March 31, 2006 and 2007, the undistributed earn-

ings not subject to deferred tax liabilities were ¥2,676,892

million and ¥2,995,170 million ($25,372 million), respectively.

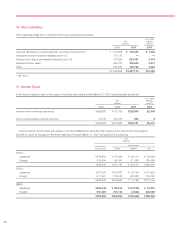

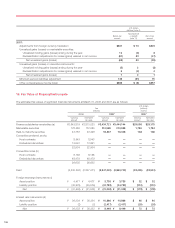

12. Dividends and Legal Reserves

The Company law of Japan enforced on May 1, 2006 pro-

vides that earnings in an amount equal to 10% of dividends

of retained earnings shall be appropriated as a capital sur-

plus or a legal reserve on the date of distribution of retained

earnings until an aggregated amount of capital surplus and a

legal reserve equals 25% of stated capital. The Japanese

Commercial Code, effective until the enforcement of the

Company law of Japan, provided that earnings in an amount

equal to at least 10% of appropriations of retained earnings

that were paid in cash shall be appropriated as a legal

reserve until an aggregated amount of capital surplus and the

legal reserve equaled 25% of stated capital. Certain foreign

subsidiaries are also required to appropriate their earnings to

legal reserves under the laws of the respective countries.

Dividends and appropriations to the legal reserves

charged to retained earnings during the years in the three-

year period ended March 31, 2007 represent dividends paid

out during those years and the related appropriations to the

legal reserves. Dividends per share for each of the years in

the three-year period ended March 31, 2007 were ¥25.5,

¥38.5 and ¥77 ($0.65), respectively. The accompanying con-

solidated financial statements do not include any provision

for the dividend of ¥20 ($0.17) per share aggregating

¥36,456 million ($309 million) proposed and resolved in the

general stockholders’ meeting held in June 2007.

The Company executed a two-for-one stock split for the

Company’s common stock effective July 1, 2006. Information

pertaining to dividends per share has been adjusted retroac-

tively for all periods presented to reflect this stock split.

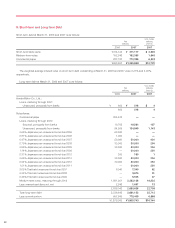

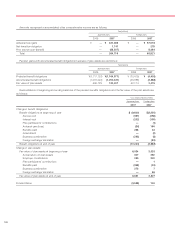

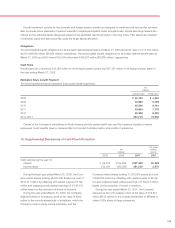

13. Pension and Other Postretirement Benefits

The Company and its subsidiaries have various pension

plans covering substantially all of their employees in Japan

and certain employees in foreign countries. Benefits under

the plans are primarily based on the combination of years of

service and compensation. The funding policy is to make

periodic contributions as required by applicable regulations.

Plan assets consist primarily of listed equity securities and

bonds.

Retirement benefits for directors, excluding certain ben-

efits, are provided in accordance with management policy.

There are occasions where officers other than directors

receive special lump-sum payments at retirement. Such pay-

ments are charged to income as paid since amounts vary

with circumstances and it is impractical to compute a liability

for future payments.

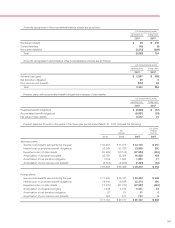

In January 2003, the Emerging Issues Task Force (EITF)

reached a final consensus on Issue No. 03-2 “Accounting for

the Transfer to the Japanese Government of the Substitu-

tional Portion of Employee Pension Fund Liabilities” (“EITF

03-2”). EITF 03-2 addresses accounting for a transfer to the

Japanese government of a substitutional portion of an

Employees’ Pension Fund (“EPF”) plan, which is a defined