Honda 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

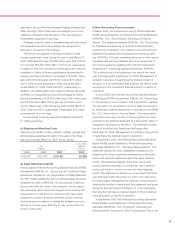

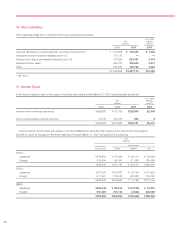

5. Inventories

Inventories at March 31, 2006 and 2007 are summarized as follows:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Finished goods ¥0,687,230 ¥0,772,917 $06,547

Work in process 28,218 34,970 296

Raw materials 320,856 375,229 3,179

¥1,036,304 ¥1,183,116 $10,022

6. Investments and Advances-Affiliates

Investments in affiliates are accounted for using the equity

method. Differences between the cost of investments in affili-

ates and the amount of underlying equity in net assets of the

affiliates principally represent investor level goodwill.

Honda considers whether the fair value of any of its equity

method investments have declined below their carrying value

whenever adverse events or changes in circumstances indi-

cate that recorded values may not be recoverable. If Honda

considered any such decline to be other than temporary

based on various factors, then a write-down would be

recorded to estimated fair value.

Significant investments in affiliates accounted for under

the equity method at March 31, 2006 and 2007 are Showa

Corporation (33.5%), Keihin Corporation (42.2%),

Guangzhou Honda Automobile Co., Ltd. (50.0%), Dongfeng

Honda Engine Co., Ltd. (50.0%), and P.T. Astra Honda Motor

(50.0%).

Certain adjustments were recorded to investments and

advances to affiliates as of April 1, 2006, please refer to note

1(u) for further information.

The difference between the carrying amount of investment

in affiliates and the amount of underlying equity in net assets

is not material as of March 31, 2006 and 2007.

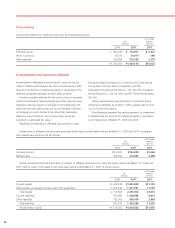

Investments in affiliates include equity securities which have quoted market values at March 31, 2006 and 2007 compared

with related carrying amounts as follows:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Carrying amount ¥130,802 ¥184,879 $1,566

Market value 444,250 412,892 3,498

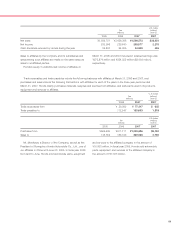

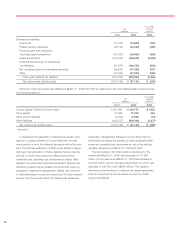

Certain combined financial information in respect of affiliates accounted for under the equity method at March 31, 2006 and

2007, and for each of the years in the three-year period ended March 31, 2007 is shown below:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Current assets ¥1,056,428 ¥1,434,855 $12,155

Other assets, principally property, plant and equipment 1,063,235 1,317,057 11,157

Total assets 2,119,663 2,751,912 23,312

Current liabilities 762,660 1,038,968 8,801

Other liabilities 182,503 306,418 2,596

Total liabilities 945,163 1,345,386 11,397

Stockholders’ equity ¥1,174,500 ¥1,406,526 $11,915