Honda 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

sales decreased 3.4%, to 672,000 units. Overseas unit sales

increased 10.6%, to 2,980,000 units, due mainly to increased

unit sales in North America, Europe, Asia and other regions.

Revenue from unaffiliated customers increased 11.0%, to

¥8,889.0 billion, from the previous fiscal year, due to increased

unit sales and the positive impact of the currency translation

effects. Honda estimates that if the exchange rate of the Japa-

nese yen had remained unchanged from the previous fiscal

year, consolidated net sales and operating revenue for the

period would have increased by approximately 7.0%. Operat-

ing income decreased 4.6%, to ¥599.5 billion, from the previ-

ous fiscal year, due mainly to the negative impact of changes in

the model mix, substantially increased raw material costs,

increased SG&A expenses, higher R&D expenses and the gain

on return recorded in the fiscal year ended March 31, 2006,

which offset the positive impacts of higher revenue attributable

to the increased unit sales, continuing cost reduction effects

and the currency effects caused by the depreciation of the

Japanese yen. The operating margin was 6.7%.

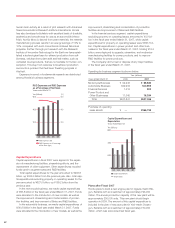

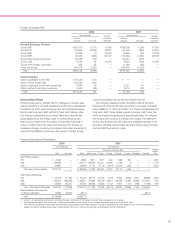

Unit Sales

Thousands

Years ended March 31 2006 2007 % change

Japan 696 672 (3.4)%

North America 1,682 1,788 6.3

Europe 291 324 11.3

Asia 521 620 19.0

Other Regions 201 248 23.4

Total 3,391 3,652 7.7%

Net Sales

Yen (millions)

Years ended March 31 2006 2007 % change

Japan ¥1,447,388 ¥1,412,726 (2.4)%

North America 4,722,354 5,179,139 9.7

Europe 717,360 917,199 27.9

Asia 731,833 861,612 17.7

Other Regions 385,759 518,404 34.4

Total ¥8,004,694 ¥8,889,080 11.0%

Japan

Total automobile demand in Japan in calendar year 2006

remained largely unchanged, at around 5,740,000 units. With

the number of mini-cars increased and the number of regis-

tered vehicles declined.

In fiscal year 2007, unit sales declined 3.4%, to 672,000

units. Although Honda’s sales of the Zest and new Stream,

CR-V and Crossroad models increased, sales of the Step

Wagon, Life and Airwave decreased. In July 2006, Honda

introduced the new Stream, a stylish model that offers powerful

driving performance. In October, the new CR-V also went on

sale. This model features advancements in design, user-

friendliness and driving performance, as well as an increased

number of advanced safety features. In February 2007, Honda

launched the Crossroad. This new model combines the han-

dling ease of a compact car with the rugged exterior and

versatility of an SUV.

Since integrating our sales channels in March 2006, sales

have increased for mini-cars and other vehicles used to be sold

exclusively by each channel.

In the mini-car segment, Honda strengthened its capital

relationship with Yachiyo Industry Co., Ltd., strengthening its

alliance with the Company. The objective of this move was to

strengthen Honda’s ability to develop highly competitive

products and strengthen its business in this segment.

North America

In calendar year 2006, total demand in the United States was

down to approximately 16,550,000 units. Impacted by the

sharp rise in gasoline prices, demand for fuel-efficient vehicles

expanded, while sales of large SUVs and pickup trucks was

stagnant.

Total North American unit sales in fiscal year 2007 came to

1,788,000 units, up 6.3% from the previous year. Unit sales in

the passenger car segment benefited from the April 2006 intro-

duction of the Fit, but sales of Acura-brand cars declined,

causing overall unit sales in this segment to be approximately

the same level as the previous fiscal year. In the light truck

segment, on the other hand, the new Acura RDX—an entry-

premium SUV—launched in August. The CR-V, a compact

SUV which underwent a full model change, went on sale in

September, and the new Acura MDX, a premium SUV,

launched in October. A favorable market response to these

new models strengthened overall sales performance in this

region.

To increase the local production of powertrain components,

in May 2006 we started operating a new automatic transmis-

sion plant in Georgia. The Pilot, which was being manufactured

on the second line of our plant in Canada, was transferred to

Honda’s plant in Alabama in February 2007 and the second

line of our plant in Canada began manufacturing the Civic in

April 2007, raising annual capacity by 60,000 units, so as to

respond to heightened demand for fuel-efficient vehicles.

Honda vehicles were selected as Top Picks in three of the

10 automobile categories rated by U.S. Consumer Reports

magazine for 2007 models, earning particularly high marks for

their fuel efficiency and safety performance. Earning top place

were the Civic in the small sedan category, the Accord in the

family sedan category and the Fit in the budget car category.

03 04 05 06 07 03 04 05 06 07

4,000

2,000

3,000

1,000

2,888

6,440

2,983

3,242

6,592 6,963

0

10,000

7,500

5,000

2,500

0

3,391

3,652

8,004 8,889

Unit Sales

Y

ears ended March 31

(Thousands)

Net Sales

Years ended March 31

Yen (billions)

Japan

North America

Europe

Asia

Other Regions

Japan

North America

Europe

Asia

Other Regions